ECB monetary policy decision is a major focus for today and “recalibration” of the instruments are widely expected. Of the various tools, the pandemic emergency purchase program (PEPP) and the targeted longer-term refinancing operations (TLTROs) are the keys. For the former, we expect to see an increase of EUR 500B to the current envelope, making the total size to EUR 1850B . The program will extend to last at least until end-2021. Meanwhile, the discount window of TLTRO-III could be extended to the entire 3-year duration. Further easing in the collateral requirement is also likely.

Some suggested readings:

- ECB Preview – Policy Recalibration to Focus on PEPP and TLTRO

- ECB Meeting: Sinking the Euro Won’t be Easy

- ECB Preview: Recalibrating, Not Easing

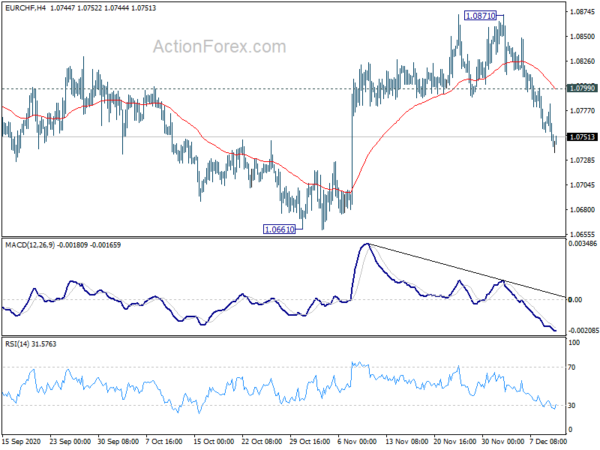

Technically, Euro is relatively mixed for the moment. EUR/CHF’s decline from 1.0871 was deeper then originally expected. It suggests that EUR/CHF is in another falling leg inside the corrective pattern from 1.0915. Deeper fall is in favor as long as 1.0799 minor resistance holds, for 1.0661 support.

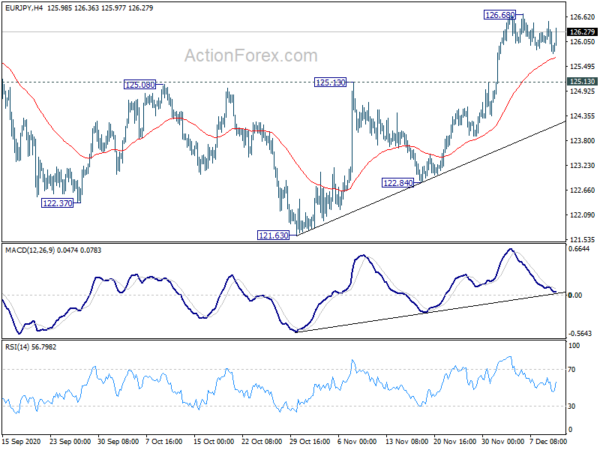

On the other hand, EUR/JPY’s price actions from 126.68 are clearly corrective. It’s also holding well above 125.13 resistance turned support. Thus, another rise is in favor through 126.68 to 127.07 key resistance. Decisive break there will resume whole rally form 114.42. We’d see which way the Euro goes soon.