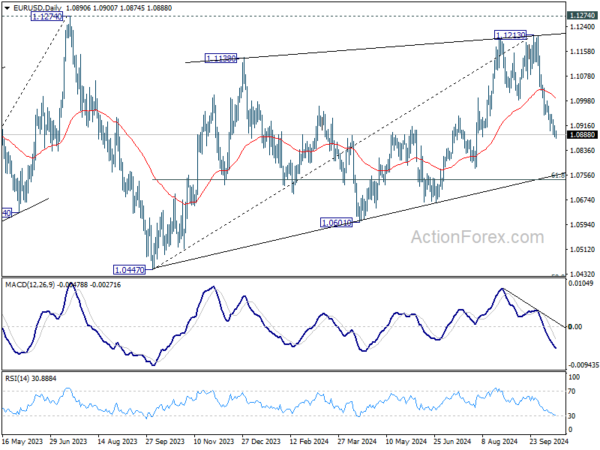

Daily Pivots: (S1) 1.0876; (P) 1.0897; (R1) 1.0911; More….

EUR/USD’s fall from 1.1213 is in progress and intraday bias remains on the downside. This decline is seen as the third leg of the corrective pattern from 1.1274. Deeper fall would be seen to 61.8% retracement of 1.0447 to 1.1213 at 1.0740 next. On the upside, above 1.0953 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another decline.

In the bigger picture, rejection by 1.1274 resistance suggests that corrective pattern from 1.1274 (2023 high) is not completed yet. Instead, decline from 1.1213 might be another falling leg. Sustained break of 55 W EMA (now at 1.0877) will validate this case, and bring deeper fall towards 1.0447 support again. But downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404.