- The US dollar may suffer because of Kevin Warsh

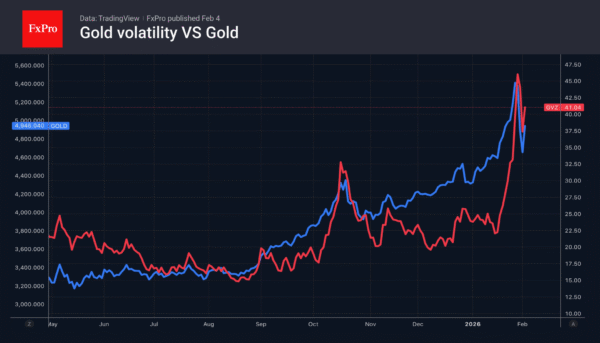

- Gold volatility remains elevated.

The collapse of US stock indices amid new developments in artificial intelligence has caused the US dollar to retreat. Software stocks have been hit hardest by Anthropic’s innovations. The US market no longer looks as exceptional as it once did, with investors tending to diversify their portfolios and sell off American stocks. Coupled with a reassessment of Kevin Warsh’s views as Fed chairman, this brings back interest in buying EURUSD.

The futures market gives a 59% probability of a federal funds rate cut in June and expects two acts of monetary expansion before the end of the year. MUFG Bank notes that Kevin Warsh is respected by the markets. Donald Trump’s choice in his favour has eased concerns about the Fed losing its independence and boosted confidence in the US dollar. However, the former FOMC official intends to cut rates. Rumours are growing on Forex that they will fall by 100-125 basis points.

The Fed is not a one-man show. It will require a change in the economic outlook of the majority of the Open Market Committee, and this process is already underway. According to Richmond Fed President Thomas Barkin, companies are not raising prices due to customer resistance. They are absorbing the tariffs. This is good news for inflation. The US economy is growing thanks to the artificial intelligence ecosystem and serving wealthy customers.

The retreat of the US dollar has strengthened investors’ desire to buy up gold after the slump. Political and geopolitical tensions remain high, fuelling interest in gold as a safe-haven asset. In percentage terms, the precious metal recorded its largest daily gain since March 2009. At that time, investors were actively buying it due to the global economic crisis.

However, Bank of America warns that there was no decline in volatility after gold collapsed on Black Friday, 30 January. The indicator continues to remain at high levels, increasing the risks of a new bubble forming.

As the parliamentary elections approach, hedge funds are increasing their sales of the yen. If the Liberal Democratic Party strengthens its position in the lower house, interest in ‘Takaichi trade’ will return, inspiring USDJPY bulls.