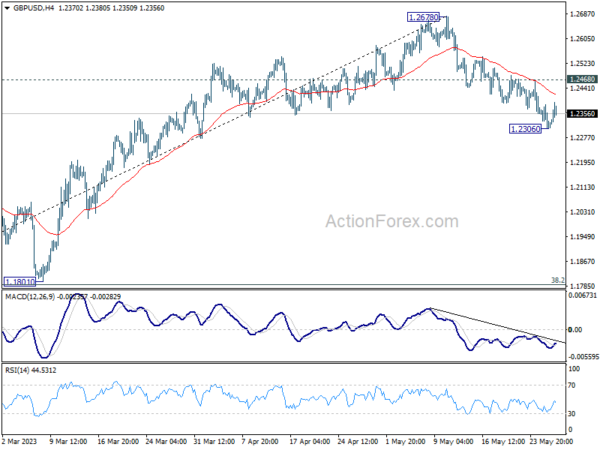

Daily Pivots: (S1) 1.2291; (P) 1.2339; (R1) 1.2370; More…

Intraday bias in GBP/USD is turned neutral first with current recovery. But further fall is expected as long as 1.2468 resistance holds. Decline from 1.2678 is seen as correcting whole up trend from 1.0351. Break of 1.2306 will target 1.1801 cluster support (38.2% retracement of 1.0351 to 1.2678 at 1.1789). On the upside, above 1.2468 minor resistance will turn bias back to the upside for stronger rebound.

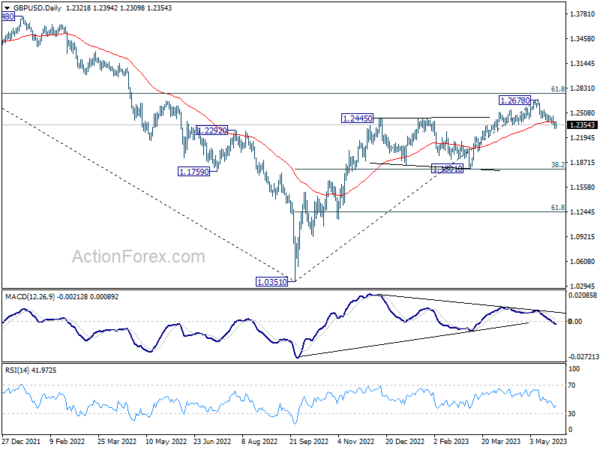

In the bigger picture, as long as 1.1801 support holds, rise from 1.0351 medium term bottom (2022 low) is expected to extend further. Sustained break of 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759 will add to the case of long term bullish trend reversal. However, firm break of 1.1801 will indicate rejection by 1.2759, and bring deeper decline, even as a correction.