Stock markets staged a strong rally in Asian session as lifted by better than expected manufacturing data from China. Both official and Caixin PMI manufactured climbed back into expansionary region, suggests that the worst could be over. Australian Dollar jumps broadly following generally positive risk sentiments, followed by New Zealand Dollar. Sterling also recovers as markets await what’s next on Brexit. Yen and Swiss Franc are the weakest naturally, followed by Dollar.

Technically, despite today’s rally, AUD/USD and AUD/JPY are still held in recently established range. Thus, bias in the two pairs remain neutral. Though, EUR/AUD broke 1.5780 support and is heading to 1.5721 low. Break will resume larger decline from 1.6765 flash crash top. USD/JPY’s break of 110.95 minor resistance suggests that pull back from 112.13 has completed already and further rise is in favor to retest this resistance. GBP/USD and EUR/USD are both losing downside momentum and there are prospects of some recovery ahead.

In other markets, Nikkei closed up 1.43%. Hong Kong HSI is up 1.43%. China Shanghai SSE is up 2.52%. Singapore Strait Times is up 1.05%. Japan 10-year JGB yield is up 0.018 at -0.073, still negative though.

China Caixin PMI manufacturing rose to 50.8, employment expands again after five years

China Caixin PMI manufacturing rose to 50.8 in March, up from 49.9 and beat expectation of 50.0. The reading is back in expansionary region and is the highest since July 2018. Markit noted that production and total new work both increase at quicker rates. Also, employment expands for first time in over five years.

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said the reading indicates “a notable improvement in the manufacturing industry.” “Overall, with a more relaxed financing environment, government efforts to bail out the private sector and positive progress in Sino-U.S. trade talks, the situation across the manufacturing sector recovered in March. The employment situation improved greatly.”

China official PMI manufacturing rose to 50.5, economy still in a critical period of stabilization

Released over the weekend, official China PMI manufacturing rose to 50.5 in March, up from 49.2 and beat expectation of 49.6. That’s firstly the largest monthly rise since 2012. Secondly, it’s also the highest level in six months. The improvement from February’s 3-yer low suggests stabilization in the slowdown in the sector. PMI non-manufacturing rose to 54.8, up from 54.3, and beat expectation of 54.5 too.

In the release, it’s noted the improvement stemmed from post Chinese New Year production recovery and effect of growth stabilization policies. However, overall recovery in market demand is still not apparent. Export orders rebounded while expectations also improved. The positive signals from Sino-US trade negotiations have begun to take effect.

But overall, the statement noted that the current economy is still in a “critical period of stabilization and recovery”. And, it is necessary to “further consolidate and enhance confidence recovery, and to restore market demand and stabilize economic growth.

Japan Tankan large manufacturing dropped to 12, lowest since 2017, large fall since 2012

Japan Tankan large manufacturing index dropped to 12 in Q1, down from 19 and even missed expectation of 13. That’s also the lowest level since March 2017. The quarterly decline was sharpest since 2012. Large non-manufacturing index dropped to 21, down from 24 and missed expectation of 22. It’s also the lowest level since March 2017.

Large manufacturing outlook also dropped to 8 down from 15 and missed expectation of 13. Large non-manufacturing outlook was unchanged at 20, matched expectations. All industry capex rose 1.2% in Q1, suggesting large firms expect to increase capital expenditure by a mere 1.2% in the year that begins in April. It’s sharply lower than prior 14.3% but beat expectation of 0.8%.

The overall set of numbers are weak, suggesting worsening outlook and deeper slowdown in the Japanese economy. Down the road, if the trend continues, BoJ might be force to re-evaluate its own monetary policy.

Japan PMI manufacturing finalized at 48.9, worst quarterly performance since 2016

Japan PMI manufacturing was finalized at 49.2 in March, up[ from February’s 48.9, signalling slowdown continues. Markets noted that demand remains sluggish, pulling output lower. Firms push resources to clearing backlogs due to lack of new work. And business confidence remains among lowest on record.

Joe Hayes, Economist at IHS Markit, said: “The final manufacturing PMI print of Q1 for Japan points to the worst quarterly performance in the sector since Q2 2016… The economic backdrop for the manufacturing sector in Japan remains fiercely challenging. Asian goods producers face headwinds from slowing growth in Europe and China, while global trade risks are yet to be mitigated by a breakthrough in US-Sino relations.”

Australia NAB business conditions improved, but confidence dropped

Australia NAB Business Conditions rose 3 pts to 7 in March, beat expectation of 2.On the positive side, employment index rose 2 pts to 7. It remains “well above average, suggesting that for now, survey indicators of labour demand remain favourable.” Trading and profitability also rebounded.

However, Business Confidence dropped -2 pts to 0, missed expectation of 4. It also “continued the below average run. “Other forward looking indicators – capacity utilisation and forward orders – showed some improvement but remain at or below average. Also, it’s noted that “overall survey measures of prices and inflation remain weak.”

AiG Performance of Manufacturing index dropped -3 pts to 51 in March, indicating slower pace of expansion. Some respondents attributed the down trend since mid-2018 to “general slowing in the economy”. Some said their customers are “delaying orders” until after Federal election. Also, downturn in housing construction also affect demand.

TD securities inflation accelerated to 0.4% mom in March.

Heavy weight data ahead to indicate how serious are recession risks

Global slowdown and recession fear was a major theme back in March. This week’s set of important growth and confidence indicators will reveal whether there was already a turnaround, or weakness would be carried over Q2.

Data from the US catch most attention with retail sales, ISM indices, durables goods and employment featured. In particular, following the terrible 20k NFP growth in February, markets are eager to see strong rebound in March, and possibly upward revision in February’s number. Meanwhile, UK PMIs, Eurozone CPI, German production, Canada employment, Australia retail sales and China PMIs will catch a lot on attentions too.

RBA rate decision will also be a focus. While the central bank is generally expected to cut interest rates twice this year, April is probably a month to early to turn dovish. RBA will likely wait for more Q1 data, as well as May economic projections before making the shift. ECB will also release March monetary policy accounts. They should reveal more about policymakers’ views on outlook, after recent downgrade.

Here are some highlights for the week.

- Monday: Japan Tankan survey, PMI manufacturing final; Australia NAB business confidence; China Caixin PMI manufacturing; Swiss retail sales, PMI manufacturing; Eurozone PMI manufacturing final, CPI flash, unemployment rate; UK PMI manufacturing; US retail sales, ISM manufacturing, business inventories, construction spending; Canada PMI manufacturing

- Tuesday: Japan monetary base; RBA rate decision, Australia budget release; Swiss CPI; UK PMI construction; Eurozone PPI; US durable goods orders

- Wednesday: UK BRC shop price; Australia retail sales, trade balance; China Caixin PMI services; Eurozone PMI services final, retail sales; UK PMI services; US ADP employment, ISM non-manufacturing

- Thursday: Germany factory orders; ECB monetary policy accounts; US Challenger job cuts, jobless claims: Canada Ivey PMI

- Friday: Japan labor cash earnings, household spending, leading indicators; Germany industrial production; Swiss Foreign currency reserves; Canada employment; US non-farm payrolls

AUD/USD Daily Outlook

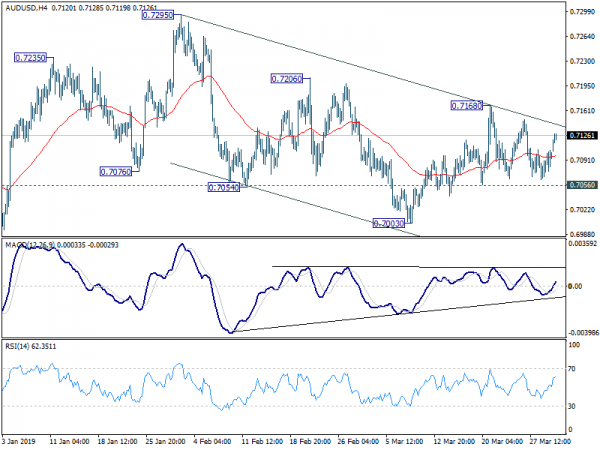

Daily Pivots: (S1) 0.7077; (P) 0.7091; (R1) 0.7110; More…

AUD/USD rebounds strongly today but stays in range below 0.7168. Intraday bias remains neutral first. On the upside, break of 0.7168 will resume the rise from 0.7003 and turn bias to the upside for 0.7295 resistance. Break will extend the whole rebound from 0.6722 to 0.7393 key resistance level. On the downside, though, break of 0.7056 minor support will turn bias to the downside for 0.7003 first. Break will resume the whole decline from 0.7295.

In the bigger picture, as long as 0.7393 resistance holds, we’d treat fall from 0.8135 as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Manufacturing Index Mar | 51 | 54 | ||

| 23:50 | JPY | Tankan Large Manufacturing Index Q1 | 12 | 13 | 19 | |

| 23:50 | JPY | Tankan Large Manufacturers Outlook Q1 | 8 | 13 | 15 | |

| 23:50 | JPY | Tankan Large Non-Manufacturing Index Q1 | 21 | 22 | 24 | |

| 23:50 | JPY | Tankan Non-Manufacturing Outlook Q1 | 20 | 20 | 20 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 1.20% | 0.80% | 14.30% | |

| 23:50 | JPY | Tankan Small Manufacturing Index Q1 | 6 | 10 | 14 | |

| 23:50 | JPY | Tankan Small Manufacturing Outlook Q1 | -2 | 6 | 8 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Index Q1 | 12 | 9 | 11 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Outlook Q1 | 5 | 5 | 5 | |

| 0:00 | AUD | TD Securities Inflation M/M Mar | 0.40% | 0.10% | ||

| 0:30 | AUD | NAB Business Conditions Mar | 7 | 2 | 4 | |

| 0:30 | AUD | NAB Business Confidence Mar | 0 | 4 | 2 | |

| 0:30 | JPY | PMI Manufacturing Mar F | 49.2 | 48.9 | ||

| 1:45 | CNY | Caixin PMI Manufacturing Mar | 50.8 | 50 | 49.9 | |

| 5:30 | AUD | Commodity Index AUD Mar | 129.7 | |||

| 6:30 | CHF | Retail Sales Real Y/Y Feb | -0.40% | |||

| 7:30 | CHF | PMI Manufacturing Mar | 53.5 | 55.4 | ||

| 7:45 | EUR | Italy Manufacturing PMI Mar | 47.5 | 47.7 | ||

| 7:50 | EUR | France Manufacturing PMI Mar F | 49.9 | 49.8 | ||

| 7:55 | EUR | Germany Manufacturing PMI Mar F | 44.7 | 44.7 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Mar F | 47.7 | 47.6 | ||

| 8:30 | GBP | PMI Manufacturing Mar | 51.2 | 52 | ||

| 9:00 | EUR | Eurozone Unemployment Rate Feb | 7.80% | 7.80% | ||

| 9:00 | EUR | Eurozone CPI Estimate Y/Y Mar | 1.50% | 1.50% | ||

| 9:00 | EUR | Eurozone CPI Core Y/Y Mar A | 1.00% | 1.00% | ||

| 12:30 | USD | Retail Sales Advance M/M Feb | 0.30% | 0.20% | ||

| 12:30 | USD | Retail Sales Ex Auto M/M Feb | 0.40% | 0.90% | ||

| 13:30 | CAD | Manufacturing PMI Mar | 52.6 | |||

| 13:45 | USD | Manufacturing PMI Mar F | 52.5 | 52.5 | ||

| 14:00 | USD | ISM Manufacturing Mar | 54.3 | 54.2 | ||

| 14:00 | USD | ISM Prices Paid Mar | 49.4 | |||

| 14:00 | USD | ISM Employment Mar | 52.3 | |||

| 14:00 | USD | Construction Spending M/M Feb | -0.10% | 1.30% | ||

| 14:00 | USD | Business Inventories Jan | 0.40% | 0.60% |