Australian Dollar weakened across the board in Asian session, dragged down by unexpectedly poor retail sales data for March. The contraction in sales is a reminder to RBA about the ongoing impact of cost of living pressures exacerbated by higher interest rates and inflation. This challenging economic backdrop is likely to make RBA more cautious about any further rate hikes, which would place additional financial strains on consumers.

Concurrently, the economic outlook from China presents a mixed picture. While manufacturing data showed some resilience, disappointing services sector performance is casting doubts on the momentum of China’s economic recovery. This uncertainty in China’s economic conditions is holding back Aussie bulls from adding to their long positions.

Meanwhile, Japanese Yen also weakened slightly as yesterday’s rebound faded. Japan’s chief currency diplomat, Masato Kanda, has yet to confirm any official intervention in the currency markets. Though he noted the authorities’ readiness to address foreign exchange issues around the clock, whether it’s London, New York or Wellington hours. At same time, Nikkei index is having a robust rebound as it resumed trading post-holiday, arguing that investors are embracing stabilization in Yen’s selloff.

On the other hand, Dollar is recovering broadly, while Swiss Franc is strengthening slightly too. Euro is also mildly on the firmer side while Sterling and Canadian are positioning in the middle. Lots of market moving economic data are featured today, with most focuses on Eurozone GDP and CPI flash, Canada’s GDP, and US consumer confidence.

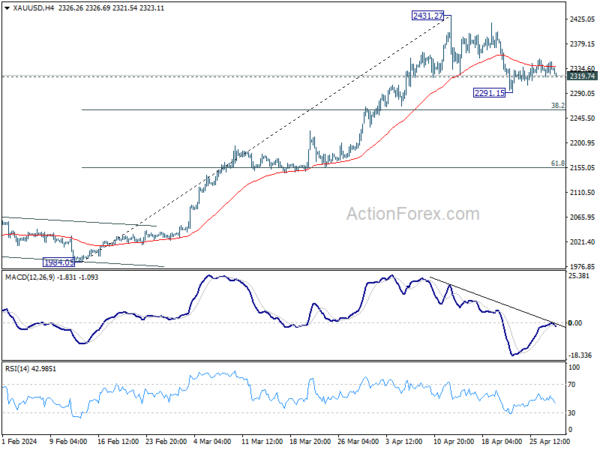

Technically, Gold’s recovery lost momentum after meeting resistance from 55 4H EMA. Immediate focus is now on 2319.74 minor support. Firm break there will argue that the corrective fall from 2431.27 is ready to resume through 2291.15, and target 38.2% retracement of 1984.05 to 2431.27 at 2260.43.

In Asia, at the time o f writing, Nikkei is up 1.05%. Hong Kong HSI is down -0.03%. China Shanghai SSE is down -0.23%. Singapore Strait Times is up 0.25%. Japan 10-year JGB yield is down -0.054 at 0.874. Overnight, DOW rose 0.38%. S&P 500 rose 0.32%. NASDAQ rose 0.35%. 10-year yield fell -0.055 to 4.614.

Japan’s industrial production rises 3.8% mom in Mar, more growth ahead

Japan’s industrial sector showed a robust rebound in March, with production rising by 3.8% mom, surpassing expectations of a 3.4% increase. This significant uptick represents a strong recovery from the previous month’s -0.6% yoy decline.

Production of machinery, including semiconductor manufacturing equipment, jumped by 11.6% mom, while output in electronic parts and devices saw 9.2% mom increase.

According to manufacturers surveyed by Japan’s Ministry of Industry, the up trend in industrial output is expected to continue, with projections of a 4.1% rise in April and a further 4.4% expansion in May.

Contrastingly, the retail sector did not fare as well. Retail sales in March increased by only 1.2% yoy, falling short of 2.2% yoy growth anticipated and marking a deceleration from February’s robust 4.7% yoy increase. On a month-on-month basis, retail sales contracted -1.2%, reversing the 1.7% gain observed in February.

Australia’s retail sales falls -0.4% mom in Mar amid cost of living pressures

Australia’s retail sales fell -0.4% mom in March, well below expectation of 0.2% mom.

Ben Dorber, ABS head of retail statistics, highlighted the impact of cost of living pressures on consumer behavior.

He further noted the stagnation in the sector, stating, “Underlying retail turnover has been flat for the past six months and was up only 0.8 percent compared to March 2023.”

This represents one of the weakest growth rates on record for this period, excluding the unique economic circumstances induced by the pandemic and the introduction of GST.

New Zealand ANZ business confidence plunges to 14.9 amid rising costs and weak demand

ANZ Business Confidence dropped notably from 22.9 to 14.9 in April. Own Activity Outlook similarly decreased from 22.5 to 14.3.

The survey highlighted escalating cost pressures as a primary concern for businesses. Cost expectations rose from 74.6 to 76.7, marking the highest level since last September. Conversely, wage expectations decreased from 80.5 to 75.5. Profit expectations also worsened, deepening from -3.8 to -9.8.

Pricing intentions, which indicate how businesses plan to adjust their selling prices, increased slightly from 45.1 to 46.9. Inflation expectations showed a marginal decrease from 3.80% to 3.76%.

ANZ analysts pointed to several factors contributing to this environment of cost-push inflation amidst weak demand. Rising oil prices due to escalating tensions in the Middle East, coupled with recent decline in New Zealand Dollar have increased the cost of imports significantly. Additionally, the recent increase in the minimum wage, effective from April 1, although smaller than previous years, has added another layer of cost for businesses.

China’s NBS PMI manufacturing falls to 50.4, Caixin rises to 51.4

China’s NBS PMI Manufacturing fell from 50.8 to 50.4 in April, matched expectations. NBS PMI Non-Manufacturing fell from 53.0 to 51.2, below expectation of 52.2. PMI Composite fell from 52.7 to 51.7.

The breakdown of the manufacturing PMI reveals challenges in solidifying demand, as the new orders subindex dropped to 51.1 from 53, and the new export orders fell to 50.6 from 51.3. Conversely, the production subindex showed modest improvement, rising to 52.9 from 52.2.

Senior NBS statistician Zhao Qinghe noted, “Though economic activities continued to expand, more manufacturers are facing higher costs.” He highlighted specific industries such as automobiles and electrical machinery, where domestic and foreign market demands are reportedly strengthening.

In contrast, Caixin PMI, which focuses more on smaller, private manufacturing firms, presented a more optimistic view. Caixin Manufacturing PMI rose to 51.4 from 51.1, surpassing expectations of 51.0.

According to Wang Zhe, senior economist at Caixin Insight Group, “the manufacturing sector continued to improve, with accelerated expansion in supply and demand, sweetened by exceptional performance in overseas demand.”

Looking ahead

Eurozone CPI flash and GDP preliminary are the mian focuses in Europeansession. France conumser spending and GDP, Germany import prices, retail sales, unemployment and GDP will also be featured. Swiss will publish KOF economic barometer.

Later in the day, Canada GDP is the main focus. US wil release employment cost index, house price index, Chicago PMI and consumer confidence.

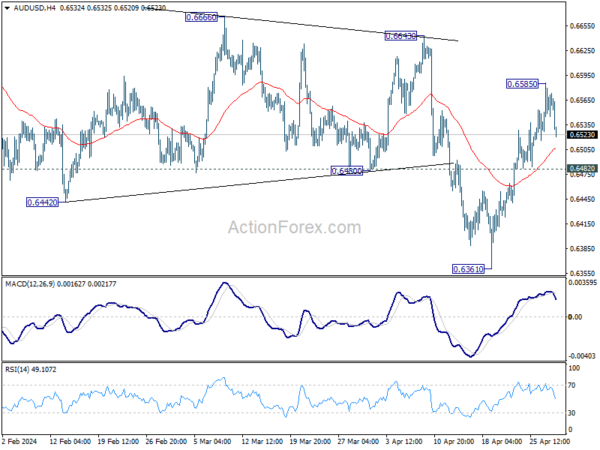

AUD/USD Daily Report

Daily Pivots: (S1) 0.6532; (P) 0.6559; (R1) 0.6594; More…

Intraday bias in AUD/USD is turned neutral first with current retreat. Another rise is mildly in favor as long as 0.6482 support holds. Fall from 0.6870 might have completed at 0.6361 already Above 0.6585 will target 0.6643 resistance next. However, firm break of 0.6482 will dampen this view and bring retest of 0.6361 low instead.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which is still in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Mar P | 3.80% | 3.40% | -0.60% | |

| 23:50 | JPY | Retail Trade Y/Y Mar | 1.20% | 2.20% | 4.70% | |

| 23:30 | JPY | Unemployment Rate Mar | 2.60% | 2.50% | 2.60% | |

| 01:00 | NZD | ANZ Business Confidence Apr | 14.9 | 22.9 | ||

| 01:30 | AUD | Retail Sales M/M Mar | -0.40% | 0.20% | 0.30% | |

| 01:30 | AUD | Private Sector Credit M/M Mar | 0.30% | 0.40% | 0.50% | |

| 01:30 | CNY | NBS Manufacturing PMI Apr | 50.4 | 50.4 | 50.8 | |

| 01:30 | CNY | NBS Non-Manufacturing PMI Apr | 51.2 | 52.2 | 53 | |

| 01:45 | CNY | Caixin Manufacturing PMI Apr | 51.4 | 51 | 51.1 | |

| 05:00 | JPY | Housing Starts Y/Y Mar | -12.80% | -7.60% | -8.20% | |

| 05:30 | EUR | France Consumer Spending M/M Mar | 0.40% | 0.10% | 0.00% | |

| 05:30 | EUR | France GDP Q/Q Q1 P | 0.20% | 0.20% | 0.10% | |

| 06:00 | EUR | Germany Import Price Index M/M Mar | 0.10% | -0.20% | ||

| 06:00 | EUR | Germany Retail Sales M/M Mar | 1.30% | -1.90% | ||

| 07:00 | CHF | KOF Leading Indicator Apr | 101.7 | 101.5 | ||

| 07:55 | EUR | Germany Unemployment Change Apr | 7K | 4K | ||

| 07:55 | EUR | Germany Unemployment Rate Apr | 5.90% | 5.90% | ||

| 08:00 | EUR | Italy GDP Q/Q Q1 P | 0.20% | 0.20% | ||

| 08:00 | EUR | Germany GDP Q/Q Q1 P | 0.10% | -0.30% | ||

| 08:30 | GBP | M4 Money Supply M/M Mar | 0.40% | 0.50% | ||

| 08:30 | GBP | Mortgage Approvals Mar | 61K | 60K | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q1 P | 0.10% | 0.00% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Apr P | 2.40% | 2.40% | ||

| 09:00 | EUR | Eurozone CPI CoreY/Y Apr P | 2.60% | 2.90% | ||

| 12:30 | CAD | GDP M/M Feb | 0.30% | 0.60% | ||

| 12:30 | USD | Employment Cost Index Q1 | 1.00% | 0.90% | ||

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Feb | 6.70% | 6.60% | ||

| 13:00 | USD | Housing Price Index M/M Feb | 0.10% | -0.10% | ||

| 13:45 | USD | Chicago PMI Apr | 45.2 | 41.4 | ||

| 14:00 | USD | Consumer Confidence Apr | 104 | 104.7 |