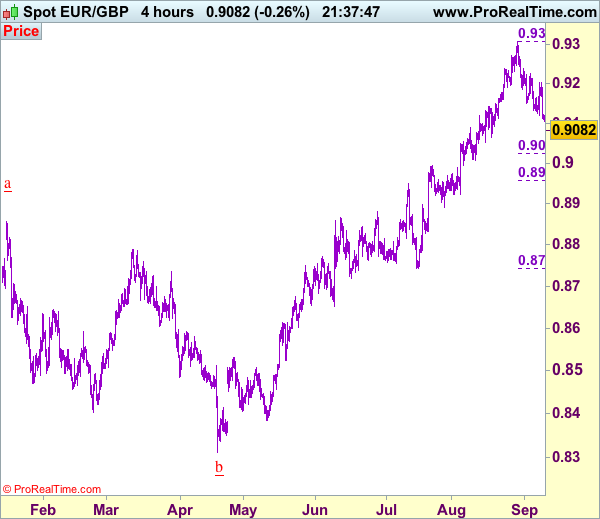

EUR/GBP – 0.9081

Original strategy :

Sell at 0.9200, Target: 0.9060, Stop: 0.9240

Position : –

Target : –

Stop : –

New strategy :

Sell at 0.9130, Target: 0.9000, Stop: 0.9170

Position : –

Target : –

Stop : –

As the single currency has fallen again after brief recovery, adding credence to our view that the fall from 0.9307 is still in progress and mild downside bias remains for this move from temporary top of 0.9307 to bring retracement of recent upmove to 0.9050 (61.8% Fibonacci retracement of 0.8892-0.9307), then towards 0.9025 (50% Fibonacci retracement of 0.8743-0.9307), however, near term oversold condition should prevent sharp fall below support at 0.9008l and price should stay well above 0.8955-60 (61.8% Fibonacci retracement), bring rebound later.

In view of this, we are inclined to sell euro on recovery as 0.9130-35 should limit upside. Above 0.9160-70 would defer and risk rebound to resistance at 0.9203, break there would suggest low is formed instead, bring a stronger rebound to 0.9235-40 but price should falter well below said resistance at 0.9307.

Our preferred count is that, after forming a major top at 0.9805 (wave V), (A)-(B)-(C) correction is unfolding with (A) leg ended at 0.8400 (A: 0.8637, B: 0.9491 and 5-waver C ended at 0.8400. Wave (B) has ended at 0.9413 and impulsive wave (C) has either ended at 0.8067 or may extend one more fall to 0.8000 before prospect of another rally. Current breach of indicated resistance at 0.9043 confirms our view that the (C) leg has ended and bring stronger rebound towards 0.9150/54, then towards 0.9240/50.