- AUDCAD briefly breaks below upside support line

- Oscillators suggest that momentum is turning bearish

- For the outlook to brighten, a recovery above 0.8945 may be needed

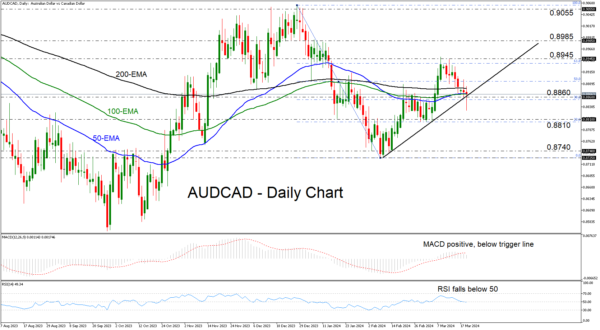

AUDCAD entered a sliding mode on March 12, after hitting resistance at 0.8945, slightly above the 61.8% Fibonacci retracement level of the December 18 – February 8 decline. Today, after the RBA softened its policy guidance, the pair fell below the upward sloping support line drawn from the low of February 9, but it rebounded back above it after Canada’s lower-than-expected CPI numbers.

Both the MACD and the RSI suggest that another round of declines may be possible soon. The former, although still positive, has fallen below its trigger line, while the latter has crossed below its 50 line, indicating bearish momentum.

If the bears are strong enough to take the pair back below the upside line and the 0.8860 area, they may drive the action towards the 0.8810 barrier, which offered support between February 28 and March 5. If that zone doesn’t hold, then a further decline could pave the way towards the 0.8740 territory, near the lows of February 13 and 14.

For the outlook to brighten again, the pair may need to climb all the way above the 0.8945 barrier. Such a move will confirm a higher high and thereby the continuation of the recovery phase that started on February 9. The next obstacle for the bulls may be at around 0.8985, the break of which could carry extensions towards the 0.9055 territory, which acted as a ceiling between December 14 and January 2.

To recap, AUDCAD has been trading in a sliding mode recently, briefly falling below an upward sloping support line today. If the bears regain control soon and push the price back below that line, this may signal the end of the upside correction that started on February 9.