Commodity currencies, particularly the Australian and Canadian dollars, remain under pressure ahead of the Jackson Hole Symposium, as investors await signals from Jerome Powell on the future trajectory of the Federal Reserve’s monetary policy. Adding to the uncertainty were the recently released FOMC minutes: most Committee members expressed concern about accelerating inflation amid tariff policies and are not ready to rush into easing. At the same time, for the first time since 1993, two members advocated a 25 bps rate cut. Meanwhile, markets are closely monitoring fresh inflation data in Canada and US business activity indices, which could fuel volatility and provide short-term guidance for USD/CAD and AUD/USD.

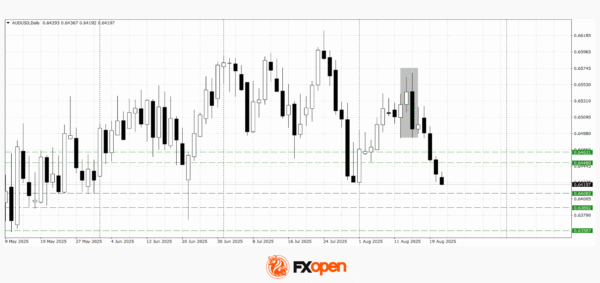

AUD/USD

The AUD/USD pair approached the July highs earlier this week. Technical analysis of AUD/USD suggests a possible strengthening of the downtrend should the pair firmly consolidate below 0.6400. On the daily timeframe, several bearish candlestick patterns (bearish engulfing and three black crows) have formed, with their completion potentially paving the way for a test of key support levels at 0.6340–0.6380. At the same time, sharp pullbacks and false breakouts of these levels could occur, with a subsequent return to 0.6440–0.6460. The pair has been declining for the second consecutive week, and given the corresponding fundamental backdrop, a corrective rebound remains possible.

Key events that could influence AUD/USD:

- Today at 14:30 (GMT+3): Speech by FOMC member Raphael Bostic

- Today at 15:30 (GMT+3): Philadelphia Fed Manufacturing Index (US)

- Today at 16:45 (GMT+3): US Manufacturing PMI

- Tomorrow at 17:00 (GMT+3): Speech by Fed Chair Jerome Powell

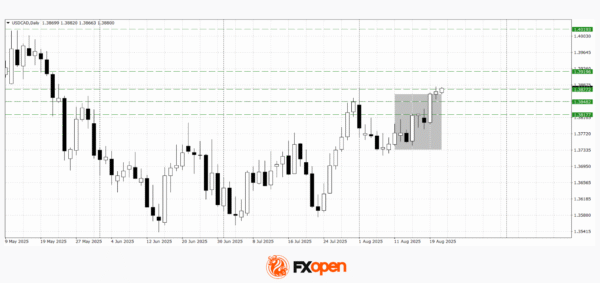

USD/CAD

Yesterday, USD/CAD buyers managed to refresh the monthly high at 1.3880. On the daily timeframe, several bullish patterns have emerged, the completion of which might support further gains towards 1.3920–1.4000. A move below 1.3850, however, could bring the pair back to 1.3800.

Key events that could influence USD/CAD:

- Today at 15:30 (GMT+3): Raw Materials Price Index (RMPI) in Canada

- Tomorrow at 15:30 (GMT+3): Core Retail Sales in Canada

- Tomorrow at 17:30 (GMT+3): Bank of Canada Senior Loan Officer Survey

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.