Fed is widely expected to hold interest rates steady at the current range of 5.25-5.50% today. The focal point of today’s announcement, however, lies beyond the immediate rate decision; all eyes are on Fed’s updated economic projections and dot plot for insights into the path of monetary easing this year.

The crux of the matter hinges on whether Fed’s new projections will continue to forecast three rate cuts within the year, and thus making June the likely month to commence.

Alternatively, amidst recent data revealing the stubborn persistence of inflation, Fed might adjust its outlook to envision just two cuts for the year, which would likely postpone the initial reduction to the third quarter.

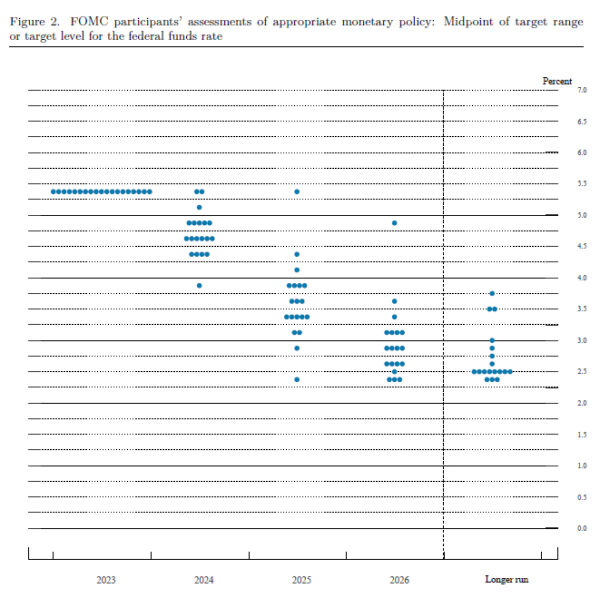

The December dot plot presented a 8-11 split among Fed members, with 8 anticipating the federal funds rate to exceed 4.75% by year-end, while 11 predicted it would fall below this mark. A subtle but pivotal shift of just two dots would sway the balance to 10-9, leaning towards the scenario of only two rate cuts.

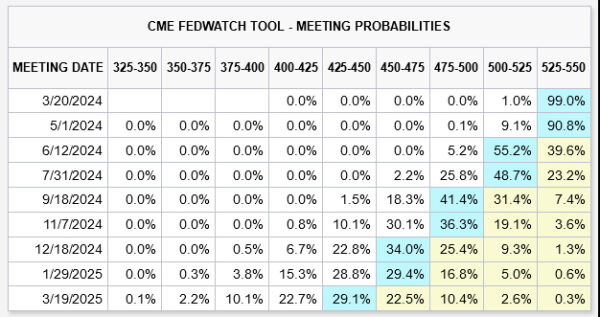

Market expectations, as reflected in Fed fund futures, currently assign slightly over 60% probability to a June rate cut. By December’s end, there’s a 64% likelihood of the federal funds rate adjusting down to 4.50-4.75%.

10-year yield retreated mildly overnight to close at 4.297, but there is no clear sign of topping yet. A hawkish FOMC result today, signalling fewer rate cut this year, could give TNX another push through 4.354 resistance, and thus pulling Dollar higher along. Yet, strong resistance is expected between 4.391 and 4.534 (50% and 61.8% retracement of 4.997 to 3.785) to limit upside, to complete the corrective rebound from 3.785.