Swiss Franc weakness is the main theme in rather directionless markets today. In particular, EUR/CHF is leading the way higher on expectation of policy divergence between ECB and SNB. Also, the need for safe haven diminished much after situations in Turkey and Italy stabilized for a while. Funds are flowing back from the Franc back to Euro. This could be reflected in the strong rally in German 10 year bund yield too. At the time of writing, German 10 year bund year is rising 0.023 to 0.535.

Both the Pound and Euro are the stronger ones today. But their strength remain unconvincing. EUR/USD, GBP/USD, EUR/JPY and GBP/JPY are bounded in familiar range. For now, it seems traders are refusing to commit ahead of FOMC rate hike and projections tomorrow.

In other markets, major European indices are trading higher today. At the time of writing, DAX is up 0.21%, CAC up 0.18% and FTSE up 0.55%. Earlier in Asia, Nikkei closed up 0.29% and Singapore Strait Times rose 0.53%. China Shanghai SSE dropped -1.62% to close at 27499.39. WTI crude oil continues this week’s rally and is up 0.5% at 72.44 for now. Gold is still gyrating in tight range around 1200 handle.

ECB Praet: Price pickup a long process conditioned on very easy monetary conditions

ECB Chief Economist Peter Praet said today that “clearly we see progress in the underlying (prices), what is behind the inflation process.” However he emphasized that “it’s a long process and conditioned on very easy monetary conditions.”

Yesterday, Euro spiked higher on ECB President Mario Draghi’s comments that “domestic price pressures are strengthening and broadening”. However, Praet talked it down and said there was “nothing new” in Draghi’s comments.

Also, Praet added the the biggest risk to price stability is a “growth accident”. That is, a sudden stop in the growth cycle. And that could come from from rising protectionism or emerging markets slowdown.

German BDI lowered growth and export forecasts, risks arise with almost every US protectionist measure

The Federation of German Industries (BDI) lowered 2018 GDP growth forecast to 2.0%, down from prior estimate of 2.25%. Also, export growth is expected to be 3.5% in real terms, down from prior forecast of 5%.

BDI president Dieter Kempf urged the country to “prepare for the downturn” in a statement. He noted that “the high phase of the global economic recovery is over, investment activity has flattened.” And, for German companies “risks arise with almost every protectionist measure – even if they are directed by the US against China.”

Kempf also completed that “the industry is waiting impatiently for economic policy of the Federal Government, especially in the tax, digitization and energy policy.”

At the same time, he also emphasized that “in our society, xenophobia has no place.” And, “investments by foreign companies and the integration of skilled workers from other countries contribute significantly to prosperity and jobs in Germany.”

BoJ Kuroda: Must consider positive and side effects of loose monetary policy in balanced manner

BoJ Governor Haruhiko Kuroda said today that the central bank is now at a stage that the benefits and side-effects of the ultra-loose monetary policy must be considered in a “balanced manner”. He pointed to strengthening in the recovery and pickup in wages and prices. But he also echoed the July meeting minutes that it takes more time than expected to achieve the 2% inflation target.

Kuroda added that “under such a fairly complex economic and price situation, monetary policy must take into account various developments in a comprehensive manner”. And, “this means that, in continuing with powerful monetary easing, we now need to consider both its positive effects and side-effects in a balanced manner.”

Meanwhile, he maintained the pledge that “BOJ will continue to make its utmost efforts to firmly support corporate activity, taking into account economic, price and financial developments.”

BoJ July minutes: Sentiments could worsen if US-China trade friction intensifies

The minutes of July 30-31 BoJ meeting showed that the board members expected Japan’s economy to grow above potential in fiscal 2018. For 2019 and 2020, growth would likely continue “partly supported by external demand”. However, the pace would decelerate “due to a slowdown in domestic demand. On prices, most members agreed that CPI would likely increase increase gradually towards 2% as “firms’ stance gradually would shift toward further raising wages and prices”. But these members agreed that “it would take more time than expected to achieve 2 percent inflation”. Thus, the inflation projection in the July Outlook Report was lowered from April’s.

The minutes also noted that the global financial markets had temporarily become unstable through early July, “mainly against the background of uncertainties over trade policy, especially between the United States and China”. And, many members warned that “risk sentiment could worsen again if trade friction between the United States and China intensified.” Also, one member added that ” if the Chinese yuan depreciated further, due mainly to concerns over the possible negative impact on the Chinese economy, there was a risk of this having a negative impact on investors’ sentiment regarding emerging markets in Asia.”

China to US: No trade talks under threats and pressure

Chinese Vice Commerce Minister Wang Shouwen said at a news conference today that whether trade talk could restart depends on the “will” of the US. But he emphasized that trade meeting will not take place against the backdrop of “threats and pressure” from the US.

He said, “now that the United States has adopted such a huge trade restriction measure … how can the negotiations proceed? It’s not an equal negotiation.”

Wang also added that “if this continues, it will destroy in an instant the gains of the last four decades of China-U.S. relations.”

EUR/CHF Mid-Day Outlook

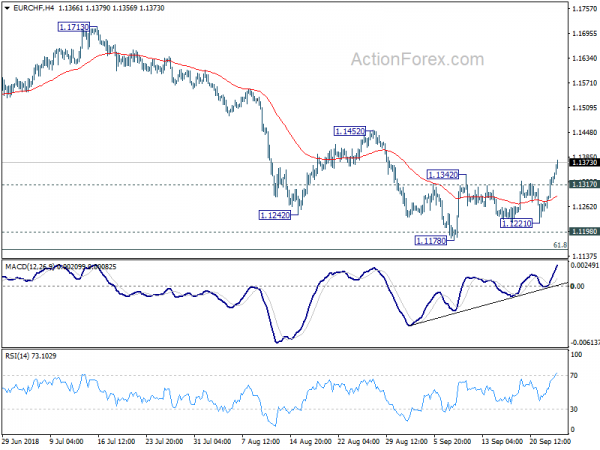

Daily Pivots: (S1) 1.1279; (P) 1.1309; (R1) 1.1364; More…

EUR/CHF rises to as high as 1.1379 so far today and intraday bias remains on the upside for 1.1452 resistance. Firm break there should confirm near term reversal. That is, whole correction from 1.2004 has completed at 1.1178 after hitting 1.1154/98 key support zone. In that case, further rise should be seen to 1.1713 resistance next. On the downside, below 1.1317 minor support will dampen this bullish view and turn intraday bias neutral again first.

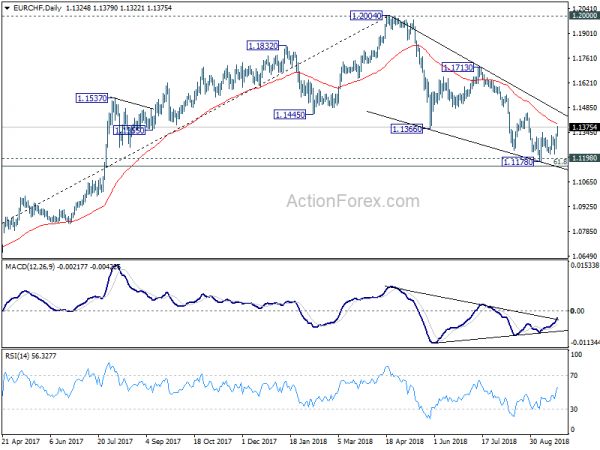

In the bigger picture, for now, the price actions from 1.2004 medium term top is seen as a correction only. Downside should be contained by support zone of 1.1198 (2016 high) and 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to complete it and bring rebound. This cluster level is in proximity to long term channel support (now at 1.1207) too. A break of 1.2 key resistance is still expected in the medium term long term. However, sustained break of the mentioned support zone will mark reversal of the long term trend. In that case, 1.0629 key support will be back into focus.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Minutes | ||||

| 23:50 | JPY | Corporate Service Price Y/Y Aug | 1.30% | 1.10% | 1.10% | |

| 13:00 | USD | House Price Index M/M Jul | 0.20% | 0.20% | ||

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Jul | 6.20% | 6.30% | ||

| 14:00 | USD | Consumer Confidence Index Sep | 130.5 | 133.4 |