Asian stocks are under pressure today as weaker than expected data from China prompted growth worries. New Zealand and Australian Dollar are trading as the weakest ones for today. Sterling follows as the third weakest as UK Prime Minister Theresa May got nothing but vague assurances from the EU summit. On the other hand, Yen is lifted by risk aversion. Dollar follows as second strongest as focus turns to US retail sales. Euro is steady even though ECB delivered a mildly dovish shift yesterday.

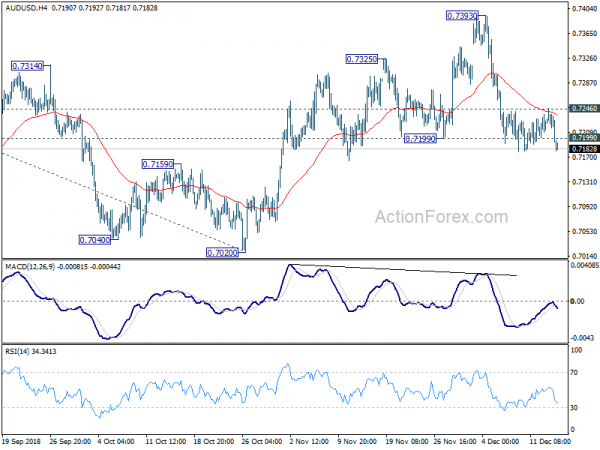

Technically, AUD/USD’s is back below 0.7199 support. Sustained trading below will confirm near term reversal and target 0.7020 low. Euro remains mixed in range. EUR/GBP and EUR/AUD recovered well ahead of 0.8931 and 1.5596 support, thus maintaining near term bullishness. But EUR/USD and EUR/JPY are stuck in range, maintaining near term bearishness. A focus today is whether Sterling has completed this week’s recovery and would revisit near term low.

In other markets, Nikkei closed down -2.02% at 21374.83. Hong Kong HSI is currently down -1.56%, China Shanghai SSE is down -1.23%, Singapore Strait Times is down -1.12%. 10 year JGB yield is down notably by -0.0197 at 0.035.

UK got vague assurances from EU over Irish backstop

The assurances that UK Prime Minister Theresa May got from the EU were rather vague and they unlikely to appease the MPs. But at the time same, it’s reported that May has been vague in her requests too. It caused some griefs from European Commission President Jean-Claude Juncker. He said at a press conference that “I do find it uncomfortable that there is an impression perhaps in the UK that it is for the EU to propose solutions”. And, “It is the UK leaving the EU. And I would have thought it was rather more up to the British Government to tell us exactly what they want.”

After yesterday’s EU summit, EU27 leaders concluded their positions on Brexit in a five point statement. Firstly, it’s “not open for renegotiation”. Secondly EU wishes to “establish as close as possible a partnership” with the UK in the future. Thirdly, the backstop is intended as an “insurance policy” to prevent hard Irish border. And EU has “firm determination to work speedily on a subsequent agreement” so that “the backstop will not need to be triggered”. Fourthly, if the backstop were triggered, “it would apply temporarily, unless and until it is superseded by a subsequent agreement that ensures that a hard border is avoided.” Fifthly, EU calls for preparedness for all possible Brexit outcome.

Japan tankan capex surged, PMI manufacturing improved

Economic data released from Japan today are not bad. Based on the results of the Tankan survey, it’s unlikely for BoJ to ease monetary further. Yet, it’s not time for the central bank to start stimulus exit too.

- Large manufacturing index was unchanged at 19 versus expectation of a drop to 17.

- Large manufacturing outlook dropped notably by -4 to 15, missed expectation of 16.

- Large non-manufacturing index rose 2pts to 24, above expectation of 21.

- Large non-manufacturing outlook also rose 2pts to 24, above expectation of 20.

- Large all industry capex rose 14.3% in Q4, beat expectation of 12.7%.

PMI manufacturing improved to 52.4, up from 52.2 and beat expectation of 52.3. Markit noted that “new order growth accelerates despite exports declining to sharpest extent in over two years”. However, “business confidence drops for seventh straight month to lowest since October 2016”.

Joe Hayes, Economist at IHS Markit, said in the release that “Japan’s manufacturing sector closed 2018 with a strong finish.” But the data also “bring some cautious undertones to the fore,”. In particular “Export orders declined at the fastest pace in over two years, while total demand picked up only modestly. Confidence also continued to fall, a seventh straight month in which this has now occurred.” He added “the prospects heading into 2019 ahead of the sales tax hike still appear skewed to the downside.”

Elsewhere

New Zealand BusinessNZ manufacturing PMI dropped -0.2 to 53.5 in November. China retail sales rose 8.1% yoy in November, below expectation of 8.8%. Industrial production rose 5.4% yoy, below expectation of 5.9%. Fixed assets investments rose 5.9% ytd yoy, matched expectations.

Looking ahead, Eurozone PMIs will be the main focus in European session. US will release retail sales, industrial productions, PMIs and business inventories.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7210; (P) 0.7229; (R1) 0.7245; More…

AUD/USD drops notably after failing to sustained above 4 hour 55 EMA. Focus is back on 0.7199 support. Sustained trading below 0.7199 will confirm completion of corrective rebound from 0.7020. And, deeper fall should then be seen back to retest 0.7020 low. On the upside, above 0.7246 minor resistance will turn bias back to the upside. In that case, corrective rise from 0.7020 would extend to 38.2% retracement of 0.8135 to 0.7020 at 0.7446 before completion.

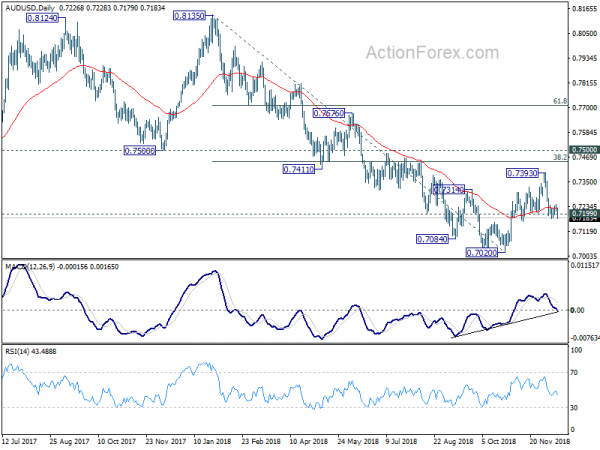

In the bigger picture, a medium term bottom is in place at 0.7020 ahead of 0.6826 key support (2016 low). Stronger rebound might be seen to correct the whole fall from 0.8135 high. But we’d expect strong resistance from 0.7500 support turned resistance to limit upside. Medium term fall from 0.8135 should resume and extend to take on 0.6826 low at a later stage, after the correction from 0.7020 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | BusinessNZ Manufacturing PMI Nov | 53.5 | 53.5 | 53.7 | |

| 23:50 | JPY | Tankan Large Manufacturing Index Q4 | 19 | 17 | 19 | |

| 23:50 | JPY | Tankan Large Manufacturers Outlook Q4 | 15 | 16 | 19 | |

| 23:50 | JPY | Tankan Large Non-Manufacturing Index Q4 | 24 | 21 | 22 | |

| 23:50 | JPY | Tankan Large Non-Manufacturing Outlook Q4 | 24 | 20 | 22 | |

| 23:50 | JPY | Tankan Small Manufacturing Index Q4 | 14 | 13 | 14 | |

| 23:50 | JPY | Tankan Small Manufacturing Outlook Q4 | 8 | 11 | 11 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Index Q4 | 11 | 9 | 10 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Outlook Q4 | 5 | 6 | 5 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q4 | 14.30% | 12.70% | 13.40% | |

| 0:30 | JPY | PMI Manufacturing Dec P | 52.4 | 52.3 | 52.2 | |

| 2:00 | CNY | Retail Sales Y/Y Nov | 8.10% | 8.80% | 8.60% | |

| 2:00 | CNY | Industrial Production Y/Y Nov | 5.40% | 5.90% | 5.90% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Nov | 5.90% | 5.90% | 5.70% | |

| 4:30 | JPY | Industrial Production Y/Y Oct F | 4.20% | 5.90% | 5.90% | |

| 8:00 | EUR | France Manufacturing PMI Dec P | 50.7 | 50.8 | ||

| 8:00 | EUR | France Services PMI Dec P | 54.8 | 55.1 | ||

| 8:30 | EUR | Germany Manufacturing PMI Dec P | 51.7 | 51.8 | ||

| 8:30 | EUR | Germany Services PMI Dec P | 53.5 | 53.3 | ||

| 8:30 | EUR | Eurozone Manufacturing PMI Dec P | 51.9 | 51.8 | ||

| 8:30 | EUR | Eurozone Services PMI Dec P | 53.4 | 53.4 | ||

| 13:30 | USD | Retail Sales Advance M/M Nov | 0.40% | 0.80% | ||

| 13:30 | USD | Retail Sales Ex Auto M/M Nov | 0.50% | 0.70% | ||

| 14:15 | USD | Industrial Production M/M Nov | 0.30% | 0.10% | ||

| 14:15 | USD | Capacity Utilization Nov | 78.60% | 78.40% | ||

| 14:45 | USD | Manufacturing PMI Dec P | 55.1 | 55.3 | ||

| 14:45 | USD | Services PMI Dec P | 55 | 54.7 | ||

| 15:00 | USD | Business Inventories Oct | 0.50% | 0.30% |