Dollar trades generally softer today as markets turned cautious ahead of non-farm payroll report. After a string of weak economic data from the US this week, recession fears intensified. NFP today could be a make-or-break point for investor sentiments in general. For now, Swiss Franc is the weakest for today, followed by Dollar. New Zealand Dollar is the strongest, followed by Australian. But for the weak, Yen is the strongest followed by Sterling, while Swiss Franc is weakest followed by Canadian.

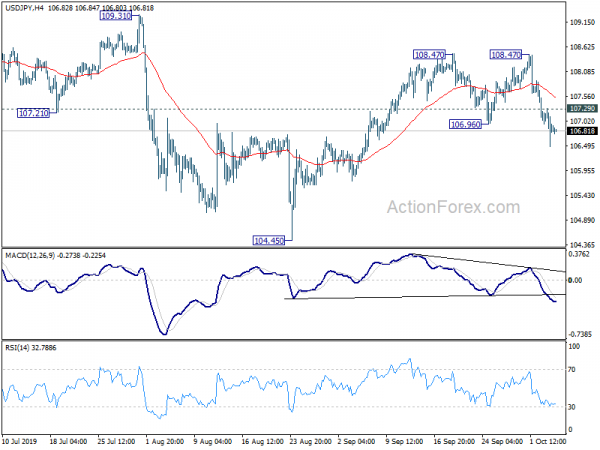

Technically, USD/JPY’s break of 106.96 support yesterday aligned its outlook with other Yen crosses. That is, rebound from 104.45 has completed to 108.47. Deeper fall would be seen back to retest this low. AUD/USD formed a temporary low after drawing support from 0.6677 low. Further recovery is now in favor but upside should be limited by 0.8894 resistance to bring fall resumption eventually. UD/CAD lost some momentum but is still on track to take on 1.3382 resistance.

In Asia, currently, Nikkei is currently up 0.25%. Hong Kong HSI is down -0.37%. China is still on holiday. Singapore Strait Times is down -0.31%. Japan 10-year JGB yield is down -0.0173 at -0.207. Overnight, DOW rose 0.47%. S&P 500 rose 0.80%. NASDAQ rose -1.12%. 10-year yield dropped -0.060 to 1.536. 30-year yield dropped -0.048 to 2.038.

10-year yield heading back to 1.429 low as non-farm payrolls watched

US stocks have been under tremendous pressure this week on intensified recession fears after poor ISM indices. Dollar also turned mixed after initial rally attempt. Focus will turn to non-farm payroll reports, which could be a make-or-break point for sentiments. Markets are expecting 140k job growth in the US in September. Unemployment rate is expected to be unchanged at 3.7%. Average hourly earnings is expected to grew 0.30% mom.

Other employment data from the US were generally disappointing. ISM manufacturing employment dropped from 47.4 to 46.3, deeper into contraction region. ISM non-manufacturing employment also dropped from 53.1 to 50.4, indicating almost no growth. ADP showed 135k growth in private sector jobs, which was not too bad. Four-week moving average of initial jobless claims was largely unchanged, down from 216k to 213k. Conference Board consumer confidence also dropped sharply from 134.2 to 125.1.

In case of downside surprises, 10-year yield would be also be one to watch, in additional to stocks and Dollar. TNX’s recovery from 1.429 has completed early than expected 1.903, ahead 2.123 fibonacci level. Further decline is now mildly in favor as long as 55 day EMA holds. Next target is a retest on 1.429 low. Break will resume medium term down trend. If that happens, USD/JPY could be a pair under most selling pressure.

Fed Clarida will take each FOMC meeting one at a time

Fed Vice Chair Richard Clarida said that US consumers and economy are in a “good place,” the labor market is “very healthy”. Though, he also noted uncertainties over global slowdown, trade tensions and persistently low inflation overseas. He pledged that Fed “will act as appropriate to sustain a low unemployment rate and solid growth and stable inflation”. Yet, he emphasized that Fed is “not on a preset course” and policymakers will take the meetings “one at a time”.

Dallas Fed President Robert Kaplan said he has an “open mind” as regards to next rate move. And, “time will tell” if this year’s two rate cuts are enough to support the economy. Yet, he’s cautious that “if we wait for weakness in global growth and manufacturing and business investment to seep into other parts of the economy, if we wait see that weakness manifest itself, I think we likely have waited too long.”

EU Malmstrom still working on negotiated solution with US on tariffs

EU appeared to be still working on avoiding trade war escalation with US. Earlier this week, WTO gave US the go ahead for tariffs on as much as USD 7.5B of EU imports, as retaliation for EU subsidies to Airbus. US Trade Representative quickly announced 10% on large civil aircraft and 25% on agricultural and other products, effective October 18.

EU has already drafted retaliation plan to target US 4B of American goods, on a WTO case from 22 years ago. But European Trade Commissioner Cecilia Malmstrom said that “until the American tariffs take effect, we haven’t given up” on reaching a “negotiated solution”. Yet, she added, “we are looking at all options and we are discussing that with member states.”

In the US, Specialty Food Association warned in a statement that the new tariffs would decrease sales and adversely impact employment at 14,000 specialty food retailers and 20,000 other food retailers. Distilled Spirits Council warned that the tariffs could lead to a loss of approximately 13,000 jobs, including truckers, farmers, and bartenders and servers in the hospitality industry.

Japan Aso said no immediate need for stimulus to counter sales tax hike

Japanese Finance Minister Taro Aso talked down the impact of the sales tax hike, from 8% to 10%, that took effect this Tuesday. He said there was not immediate need for stimulus measures to counter in the impact. He added that corporate earnings and household incomes were solid even though US-China trade tensions warranted attention.

Economy Minister Yasutoshi Nishimura sounded a bit more cautious. He said it’s necessary to carefully watch consumption trends as there are worries the hike may weigh on consumer sentiment.

On the data front

Australia retail sales rose 0.4% mom in August, below expectation of 0.5% mom. European calendar is pretty much empty today. US non-farm payroll and trade balance will be released later today. Canada trade balance and Ivey PMI will also be featured.

USD/JPY Daily Outlook

Daily Pivots: (S1) 106.49; (P) 106.90; (R1) 107.31; More…

Intraday bias in USD/JPY remains on the downside for the moment. Rebound from 104.45 should have completed at 108.57. Deeper fall should be seen to retest 104.45 low. On the upside, above 107.29 minor resistance will turn intraday bias neutral first. But risk will remain on the downside as long as 108.47 resistance holds.

In the bigger picture, decline from 118.65 (Dec 2016) is still in progress and the pair is staying well inside long term falling channel. Firm break of 104.69 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. However, firm break of 109.31 will be the first sign of medium term reversal and bring stronger rise to 112.40 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | Retail Sales M/M Aug | 0.40% | 0.50% | -0.10% | 0.00% |

| 12:30 | USD | Nonfarm Payrolls Sep | 140K | 130K | ||

| 12:30 | USD | Unemployment Rate Sep | 3.70% | 3.70% | ||

| 12:30 | USD | Average Hourly Earnings M/M Sep | 0.30% | 0.40% | ||

| 12:30 | USD | Trade Balance (USD) Aug | -54.7B | -54.0B | ||

| 12:30 | CAD | International Merchandise Trade (CAD) Aug | -1.1B | -1.1B | ||

| 14:00 | CAD | Ivey PMI Sep | 62.6 | 60.6 |