Dollar recovers mildly in relatively quiet markets today while Aussie and Euro turn softer. But major pairs and crosses are generally keep well inside Friday’s range, suggesting limited movements so far. Three central banks will meet this week including BoC, BoJ and then ECB. Lots of heavy weight economic data will be featured too including GDP from US and Eurozone. In the background, the themes of US election and stimulus, Brexit negotiations and coronavirus resurgence are ongoing.

Technically, a point to note is that while Dollar was sold off broadly last week, it’s held above recent lows against all major currencies. Gold also failed to break through 1933.17 resistance but reversed. If the selling doesn’t resume and push the greenback through near term support levels, we might indeed see Dollar bearish lighten up their positions ahead of next week’s election. That is, there is prospect of a rebound in the greenback later in the week. However, some levels need to be taken out firmly before taking the rebound, if happens, seriously. In particular, 1.1688 support in EUR/USD, 106.10 resistance in USD/JPY and 1872.82 support in Gold are key.

In Asia, currently, Nikkei is down -0.11%. Hong Kong HSI is up 0.54%. China Shanghai SSE is down -0.65%. Singapore Strait Times is down -0.19%. Japan 10-year JGB yield is down -0.003 at 0.036.

BoC to stand pat while EUR/CAD preparing for bullish breakout

BoC is widely expected to keep the overnight rate unchanged at the effective lower bound of 0.25% this week. Bank rate and deposit rate will be kept at 0.50% and 0.25% respectively. Meanwhile, as the central has already been tweaking its asset purchases program, there might be some more changes to be announced at the meeting. Though, they shouldn’t be viewed as a change in the monetary stance, but just some adjustments to fine-tune the program.

Forward guidance would be kept unchanged too as policy rate will be kept at the “effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved”. “QE program will continue until the recovery is well underway”. The question is, whether Governor Tiff Macklem would take the opportunity to start push the message that BoC would not hike before the Fed.

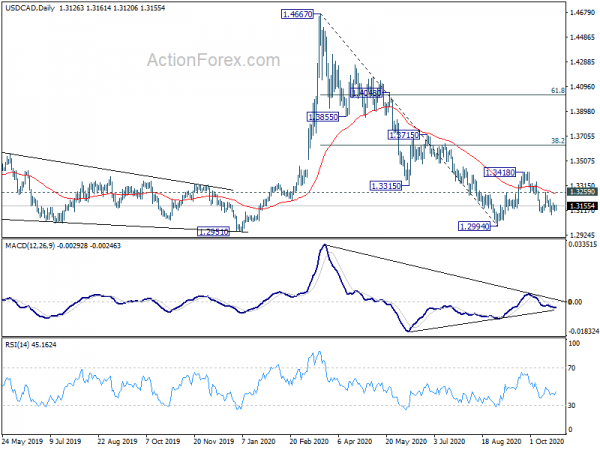

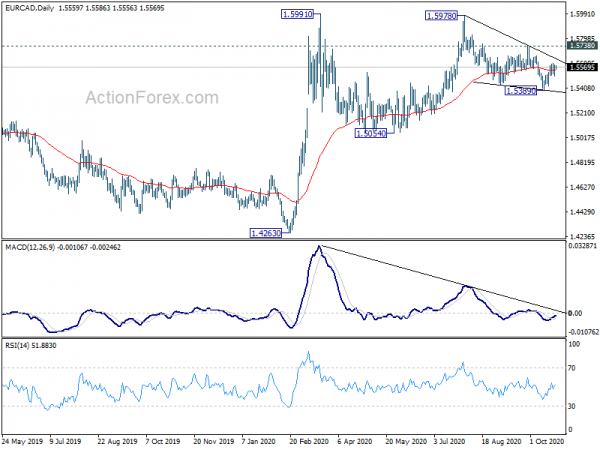

EUR/CAD is building the case of a bullish break out. EUR/CAD’s price action from 1.5978 are clearly corrective, which could have completed at 1.5389. Break of 1.5738 resistance would confirm this view and bring resumption rise from 1.5054 through 1.5978. Meanwhile, USD/CAD’s downside attempt has been contained well above 1.2994 low so far. Break of 1.3529 resistance would extend the pattern from 1.2994 with another rising leg through 1.3418 resistance. If BoC announce this week is going to trigger some selloff in the Canadian, we’d prefer to see the break of these two levels together to double confirm.

BoJ might downgrade inflation forecasts, AUD/JPY waiting for downside breakout

BoJ is widely expected to keep the parameters of the yield curve control unchanged this week. Short term policy rate would be held at -0.10%. JGB purchases will continue without upper limit to keep 10-year yield at around 0%, with fluctuations allowed to some extent. Goushi Katakoa will continue to be the sole dissenter, pushing for more monetary easing.

Governor Haruhiko Kuroda would maintain the assessment that the economy is on track to recovery from the coronavirus pandemic. Yet the path would remain highly depend on infections. There are, though, some expectations that BoJ would downgrade inflation forecasts. for the current fiscal year. With new Prime Minister Yoshihide Suga’s Go To Travel campaign that offers subsidized domestic travel, there is downward pressure on prices. But the temporary move in prices wouldn’t alter BoJ’s plan for now.

Back in June, BoJ forecasts GDP to contract -5.7% to -4.5% in fiscal 2020, then rebound by 3.0% to 4.0% in fiscal 2021. Core CPI (all item less fresh food) was forecast to be at -0.6% to -0.4% in by the end of fiscal 2020, and then at 0.2% to 0.5% by the end of fiscal 2021.

Yen’s path has decoupled from US treasury yield recently. But the next move would still be in-sync with overall risk markets, which is heavily affected by the outcome of US election. AUD/JPY is staying in the corrective pattern from 78.46. While selling hesitated ahead of 73.97 support, we’d anticipate an eventual break to the downside for 38.2% retracement of 59.89 to 78.46 at 71.36.

ECB to prepare markets for more stimulus as recovery falters

The Eurozone economic is facing much risk of double-dip recession with the resurgence of coronavirus infections. Tens of millions people are returning to restrictions which would hit the services industry particularly hard. Recent PMIs have already shown that recovery is faltering. Inflation has also turned into negative. ECB policymakers are clear that they’re ready for more stimulus.

Yet, Thursday is not seen as the time to deliver any new measures yet. After all, less than half the money allocated to the pandemic emergency purchase program has been spend. There won’t be need economic projections before December. By then, economists could finally factor in the results of US elections and Brexit negotiations. So December would be the better timing to gauge the stimulus needed next year. We might get some indication from President Christine Lagarde for the later move.

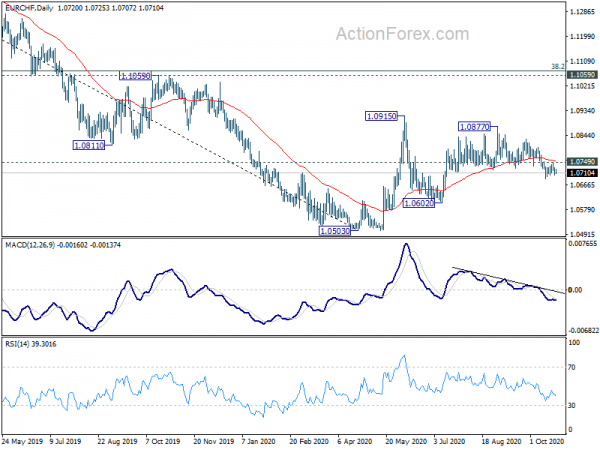

While Euro might be firm against Dollar, the picture in EUR/CHF is not looking too well for the near term. As long as 1.0749 resistance holds (which is close to 55 day EMA), we’d expect fall from 1.0877 to extend lower. Such decline is seen as the third leg of the pattern from 1.0915 and would target 1.0602 support and even below. EUR/CHF will need to overcome 1.0749 resistance to clear near term bearishness.

Looking ahead

In addition the the three central bank meetings, US elections, Brexit and coronavirus pandemic would remain the focuses for the week. Attention will be paid to some key economic data too, in particular GDP from US, Eurozone and Canada. Here are some highlights for the week:

- Monday: Japan corporate service price index; Germany Ifo business climate; US new home sales.

- Tuesday: New Zealand trade balance; Eurozone M3 money supply, UK CBI realized sales; US durable goods orders, house price index, consumer confidence.

- Wednesday: Australia CPI; Germany import prices; US goods trade balance, wholesales inventories; BoC rate decision.

- Thursday: New Zealand ANZ business confidence; Australia NAB quarterly business confidence, import prices; Japan retail sales, consumer confidence, BoJ rate decision; Germany CPI, unemployment; ECB rate decision; US pending home sales, GDP.

- Friday: Australia PPI; Japan industrial production, housing starts; France GDP, CPI; Germany GDP, retail sales; Swiss retail sales KOF economic barometer; Eurozone GDP, unemployment rate; Canada GDP, IPPI and RMPI; US personal income and spending; Chicago PMI.

USD/JPY Daily Outlook

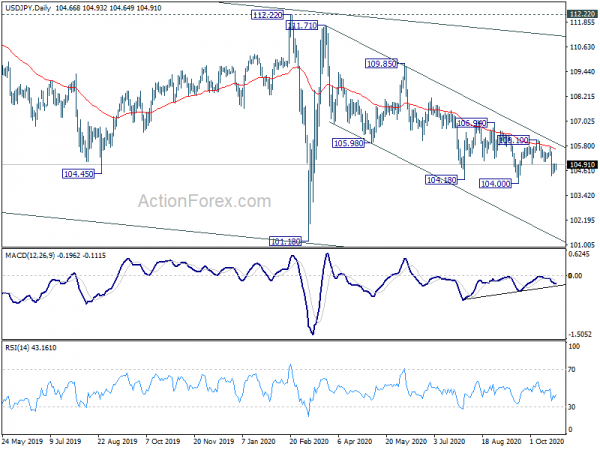

Daily Pivots: (S1) 104.52; (P) 104.73; (R1) 104.91; More...

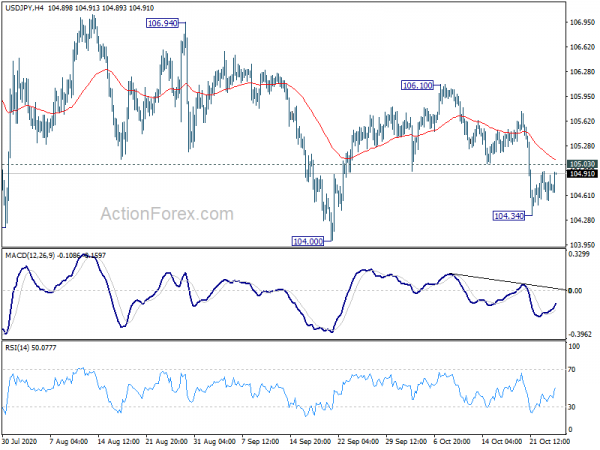

Intraday bias in USD/JPY remains neutral first and another fall is mildly in favor as long as 105.03 minor resistance holds. Below 104.34 will target 104.00 low first. Break will resume larger decline from 111.71. Nevertheless, sustained break of 105.03 support turned resistance will neutralize immediate near term bearishness. Intraday bias will be turned back to the upside for 106.10 resistance instead.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 resistance should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Sep | 1.30% | 1.00% | 1.00% | 1.10% |

| 9:00 | EUR | Germany IFO Business Climate Oct | 92.7 | 93.4 | ||

| 9:00 | EUR | Germany IFO Current Assessment Oct | 89.7 | 89.2 | ||

| 8:00 | EUR | Germany IFO Expectations Oct | 96 | 97.7 | ||

| 14:00 | USD | New Home Sales Sep | 1025K | 1011K |