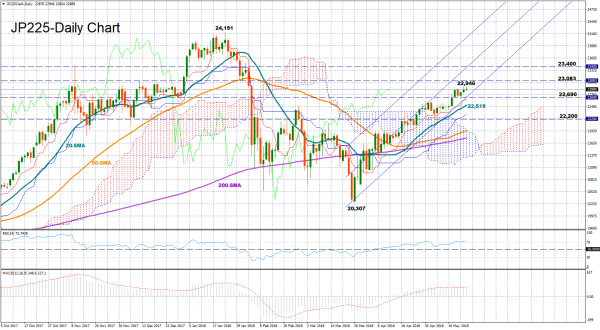

Japan 225 stock index has been fairly bullish over the past two months, printing higher highs and higher lows during the period to peak at levels last seen in early February. The bullish trend is expected to stretch into the short-term as long as the price manages to stay above the Ichimoku cloud and its moving averages which are all positively sloped. Momentum, however, could weaken according to the RSI which is currently flirting with overbought levels. Yet, the MACD supports that there is still some room for improvement as the index continues to strengthen slowly above zero and its red signal line.

Should the market gain further, nearby resistance could be found at the 3 ½-month high of 22,946 reached on Thursday before the focus shifts to December’s high of 23,083. Above from here, the next target could be met around the middle of the ascending channel, near 23,400.

Alternatively, dips in the price could face a barrier at this week’s support level of 22,690, where the lower bound of the channel happens to be. If the market fails to hold inside the channel, then negative pressures could strengthen towards the 20-day simple moving average currently standing at 22,519. Steeper decreases below that level could also test the area around 22,200, found at the 50% Fibonacci of the downleg from 24,191 to 20,307.

Turning to the medium-term picture, the outlook is expected to remain positive as far as the market continues to trade above 22,500.