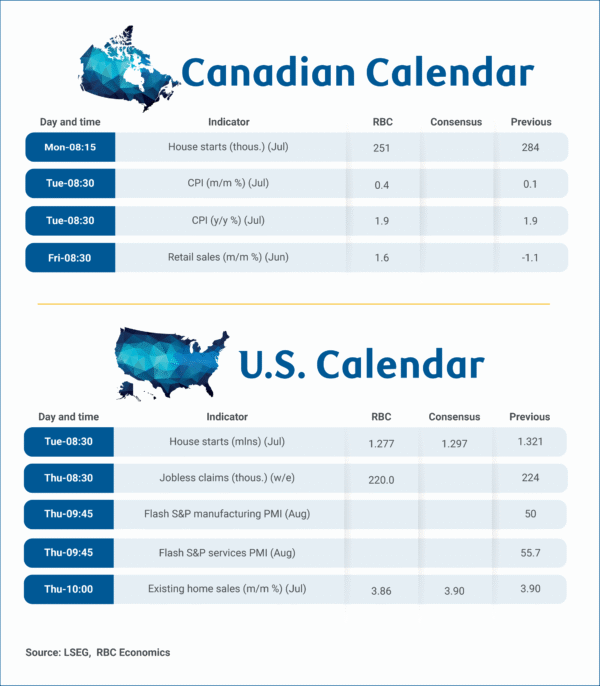

Canadian year-over-year consumer price index growth is expected to hold at 1.9% in July, matching June’s reading on Tuesday.

But, the details will be closely monitored by policymakers as the removal of the consumer carbon tax from most provinces in April continues to artificially lower headline inflation. Underlying trends have surprised upward this year, partly due to tariff impacts on products like food and vehicles, but also from higher prices for domestic services.

We expect these trends continued in July. Gasoline prices decreased 0.7% from June and 15% from July 2024. Food prices, affected by Canada’s retaliatory tariffs, likely remain about 3% above last year. Prices excluding food and energy are expected to have increased slightly to 2.7% year-over-year, up from June’s 2.6%.

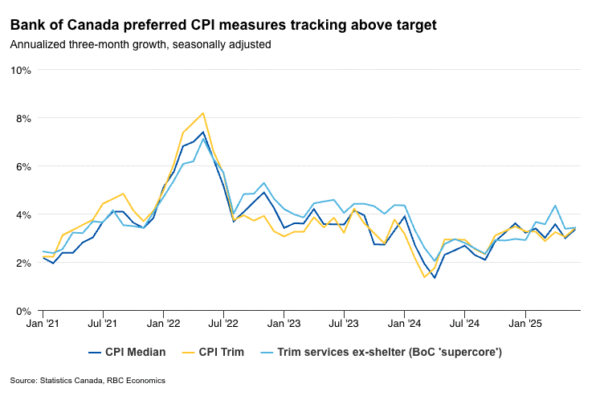

The Bank of Canada will focus on its preferred core measures that account for indirect tax changes. We expect CPI-trim and CPI-median measures to hold at approximately 3% year-over-year—still at the top end of the BoC’s 1% to 3% target range for inflation. But, the three-month rolling average growth should improve as a large increase in April falls out of that shorter time horizon calculation.

Overall, firm underlying inflation is likely connected to resilient Canadian consumer spending. Friday’s retail sales report is expected to confirm Statistics Canada’s advance estimate of a 1.6% increase in June after May’s 1.1% drop. Our RBC card transaction tracking indicates continued strength in July. Annual growth in CPI trim services excluding shelter was also running just above the target range in June.

We continue to expect the BoC will maintain current interest rates given limited further deterioration is expected in the labour market, additional fiscal stimulus will offset tariff impacts, and inflation is running at the upper limit of the central bank’s target range.

Week ahead data watch:

The advance estimate of a 1.6% increase in Canadian retail sales in June likely partially reflected a 2.2% rebound in auto prices. Sales at gas stations should be little changed with prices at the pumps not moving much from May. But, the advance estimate also implies an almost 2% jump in core sales (excluding gasoline and autos) in our estimates.