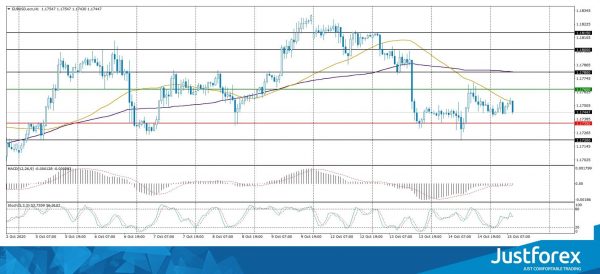

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.17446

Open: 1.17453

% chg. over the last day: +0.01

Day’s range: 1.17315 – 1.17579

52 wk range: 1.0637 – 1.2012

There is an ambiguous technical pattern on the EUR/USD currency pair. The trading instrument is in a sideways trend. The euro is testing local supply and demand zones: 1.1720-1.1735 and 1.1765-1.1780, respectively. Investors expect up-to-date information concerning negotiations in the US Congress on a new stimulus package. The situation with the COVID-19 pandemic in Europe continues to deteriorate rapidly. Today, investors will assess US economic releases. We recommend opening positions from key levels.

The news feed on 2020.10.15:

Initial jobless claims in the US at 15:30 (GMT+3:00);

Philadelphia Fed manufacturing index at 15:30 (GMT+3:00).

Indicators do not give accurate signals: the price has crossed the 50 MA.

The MACD histogram is near the 0 mark. There are no signals at the moment.

Stochastic Oscillator is in the neutral zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.1735, 1.1720, 1.1700

Resistance levels: 1.1765, 1.1780, 1.1800

If the price fixes below 1.1735, further correction of EUR/USD quotes is expected. The movement is tending to 1.1700-1.1680.

An alternative could be the growth of the EUR/USD currency pair to 1.1800-1.1820.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.29312

Open: 1.30069

% chg. over the last day: +0.60

Day’s range: 1.29861 – 1.30299

52 wk range: 1.1409 – 1.3516

In the last sessions, trades on the GBP/USD currency pair are very active. At the same time, there is no defined trend. Yesterday, demand for the British pound rose significantly following reports that a Brexit agreement is still possible in the upcoming weeks. At the moment, GBP/USD quotes are consolidating in the range of 1.2990-1.3035. The British pound has the potential for further growth. Positions should be opened from key levels.

We recommend paying attention to economic releases from the US.

Indicators do not give accurate signals: the price has crossed the 50 MA and 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy GBP/USD.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates the bullish sentiment.

Trading recommendations

Support levels: 1.2990, 1.2960, 1.2925

Resistance levels: 1.3035, 1.3080, 1.3100

If the price fixes above 1.3035, further growth of the GBP/USD currency pair is expected. The movement is tending to 1.3070-1.3100.

An alternative could be a decline in GBP/USD quotes to 1.2960-1.2925.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.31341

Open: 1.31421

% chg. over the last day: +0.06

Day’s range: 1.31388 – 1.31694

52 wk range: 1.2949 – 1.4669

The USD/CAD currency pair continues to consolidate after a prolonged fall. There is no defined trend. Currently, the loonie is testing 1.3170. The 1.3125 level is the nearest support. The trading instrument is tending to correct. We recommend paying attention to the dynamics of “black gold” prices. Positions should be opened from key levels.

The news feed on Canada’s economy is calm.

Indicators do not give accurate signals: 50 MA has crossed 100 MA.

The MACD histogram has started rising, which indicates the bullish sentiment.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which gives a signal to buy USD/CAD.

Trading recommendations

Support levels: 1.3125, 1.3100

Resistance levels: 1.3170, 1.3200, 1.3225

If the price fixes above 1.3170, USD/CAD quotes are expected to correct. The movement is tending to 1.3200-1.3225.

An alternative could be a decline in the USD/CAD currency pair to 1.3100-1.3080.

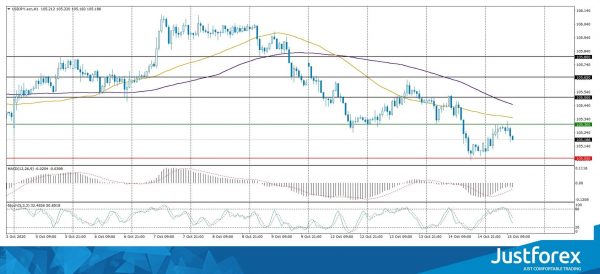

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 105.457

Open: 105.121

% chg. over the last day: -0.30

Day’s range: 105.061 – 105.332

52 wk range: 101.19 – 112.41

Sales prevail on the USD/JPY currency pair. The trading instrument has updated its local lows again. At the moment, USD/JPY quotes are consolidating in the range of 105.05-105.30. The trading instrument has the potential for further decline. We recommend paying attention to the dynamics of US government bonds yield. Positions should be opened from key levels.

The news feed on Japan’s economy is calm.

Indicators signal the power of sellers: the price has fixed below 50 MA and 100 MA.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell USD/JPY.

Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which also indicates the bearish sentiment.

Trading recommendations

Support levels: 105.05, 104.70, 104.50

Resistance levels: 105.30, 105.50, 105.65

If the price fixes below 105.05, a further fall in USD/JPY quotes is expected. The movement is tending to 104.80-104.60.

An alternative could be the growth of the USD/JPY currency pair to 105.50-105.70.