EUR/USD

Current level – 1.1828

The support zone at 1.1797 was not broken and the EUR gained some positions against the USD, reaching the current level around 1.1828 and a test of the close resistance zone at 1.1859 is highly probable. A successful violation of this level will increase the chances for a breakthrough of the next target at 1.1903 and will encourage bulls to continue the rally. The first target for the bears lies at 1.1797, followed by the lower one at 1.1699.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1860 | 1.1960 | 1.1800 | 1.1580 |

| 1.1900 | 1.2080 | 1.1699 | 1.1460 |

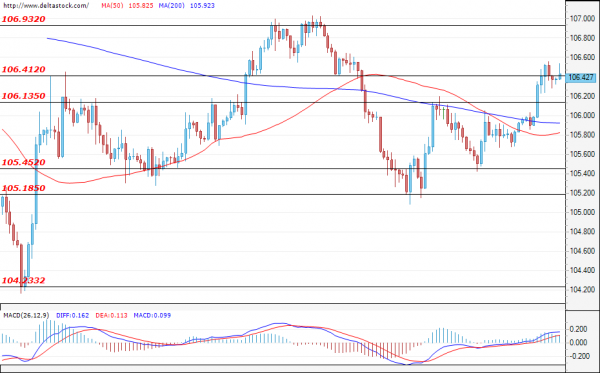

USD/JPY

Current level – 106.42

Yesterday, the positive momentum pushed the breach of the resistance level at 106.13 as the dollar continued to gain ground against the yen, reaching the resistance at 106.41. If the power of the buyers persists, we could witness a successful violation of the aforementioned level and a move towards the upper resistance zone that lies at 106.93. If bears take control, negative pullback should be limited around the zone at 106.13, but if the selling pressure increases, the odds of continuation of the downside move towards 105.45 will rise.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 106.41 | 106.93 | 106.13 | 105.18 |

| 106.93 | 107.50 | 105.45 | 104.20 |

GBP/USD

Current level – 1.3141

After the start of today’s trading, the Cable continued its struggle to overcome the resistance level 1.3138. A successful breach here could easily lead to new gains for the GBP against the USD and pave the way for the currency pair towards a test of the highs around 1.3247 and strengthen the bullish sentiment. If the resistance level holds, we will most probably see the GBP/USD decline and attempt a breach of the support zone at 1.3081, followed by the next one at 1.2996, if the pair gains enough momentum.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3140 | 1.3300 | 1.3080 | 1.2950 |

| 1.3247 | 1.3345 | 1.3000 | 1.2895 |