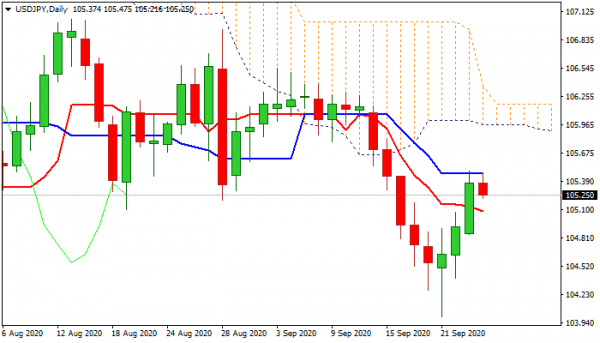

Bounce from new nearly six-month low at 104.00 (following false break below key support at 104.18), shows signs of stall.

Three-day rally was repeatedly capped by daily Kijun-sen (105.47), with fresh weakness in early Thursday’s trading, generating initial signals of reversal.

Daily moving averages are in negative setup and momentum remains weak, supporting the notion.

Fresh weakness pressures initial support at 105.17 (10DMA) and look for break below pivotal support at 104.92 (Fibo 38.2% of 104.00/105.49) that would confirm reversal.

Persisting risk aversion on worries over global economic keep safe-haven yen well supported.

Res: 105.47, 105.60, 105.75, 105.94

Sup: 105.00, 104.92, 104.74, 104.57