BoC is widely expected to continue tapering today, by announcing to lower weekly asset purchases by CAD 2B to CAD 1B. Also, the central bank would set the plan to end QE in December. Markets are currently pricing in three rate hikes in 2022, and would be eager to see any adjustment in the forward guidance to affirm such expectations. But BoC would probably hold their cards until December, and just reiterate that policy rate would stay at “the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved”.

Some previews on BoC:

- BoC Preview – Further QE Tapering

- Bank of Canada Preview: When is BoC Looking to Raise Rates?

- Bank Of Canada Meeting: Tapering And Rate Hike Timeline On The Agenda

- Forward Guidance: BoC to Ease Off the Monetary Policy Accelerator

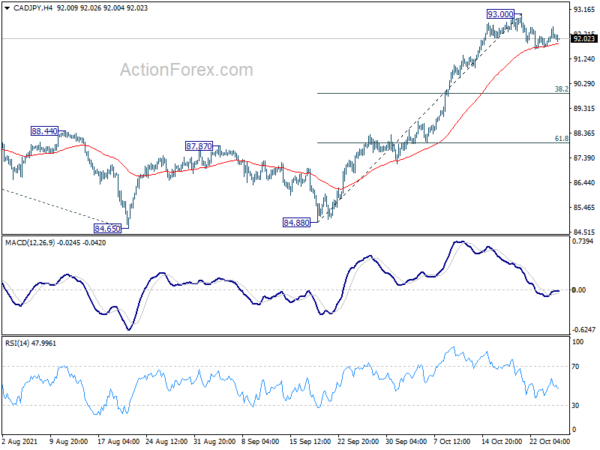

CAD/JPY turned into sideway consolidations after hitting 93.00 last week, but overall bullish outlook is unchanged. Deeper pull back cannot be ruled out. But downside should be contained by 38.2% retracement of 84.88 to 93.00 at 89.89 to bring rebound. Meanwhile, break of 93.00 will resume larger up trend from 73.80. Next target is 61.8% projection of 73.80 to 91.16 from 84.65 at 95.37.