Risk appetite is having a mild comeback in Asia today and commodity currencies are taking advantage of that. Meanwhile, Yen, Dollar and Sterling are also soft. The greenback shrugs off strong rebound in treasury yields overnight. Yen is weighed down mildly by BoJ’s downgrade on exports outlook. Meanwhile, Sterling lacks direction after UK voted for seeking Brexit delay. Yet, it’s uncertain what’s next except there will be another meaningful vote on May’s deal.

Over the week, Sterling remains the strongest one. No-deal Brexit is now politically ruled out even though it’s still technically possible. Canadian Dollar is the second, following up trend resumption in oil price. Yen is the weakest one, followed by Dollar, and then Aussie.

In Asia, Nikkei is trading up 0.98%. Hong Kong HSI is up 0.95%. China Shanghai SSE is up 1.54%, back above 3000 handle. Singapore Strait Times is up 0.29%. Japan 10-year JGB yield is up 0.0058 at -0.035, still negative. Overnight, DOW rose 0.03%. S&P 500 dropped -0.09%. NASDAQ dropped -0.16%. 10 year yield rose 0.019 to 2.630. 30-year yield rose 0.035 to 3.045. Let’s see if 30-year yield could extend the strong rebound before weekly close.

Yet another vote on May’s Brexit deal ahead after parliament voted for seeking extension

UK parliament passed the motion to seek Brexit delay by 413 to 202 votes. Under the motion, if a Brexit deal is approved, the government will seek 30 days Article 50 extension till June 30, 2019. If a deal is not approved, the length of the extension will depends on the purpose of it. But in the latter case, it will most likely be a long extension.

Prime Minister Theresa May is expected to bring her twice-defeated Brexit deal back to the Commons for another meaningful vote on Tuesday March 19, just ahead of EU Council meeting on March 21-22. Meanwhile, May also promised that she will give Parliament the chance to take over on March 25 if her deal is defeated again. The development after March 25 is wide open, with possibilities of a softer Brexit, a second referendum and a general election.

Trump: We’ll have news on China in three to four weeks, one way or the other

Trump indicated at the White House that it may take another three to four weeks to know whether there would be a trade deal with China. He said “we’ll have news on China. Probably one way or the other, we’re going to know over the next three to four weeks.” He added that China has been “very responsible and very reasonable”. And he repeated the usual rhetoric that “if that one gets done, it will be something that people will be talking about for a long time.”

Separately, Treasury Secretary Steven Mnuchin also confirmed that there will be no Trump-Xi summit this month. He added that both sides are “working in good faith” to try to reach a deal “as quickly as possible.” While there’s a lot of work to do, Mnuchin said “we’re very comfortable with where we are”.

China’s Xinhua news agency said again that Chinese Vice Premier Liu He spoke by telephone with U.S. Treasury Secretary Steven Mnuchin and U.S. Trade Representative Robert Lighthizer and the two sides made further substantive progress on trade talks. As usual from the Chinese side, no other detail was unveiled.

BoJ stands pats, expects exports to show some weakness

BoJ kept monetary policy unchanged today as widely expected. Short term interest rate is held at -0.1%. The central bank will continue to buy JGBs to keep 10-year yield at around zero percent. But yields are allowed to move upwards and downwards to some extent. Annual pace of monetary expansion is kept at around JPY 80T. Goushi Kataoka and Yutaka Harada dissented again in 7-2 vote.

BoJ continues to expect the economy to continue its “moderate expansion”. However, it noted that the economy is “being affected by the slowdown in overseas economies for the time being”. In particular, exports are projected to “show some weakness” for the time being. CPI is still “likely to increase gradually toward 2 percent”.

Separately, Japanese Finance Minister Taro Aso warned BoJ against insisting on the 2% inflation target. He said “things could go wrong if insist too much on achieving the 2 percent inflation target”. Earlier in the week, he said “no one in the public would be angry even if the inflation target isn’t achieved.”

On the data front

New Zealand BusinessNZ manufacturing PMI rose to 53.7 in February up from 53.0. Eurozone will release CPI final in European session. Later in the day, Canada will release manufacturing sales. US will release Empire State manufacturing, industrial production and U of Michigan consumer sentiment.

USD/JPY Daily Outlook

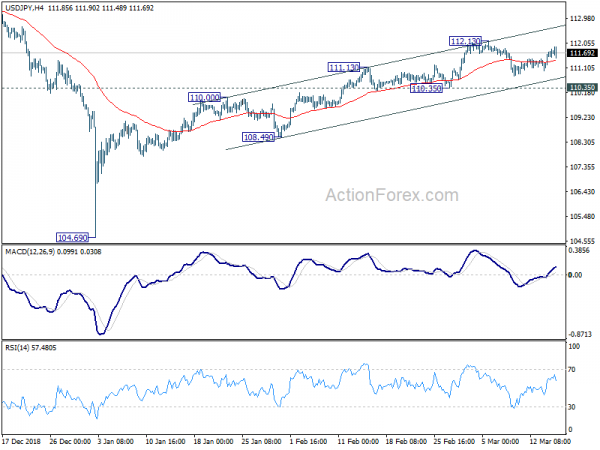

Daily Pivots: (S1) 111.27; (P) 111.56; (R1) 111.98; More…

Intraday bias in USD/JPY remains neutral at this point as it’s staying in range of 110.35/112.13. As long as 110.35 support holds, near term outlook remains bullish and rise from 104.69 is expected to resume. On the upside, break of 112.13 will target 114.54 resistance next. However, firm break of 110.35 should confirm near term reversal and turn outlook bearish for 108.49 support and below.

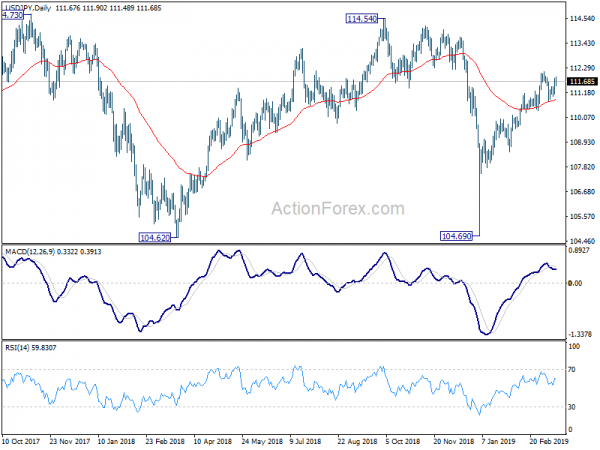

In the bigger picture, strong rebound from 104.69 argues that decline from 118.65 (2016 high) has completed with three waves down to 104.69, after failing 104.62. More importantly, the rise from 98.97 (2016 low) could be resuming. Decisive break of 114.54 resistance will add more credence to this bullish case and target 118.65. This will now be the favored case as long as 110.35 support holds. However, firm break of 110.35 will mix up the medium term outlook again and turn focus back to 104.69 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| JPY | BoJ Rate Decision | -0.10% | -0.10% | -0.10% | ||

| 21:30 | NZD | BusinessNZ Manufacturing PMI Feb | 53.7 | 53.1 | 53 | |

| 10:00 | EUR | Eurozone CPI M/M Feb | 0.30% | -1.00% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Feb F | 1.50% | 1.40% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb F | 1.00% | 1.00% | ||

| 12:30 | CAD | Manufacturing Sales M/M Jan | 0.40% | -1.30% | ||

| 12:30 | USD | Empire State Manufacturing Index Mar | 10 | 8.8 | ||

| 13:15 | USD | Industrial Production M/M Feb | 0.40% | -0.60% | ||

| 13:15 | USD | Capacity Utilization Feb | 78.50% | 78.20% | ||

| 14:00 | USD | U. of Mich. Sentiment Mar P | 95.6 | 93.8 |