Minutes of RBA’s May 4 meeting reiterated that rate hike was unlikely “until 2024 at the earliest”. Members would “consider whether to retain the April 2024 bond as the target bond for the 3-year yield target or to shift to the next maturity” in July.

Concerning QE, the members suggested they were “willing to undertake further bond purchases if doing so would assist with progress towards the Bank’s goals of full employment and inflation”. All actions are dependent on incoming economic data.

However, given that unemployment rate (5.6%) has stayed markedly above RBA’s long-term target of 4-4.5%, the central bank would likely extend QE with another AUD 100B at the July meeting.

More in RBA:

- RBA Minutes Reaffirmed Likelihood of QE Expansion in July

- RBA May Board Minutes Highlight Financial Conditions and Data Flow

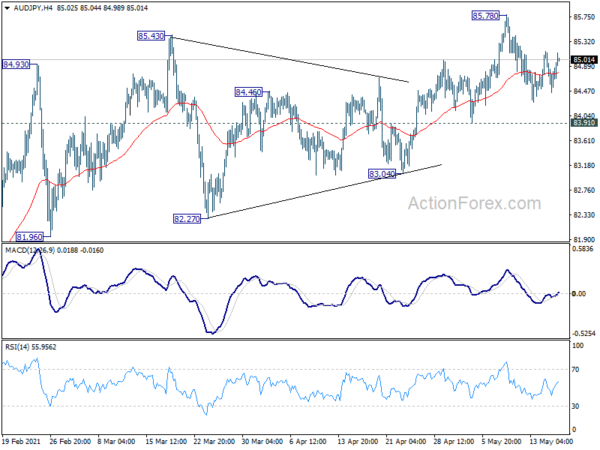

Australian Dollar trades mildly higher earlier today, mainly due to broad based risk sentiment. AUD/JPY is struggling in range below 85.78, as consolidation continues. There is no change in the bullish outlook with 83.91 support intact. Upside break through 85.78 is in favor, and up trend from 59.89 should then target 90.29 long term structural resistance.

However, break of 83.91 support will delay the bullish case. AUD/JPY could have a deeper correction towards 55 week EMA (now at 79.33) first, before resuming the up trend at a later stage.