It’s a very volatile day with two market moving events in BoE Super Thursday and EU economic forecasts. Sterling initially dived sharply after BoE downgraded economic forecasts and painted a slower rate path. But the Pound appears to rebound after BoE Governor Mark Carney insisted that the markets shouldn’t prepare for a rate cut despite the weaker outlook. Nevertheless, with never-ending Brexit uncertainty and a more dovish BoE, there is no special reason to cheer the Pound for now.

At the time of writing, Canadian Dollar is the weakest one for today as selloff accelerates in early US session. New Zealand Dollar is the second weakest after today’s job data miss. Euro is the third weakest after EU slashed Eurozone 2019 growth forecasts by -0.6% to 1.3%. Sterling’s rebound also weighs on Euro. But it should be noted that the race to be the worst performer today hasn’t ended yet. The picture could change again before tomorrow. Though, Yen is the strongest one today, followed by Swiss Franc. These two will likely hold their places, on risk aversion, and falling global treasury yields.

Technically, an immediate focus now is 124.36 minor support in EUR/JPY. Firm break there will be an indication that rebound from 118.62 flash crash low has completed. And near term outlook will be turned bearish for deeper decline back towards 118.62. EUR/GBP is now looking at 0.8726 minor support. Break there will indicate completion of rebound from 0.8617 and turn focus back to 0.8620 key support level.

In Europe, currently, FTSE is down -0.40%. DAX is down -1.79%. CAC is down -1.01%. German 10-year yield is sharply lower by -0.0352 at 0.131. Earlier in Asia, Nikkei dropped -0.59%. Japan 10-year yield closed up 0.0069 at -0.009, staying negative. Singapore Strait Times rose 0.50%. Hong Kong and China were still on holiday.

US initial jobless claims dropped -19k to 234k

US initial jobless claims dropped -19k to 234k in the week ending February 2, above expectation of 220k. Four-week moving average of initial claims rose 4.5k to 224.75k. Continuing claims dropped -42k to 1.736M in the week ending January 26. Four-week moving average of continuing claims rose 4.25k to 1.741M.

BoE revised down growth and inflation forecast, may only hike once through Q1 2022

BoE left Bank rate unchanged at 0.75% today. Asset purchase target was also held at GBP 435B. Both were done by unanimous 9-0 decision, as widely expected. In the accompanying statement, BoE noted that growth slowed in late 2018 and “appears to have weakened further in early 2019”. Such slowdown “mainly reflects weaker global activity and Brexit uncertainties. But BoE remained confidence that “greater clarity on future trading arrangements is assumed to emerge”. And growth will bounce back to 2% by 2022. Inflation is expected to “decline to slightly below” target in the near term due to fall in petrol prices. But “as that effect unwinds, CPI inflation rises above 2%”.

Meanwhile, BoE reiterated that the outlook will “continue to depend significantly on the nature of EU withdrawal, in particular: the new trading arrangements between the European Union and the United Kingdom; whether the transition to them is abrupt or smooth; and how households, businesses and financial markets respond”. And, “the monetary policy response to Brexit, whatever form it takes, will not be automatic and could be in either direction.”

In the Quarterly Inflation Report, the overall economic projections are rather dovish with downgrade in growth and inflation forecasts. Unemployment rate projections were revised higher. Meanwhile, the projected Bank rate was also revised lower across the forecast horizon. It’s now suggested that BoE may only hike once, within the forecast horizon, possibly in 2020.

Four-quarter GDP growth:

- 1.5% in 2019 Q1, down from November forecast of 1.8%

- 1.3% in 2020 Q1, down from 1.7%

- 1.7% in 2021 Q1, unchanged

- 2.0% in 2022 Q1, new

CPI:

- 1.8% in 2019 Q1, down from 2.2%.

- 2.3% in 2020 Q1, down from 2.4%.

- 2.1% in 2021 Q1, unchanged.

- 2.1% in 2022 Q1.

Unemployment rate:

- 3.9% in 2019 Q1, unchanged.

- 4.1% in 2020 Q1, up from 3.9%

- 4.1% in 2021 Q1, up from 3.9%

- 3.8% in 2022 Q1.

Bank rate:

- 0.7% in 2019 Q1, down from 0.8%.

- 0.9% in 2020 Q1, down from 1.1%

- 1.0% in 2021 Q1, down from 1.3%.

- 1.1% in 2022 Q2, new

EU to UK PM May: No Brexit renegotiation after robust but constructive talks

European Commission spokesman Margaritis Schinas said President Jean-Claude Juncker had “robust but constructive talks with UK Prime Minister Theresa May today. And, “the talks were held in a spirit of working together to achieve the UK’s orderly withdrawal from the EU.”

However, he reiterated that EU would not renegotiate the Brexit deal. Though, both team would work together on “whether a way through can be found.”

May is expected to meet Juncker again before the end of February. EU chief negotiator Michel Barnier and UK Brexit Minister Stephen Barclay will meet next Monday.

European Commission slashes 2019 Eurozone growth forecast by -0.6% to 1.3%

European Commission projected EU growth to continue for the seventh year in a row in 2019, with expansion in all member states. But the pace of growth is expected to slow further as “economic momentum at the start of this year was subdued.” Indeed, GDP growth for 2019 was quite sharply downgraded.

For Eurozone:

- 2019 growth is forecast to be 1.3%, versus prior forecast of 1.9%.

- 2020 growth is forecast to be 1.6% versus prior 1.7%.

- 2019 HICP inflation is projected to be 1.4%

- 2020 HICP inflation is projected to be at 1.5%.

For EU:

- 2019 growth is forecast to be 1.5%, versus prior 1.9%.

- 2020 growth is forecast to be 1.7%, versus prior 1.8%.

- 2019 HICP inflation is projected to be 1.6%

- 2020 HICP inflation is projected to be at 1.8%.

The commission also pointed out there is “a high level of uncertainty” surrounding the outlook, and the projections are subject to downside risks. Risks include trade tensions, slowdown in China, global financial markets and emerging markets risks, as well as Brexit.

Valdis Dombrovskis, Vice-President for the Euro and Social Dialogue said the downward revision “reflects external factors, such as trade tensions and the slowdown in emerging markets, notably in China.” He warned that being aware of the “mountings risks is half of the job”. And, “the other half is choosing the right mix of policies, such as facilitating investment, redoubling efforts to carry out structural reforms and pursuing prudent fiscal policies.”

Pierre Moscovici, Commissioner for Economic and Financial Affairs, Taxation and Customs, said slowdown in 2019 is ” set to be more pronounced than expected last autumn, especially in the euro area, due to global trade uncertainties and domestic factors in our largest economies”.

DIHK slashed Germany 2019 growth forecast to 0.9%

Germany’s DIHK Chambers of Industry and Commerce lowered 2019 growth forecast for the country to 0.9%, sharply down from 1.7%. It noted that “companies’ outlook is getting clouded. Business expectations have significantly deteriorated in all economic sectors.” And, “global trade conflicts are slowing business development, especially in the industrial sector”.

In addition, DIHK warned that should exports to the UK drops by -10%, growth could slow further to 0.7%. In case of additional turbulence in the capital markets, growth could even slow to 0.5%.

ECB bulletin: Net trade exerted a drag on activity in Q4

In the Monthly Economic Bulletin, ECB noted again that growth risks surrounding growth outlook have “moved to the downside” on “persistence of uncertainties related to geopolitical factors and the threat of protectionism, vulnerabilities in emerging markets and financial market volatility.” And, “ample degree of monetary accommodation” is still needed for the block.

In particular, ECB said downside risks to global activity have been increasing, and warned “further escalation of trade disputes could weigh on global growth.” It acknowledged that postponement of US-China tariffs has “sent a positive signal”. But “considerable uncertainty” remains to whether negotiations could lead to de-escalation.

For Eurozone, ECB said “incoming information has surprised to the downside”. Also, growth in Eurozone foreign trade “appears set to decline further in the fourth quarter of 2018”. And it described that “pace of euro area export growth slowed down substantially (to 0.1%) in the third quarter, whereas growth in imports eased (to 1.0%).”. Net trade “exerted a drag on economic activity with a large negative contribution to GDP growth”.

Released in European session, Germany industrial production dropped -0.4% mom in December. Swiss Foreign currency reserves rose to CHF 741B in January.

New Zealand unemployment rate rose to 4.3%, NZD extends decline

New Zealand unemployment rate rose to 4.3% in Q3, up from 4.0%, notably higher than expectation of 4.1%. Looking at the details, labor force participation rate dropped -0.1% to 70.9%. Employment rate dropped -0.4% to 67.8%. Total labor force rose 12k but there was only 2k growth in the number employed Annual wage inflation accelerated by 0.1% to 1.9%.

Also released in Asian session, Australia AiG performance of construction index recovered to 43.1 in January. NAB business confidence dropped to 1 in Q4. Japan leading indicator dropped to 97.9 in December. Japan leading index dropped to 97.9 in December.

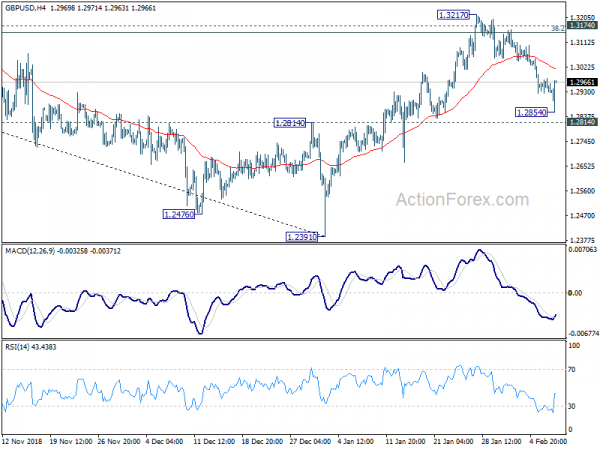

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2910; (P) 1.2944; (R1) 1.2964; More….

GBP/USD dives to 1.2854 but quickly recovered. With 4 hour MACD crossed above signal line, intraday bias is turned neutral first. But risk will stay on the downside as long as 1.3217 resistance holds. As noted before, rebound from 1.2391 has completed at 1.3217, after rejection by 1.3174 key resistance. Firm break of 1.2814 will bring retest of 1.2391 low.

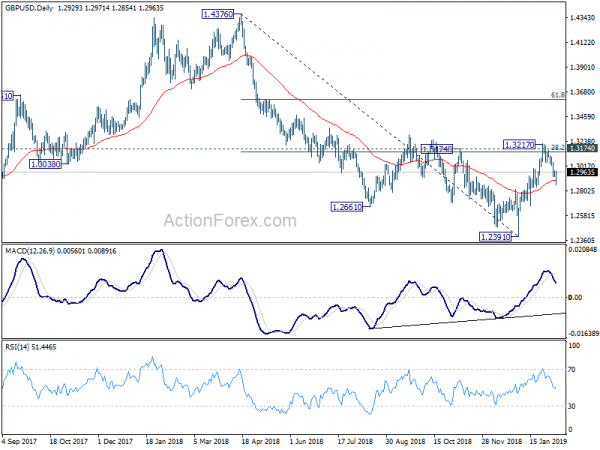

In the bigger picture, the rejection by 1.3174 key resistance revived the original view on GBP/USD. That is, decline from 1.4376 is possibly resuming long term down trend from 2.1161 (2007 high). Firm break of 1.2391 will solidify this bearish case and target 1.1946 (2016 low). However, decisive break of 1.3174 will invalidate this bearish case again and turn outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Index Jan | 43.1 | 42.6 | ||

| 21:45 | NZD | Unemployment Rate Q4 | 4.30% | 4.10% | 3.90% | 4.00% |

| 21:45 | NZD | Employment Change Q/Q Q4 | 0.10% | 0.30% | 1.10% | 1.00% |

| 21:45 | NZD | Labor Cost Private Sector Q/Q Q4 | 0.50% | 0.60% | 0.50% | |

| 00:30 | AUD | NAB Business Confidence Q4 | 1 | 3 | ||

| 05:00 | JPY | Leading Index CI Dec P | 97.90% | 97.90% | 99.10% | |

| 07:00 | EUR | German Industrial Production M/M Dec | -0.40% | 0.80% | -1.90% | |

| 08:00 | CHF | Foreign Currency Reserves Jan | 741B | 729B | ||

| 09:00 | EUR | ECB Monthly Economic Bulletin | ||||

| 12:00 | GBP | BoE Rate Decision | 0.75% | 0.75% | 0.75% | |

| 12:00 | GBP | BoE Asset Purchase Target Feb | 435B | 435B | 435B | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:00 | GBP | BoE Inflation Report | ||||

| 13:30 | USD | Initial Jobless Claims (FEB 2) | 234K | 220K | 253K | |

| 15:30 | USD | Natural Gas Storage | -228B | -173B |