Yen and Dollar are trading as the weakest ones in Asian session as risk aversion receded. In particular, Nikkei rebounds over 1% as concerns eased about last week’s typhoon and earthquake. Canadian Dollar is the strongest one at the time of writing, followed by Australian Dollar and Sterling. But for the week so far, Sterling is the star performer on Brexit deal optimism, followed by Euro. Swiss Franc, on the other hand, is the weakest one, followed by Yen. The Pound will look into today’s job data for more inspirations.

Overnight, US indices ended mixed with DOW down -0.23%. But S&P 500 and NASDAQ gained 0.19% and 0.27% respectively. There was little reaction to Republican’s tax cut 2.0, as it’s mainly seen as a political move without substance. Treasury yield also ended mixed, with five year yield up 0.005, 10-year yield down -0.005 and 30-year yield down -0.015. In Asian, Nikkei is trading up 1.12%, Hong Kong HSI down -0.31%, Singapore Strait Times down -0.27%. China Shanghai SSE is up 0.10% but remains in proximity to key support level at 2638.3. Strength of rebound from this key support continues to get weaker and weaker.

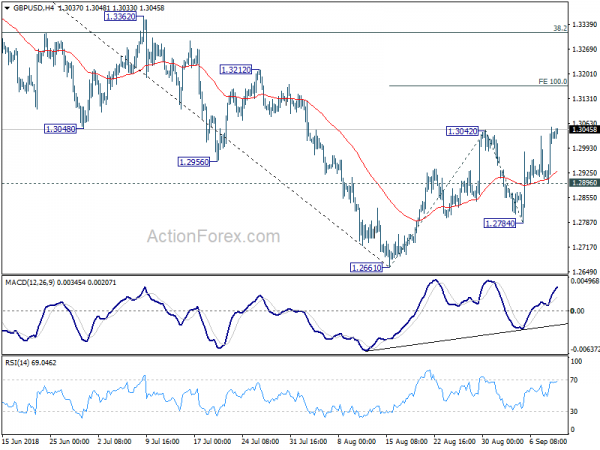

Technically, EUR/USD defended 1.1529 again yesterday and the rebound from 1.1300 is still in favor to extend higher. But even if 1.1733 near term resistance could be breached, we’d continue to expect strong resistance from 1.1779 medium term fibonacci level to limit upside. USD/CHF and EUR/CHF are yet to break 0.9766 and 1.1319 to confirm near term reversal. These two levels will continue to be watched. GBP/USD breached 1.3042 yesterday, which suggests near term rise resumption. Strong UK job data today could help push GBP/USD towards 1.3165 near term projection levels.

US House Republicans released Tax Reform 2.0 as political move

In the US, House Republicans released the so called “Tax Reform 2.0” yesterday, aiming to put it to committee-level vote this Thursday, and a full House vote on October 1. There are three major elements in the new package. Firstly, the temporary individual rates lowered in the December tax cut plan would be make permanent. Secondly, maximum age for some contributions to retirement accounts would be eliminated. Thirdly, new businesses would be allowed to write-off more start-up costs.

But some analysts saw the new tax plan as merely a political move ahead of mid-term elections. There is no chance of passing the Congress in short term. However, it will put Democrats in the position of opposing the tax cuts just ahead of November 6 elections. And there are also criticisms on adding another several billion dollars to the deficit.

Canada-US trade talk to resume as EU-US talks ended

Canada and the US will restart high-level trade talks in Washington today. Whether it’s still NAFTA or not, the two sides reached a deadlock in three key issues, Canadian dairy market access, cultural exemption for Canada and Chapter 19 dispute resolution mechanism. Not much news is released regarding the discussions as both sides agreed not to negotiate in public.

Canadian Prime Minister Justin Trudeau just reiterated yesterday that “we continue to work hard and we are positively optimistic that we can get a win-win-win for all three countries.” Foreign Minister Chrystia Freeland, who’ll be in Washington today, said last week that the negotiation has entered into a “very intense phase” and the officials have been working 24-7.

US Trade Representative Robert Lighthizer just finished a meeting with European Trade Commissioner Cecilia Malmstrom in Brussels yesterday. Malmstrom said in a tweet that “Lighthizer discussed how the EU-US achieves concrete results in the short to medium term towards a free trade agreement.” And they’ll meet again at the end of September.

Lighthizer’s office described the talks as constructive. Also, work would be done in October to identify tariff and non-tariff barriers that could be cut. And trade chiefs of EU and US will follow up in November to finalize certain results.

Sterling surged as EU Barnier said Brexit deal possible within 6-8 weeks

Sterling surged broadly yesterday as lifted by comments from EU chief negotiator Michel Barnier again. He said in a forum in Slovenia that “if we are realistic we are able to reach an agreement on the first stage of the negotiation, which is the Brexit treaty, within 6 or 8 weeks.” And, “taking into account the time necessary for the ratification process, the House of Commons on one side, the European Parliament and the Council on the other side … we must reach an agreement before the beginning of November. I think it is possible.” Also, it’s reported that EU will announce next week to hold a special summit for Brexit in November, possibly on Nov 13.

Australia NAB business confidence hit 2-year low, but business condition rebounded

Australia NAB Business Confidence dropped to 4 in August, down from 7and missed expectation of 5. That’s a two year low since August 2016, and it’s below long-run average. Confidence is lowest in wholesale and manufacturing, highest in mining and construction. And, confidence declined across all states except Western Australia and Queensland in the month, with New South Wales and Victoria continue to lag.

However, Business Condition rose to 15, up from 12 and matched expectations. Results were driven by increases in the profitability and trading indices. Forward looking indicators also rebounded a little in the month. Surveyed price and wage variables continue to show a gradual building of inflationary pressures.

Elsewhere

Japan M2 rose 2.9% yoy in August, tertiary industry index rose 0.1%. UK employment data will be the main focus in European session and Germany will also release ZEW economic sentiment. Later in the day, Canada housing starts is the main feature.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2932; (P) 1.2992; (R1) 1.3087; More…

GBP/USD’s breach of 1.3042 suggests that corrective rebound from 1.2661 is resuming. Intraday bias is back on the upside for 100% projection of 1.2661 to 1.3042 from 1.2784 at 1.3165, and possibly above. However, we’d expect upside to be limited by 1.3316 key fibonacci level to complete the corrective rise and bring near term reversal. On the downside, break of 1.2896 minor support will now argue that rebound from 1.2661 has completed. In such case, intraday bias will be turned back to the downside for 1.2784 and then 1.2661.

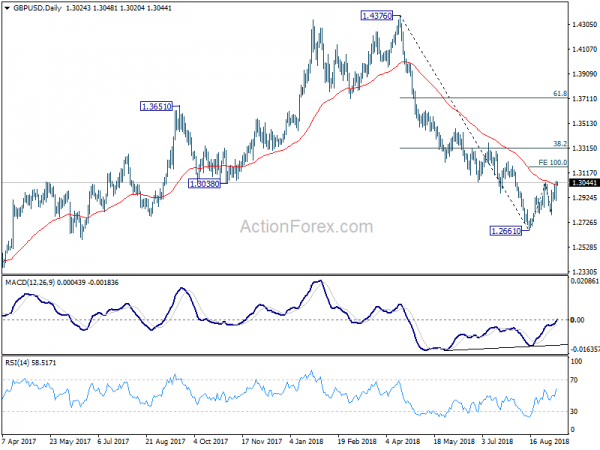

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4099). The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Aug | 2.90% | 3.00% | 3.00% | 2.90% |

| 1:30 | AUD | NAB Business Conditions Aug | 15 | 15 | 12 | |

| 1:30 | AUD | NAB Business Confidence Aug | 4 | 5 | 7 | |

| 4:30 | JPY | Tertiary Industry Index M/M Jul | 0.10% | 0.10% | -0.50% | -0.60% |

| 8:30 | GBP | Jobless Claims Change Aug | 3.6K | 6.2K | ||

| 8:30 | GBP | Claimant Count Rate Aug | 2.50% | |||

| 8:30 | GBP | Average Weekly Earnings 3M/Y Jul | 2.50% | 2.40% | ||

| 8:30 | GBP | Weekly Earnings ex Bonus 3M/Y Jul | 2.70% | 2.70% | ||

| 8:30 | GBP | ILO Unemployment Rate 3Mths Jul | 4.00% | 4.00% | ||

| 9:00 | EUR | German ZEW Economic Sentiment Sep | -13.4 | -13.7 | ||

| 9:00 | EUR | German ZEW Current Situation Sep | 72.3 | 72.6 | ||

| 9:00 | EUR | Eurozone ZEW Economic Sentiment Sep | -14.9 | -11.1 | ||

| 9:00 | EUR | Eurozone Employment Change Q/Q Q2 | 0.40% | 0.40% | ||

| 9:00 | EUR | Eurozone Employment Change Y/Y Q2 | 1.40% | 1.40% | ||

| 12:15 | CAD | Housing Starts Aug | 218K | 206K | ||

| 14:00 | USD | Wholesale Inventories M/M Jul F | 0.70% | 0.70% |