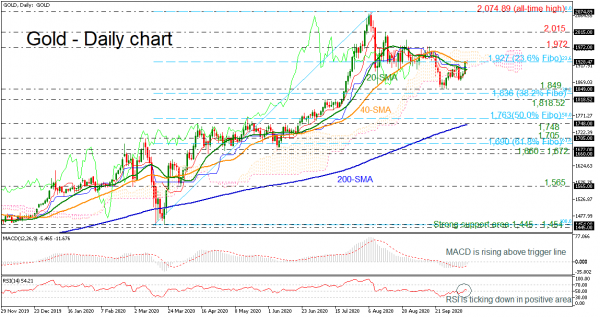

Gold has found immediate resistance at the 23.6% Fibonacci retracement level of the up leg from 1,454 to 2,074.89 at 1,927 and the 40-day simple moving average (SMA). The downside correction over the last two months is now being confirmed by the weak momentum in the MACD oscillator and the downward slope in the RSI.

However, if there is a significant step above the 23.6% Fibonacci, the door could open for the 1,972 barrier and the 2,015 hurdle. Moving higher, the all-time high of 2,074.89 could attract traders’ attention.

On the other side, a fall beneath the 20-day SMA could move the market towards the 1,849 support, which stands marginally above the 38.2% Fibonacci of 1,836 and the 1,818.52 level. Clearing these levels, the price could hit the 50.0% Fibonacci of 1,763 and the 200-day SMA currently at 1,748.

Summarizing, the precious metal has been in a downtrend after the bounce off the record high and only a decisive close above the aforementioned level could add optimism to bulls.