Week in review: Cryptos on top and Decent US Data

It’s been a roller‑coaster week—between volatile macro data, tariff threats, and fresh geopolitical turmoil, all jostling with record‑breaking crypto moves.

US inflation data eased a touch as CPI (core at 0.2% vs 0.3% exp) and PPI (unchanged, 0.2% consensus) both came in cooler than expected, while Retail Sales surprised to the upside, showing consumer demand still holding firm.

Equities briefly hit new highs—the S&P 500 and Nasdaq 100 climbed on solid earnings reports—but traders have been taking profits in today’s session. Both indices still finish the week up comfortably, except for the Dow which has really been mixed in rangebound action throughout the week.

Lower-than-expected (yet still high) inflation expectations did not do much to slow today’s selling flows.

Global Equities have also been dawdling round in the first half of July as the sudden rise in the US Dollar coming from better than expected US Data has rewired some Financial flows.

Trade tensions resurfaced as Trump floated 15–20 % tariffs on EU goods, a reminder that protectionist rhetoric remains ever‑present even as markets largely shrugged off the threat – Keep this in check for the upcoming weeks.

Meanwhile, crypto stole the spotlight: Bitcoin blasted through to a new peak of $123,230, fuelled by ETF inflows and macro hedge demand, while Ethereum outpaced BTC on the week, riding a wave of DeFi optimism and relative strength. Altcoins have been shining on this newfound Crypto trend.

Elsewhere, Australia’s jobs report was disappointing, intensifying bets on RBA rate cuts, and the UK’s employment data proved a mixed bag—wage growth held up, but unemployment ticked higher.

To cap it off, tensions flared along the Israel‑Syria border around Druze communities, adding a fresh geopolitical twist that quickly faded by Markets who don’t care too much about these headlines since the Israel-Iran tensions from the end of June.

Still, buckle up, as looking at charts and fundamentals, volatility isn’t going anywhere.

The Week ahead: Global PMIs and more inflation data

We will already be entering the fourth week of July and markets have been awaiting for the PMIs to get an idea if anything evolved for the business around the world as tariffs keep looming around.

Asia-Pacific Markets

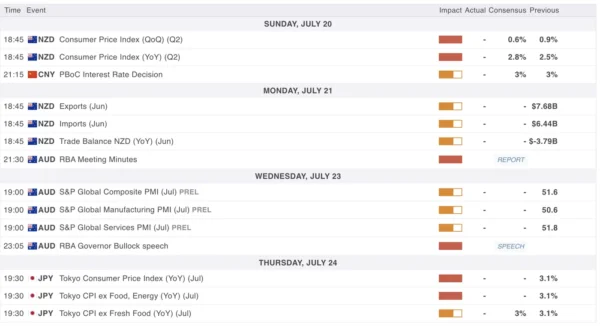

Next week’s high-tier Data for Asia-Pacific nations – MarketPulse Economic Calendar

Next week will see bouts of key data particularly for New Zealand and Australia.

The week starts early for NZD traders with the New Zealand inflation (consensus + 0.6%) release on Sunday’s overnight session.

The rest is considered slightly lower tier – PBOC Rate Decision, NZD Trade Balance data, Australian PMIs and RBA Minutes and finally on Thursday, Tokyo region’s Regional CPI for JPY Traders.

Asian stock markets (Singapore and Hong Kong) have been performing well on good Chinese data with the latest round of financial injection from the PBOC through Reverse Repo Ops (1 Trillion Yuan).

Economic Data from Europe, UK and North America – ECB Rate Decision

Next week’s high-tier Data for Europe and North-American nations – MarketPulse Economic Calendar

Next week might be a bit heavier on occidental Data releases with a slow start to the week (more action towards the middle of the week).

The week will start with mid-tier Business Outlook Surveys for Canada (typically interesting reports to get to know more what businesses are expecting for inflation etc).

We will also get Retail Sales for Canada (exp -1.1%) on Wednesday and the UK (exp 1.2%) on Friday.

European data will be heavy with ECB’s Bank Lending Survey (published once every 4 years), Eurozone, UK and German PMIs & finally, ECB’s Rate Decision on Thursday 24 (pause largely expected) – (8:45).

Don’t forget the main US Data release of the week – US Global Manufacturing and Services PMIs also on Thursday (9:45).

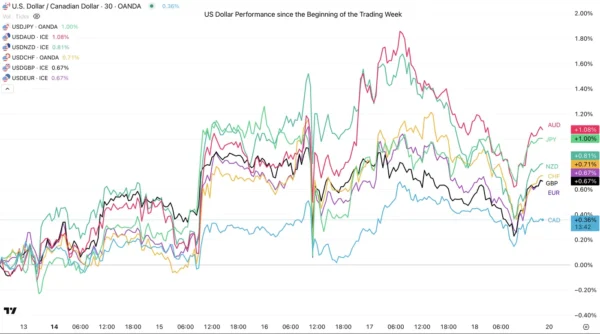

US Dollar performance versus other Forex Major counterparts

US Dollar Performance since the Beginning of the Trading Week, July 18, 2025 – Source: TradingView

The US Dollar kept rallying against other currencies throughout the week, particularly after the CPI Report which preceded a major rally with the DXY touching 98.90.

The AUD got sold off particularly strongly and the JPY got dumped again with USDJPY attaining the extremes of its range.

Dollar Index 1H Chart, July 18, 2025 – Source: TradingView

Despite a rebound today, the price action looks a bit inconclusively bearish – Let’s see what might happen next week (Expect an in-depth analysis beginning next week)

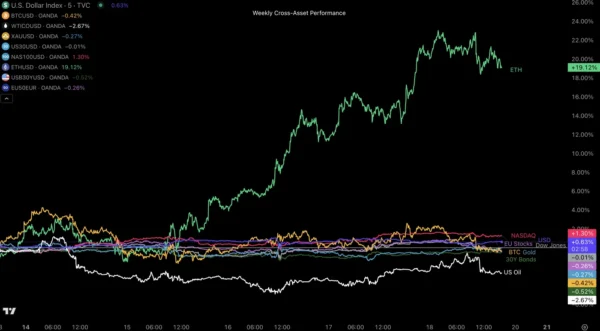

Weekly Asset Performance

Cross-Asset Weekly Performance, July 18, 2025 – Source: TradingView

Ethereum’s uprise had been warranted from its consistent rise in the past few weeks.

For the rest, despite volatile swings the weekly performance is close to unchanged for most assets, except for Oil which lost some ground (Rangebound action).

Stock indices have started to slow down a bit, so we’ll need to track sentiment closely in the upcoming sessions.

Safe Trades and Good Weekend to you all!