- We expect the Federal Reserve to maintain its monetary policy unchanged next week, in line with broad consensus and market pricing.

- The Fed will not publish updated projections, so the focus is strictly on Powell’s remarks. We do not expect new guidance on the reserve management purchases or other balance sheet considerations.

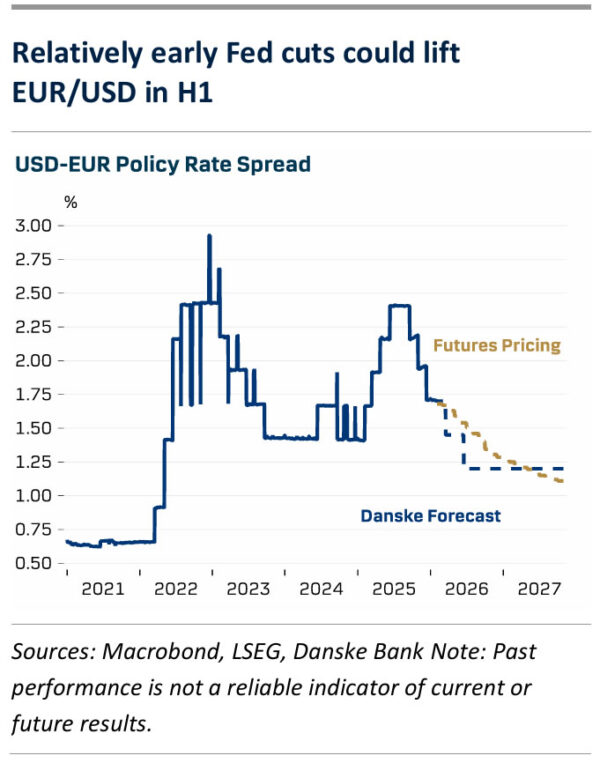

- We maintain our forecast for two more Fed cuts, in March and June, slightly ahead of market pricing. We continue to expect steeper UST yield curve and higher EUR/USD over the course of 2026.

Despite the recent geopolitical volatility, the Fed’s January decision looks like a fairly clear-cut case. Powell communicated well in advance that unless warranted by significant macro surprises (which we have not seen), the Fed would be taking a pause in its rate cutting cycle in January – and we have no reason to doubt that.

In our view, the Fed has room for cutting rates later in H1 due to the ongoing cooling in labour market balance. The ratio of job openings to the number of unemployed fell to 0.92 in November – the weakest level since March 2021. The cooling has weighed on workers’ bargaining power, which is clearly visible in job switchers earning no higher salary increases than those staying in their jobs. Inflation pressures from firms’ unit labour cost have eased significantly, and instead, higher unemployment and weaker wage growth could pose downside risks to growth forecasts.

We still forecast a solid 1.8% increase in real GDP for 2026 in comparable Q4/Q4 basis (the Fed’s Dec median projection: 2.3%, Reuters Dec consensus: 2.2%). But even so, we think the balance of risks favours continuing the cuts sooner rather than later. The latest comments from FOMC participants remain highly divided in their risk assessment. Bowman (voter) said that she remains ‘concerned about labour market fragility’ and that firms could start ‘shedding workers unless there is a demand improvement’. On the other hand, last year’s most hawkish voter, Jeffrey Schmid (non-voter in 2026), warned that the Fed has ‘no room to be complacent on inflation’.

Market pricing, which also signals 1-2 rate cuts but only from summer onwards, could naturally reflect the new Fed chair starting in May. But with regional Fed nominations already confirmed, and the risk of Supreme Court allowing Trump to fire Lisa Cook declining after this week’s hearing (see WSJ), we do not expect the upcoming nomination(s) to have a significant impact on the balance of power in the committee.

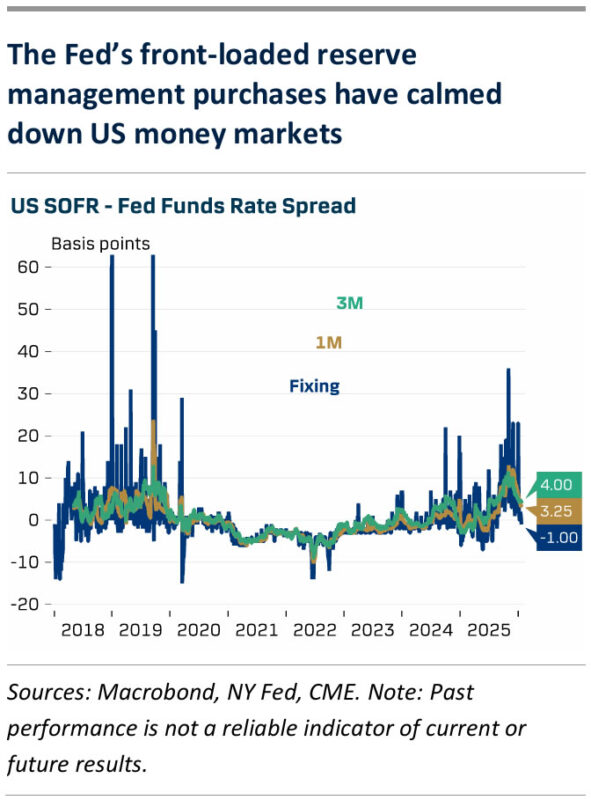

In our view, the voter rotation for 2026 can still have a marginally hawkish impact with Beth Hammack, Neel Kashkari and Lorie Logan now entering as new voters. We do not expect the Fed to announce new changes to its liquidity policies after the front-loaded reserve management purchases have calmed down US money market rates. We expect the Fed to continue T-bill purchases at a pace of USD40-50bn/month until April, after which the pace will be slowed down substantially.