The forex markets are staying in tight range in Asian session today. More clarity is needed regarding two of the biggest global risks, before traders commit more. It’s unlikely for a Brexit deal to be reached at the EU summit this week. And it’s reported that EU could hold a new emergency summit before end of the month. Yet, that would very much depend on any progress made. Meanwhile, it would take more time for US and China to hammer out what were exactly agreed in texts. Before that, nothing is considered done, not even phase 1 of a trade deal.

In the currency markets, Australian Dollar is steadily in range after RBA minutes, slightly softer. Technically, Dollar’s recovery overnight was relatively short lived and weak. 1.0941 minor support in EUR/USD and 0.6710 minor support in AUD/USD would be two levels to judge the strength of the greenback. Sterling is staying in consolidations after the spike last week. Such consolidations could enter for a while, until there is more news on Brexit coming through.

In Asia, currently, Nikkei is up 1.89%. Hong Kong HSI is down -0.21%. China Shanghai SSE is down -0.67%. Singapore Strait Times is down -0.15%. Japan 10-year JGB yield is up 0.0092 at -0.170. Overnight, DOW dropped -0.11% in quiet trading. S&P 500 dropped -0.14%. NASDAQ dropped -0.10%. 10-year yield dropped -0.019 to 1.733.

RBA minutes suggest no hurry for another rate cut despite easing bias

The minutes for October RBA meeting were clearly dovish. There, the central bank cut benchmark interest rate by -25bps to new historical low of 0.75%. Most importantly, RBA said, , “the Board would continue to monitor developments, including in the labour market, and was prepared to ease monetary policy further, if needed.”

Yet, the minutes revealed detailed arguments in favor of keeping the policy rate unchanged. But in the end, these factors ” did not outweigh the case for a further easing” at the meeting. Lower rates would help “reduce spare capacity”, and provide “greater confidence” that inflation would meet target. Additionally, RBA noted “the trend to lower interest rates globally”, and the effect on the economy and inflation outcomes.

Overall, another rate cut is still likely subject to the developments in employment and inflation. But the minutes suggested that RBA is more likely to stand pat for the rest of the year, for the effect of this year’s three rate cuts to play out.

Suggested readings:

- RBA Minutes – Sending Dovish Message by Rebuking Arguments in Favor of Keeping Rates Unchanged

- RBA Minutes Make Strong Case for Lower Rates but Timing Still likely to be February for the Next Cut

BoJ Kuroda: Need to pay closer attention to loss of momentum in inflation

In a speech to BoJ regional branch managers, Governor Haruhiko Kuroda reiterated that the central bank won’t hesitate to add to current stimulus is needed. In particular, he emphasized, “we need to pay closer attention to the possibility that momentum towards achieving our price target will be lost.”

Nevertheless, Kuroda maintained that the economy is likely to continue expanding moderately as a trend, despite overseas slowdown. Inflation is currently moving around 0.5% and is expected to accelerate gradually towards 2%, on positive output gap and rises in inflation expectation.

He also said BoJ needs to monitor the effects of Saturday’s powerful typhoon on the real economy, maintain functioning and smooth settlement of funds.

On the data front

China CPI accelerated to 3.0% yoy in September, up from 2.8% yoy and beat expectation of 2.9% yoy. PPI dropped further to -1.2% yoy, down from -0.8% yoy, matched expectations. Japan tertiary industry index rose 0.4% mom in August, missed expectation of 0.6% mom. Industrial production was finalized at -1.2% mom in August.

Looking ahead, UK employment data and German ZEW economic sentiment will be the major focuses in European session. Swiss will release PPI. US will release Empire State manufacturing index later in the day.

AUD/USD Daily Outlook

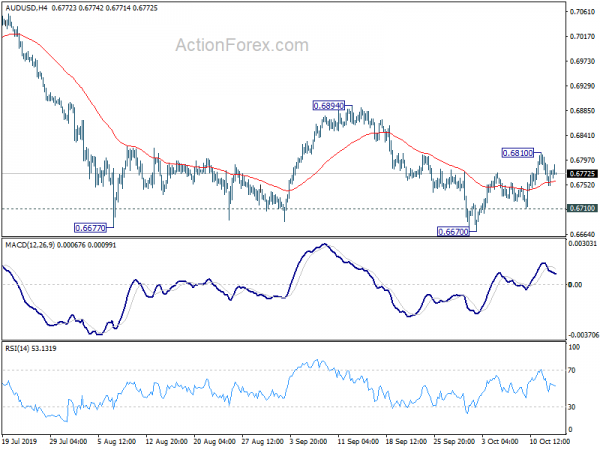

Daily Pivots: (S1) 0.6751; (P) 0.6777; (R1) 0.6802; More…

Intraday bias in AUD/USD is turned neutral with 4 hour MACD crossed below signal line. Outlook is unchanged that price actions from 0.6670 are seen as a corrective move. Above 0.6810 will bring another rise but should be limited by 0.6894 resistance to bring down trend resumption. On the downside, break of 0.6710 minor support will turn bias back to the downside for retesting 0.6670 low.

In the bigger picture, decline from 0.8135 (2018 high) is seen as resuming the long term down trend from 1.1079 (2011 high). Next target is 0.6008 (2008 low). On the upside, break of 0.7082 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | RBA Meeting Minutes | ||||

| 1:30 | CNY | CPI Y/Y Sep | 3.00% | 2.90% | 2.80% | |

| 1:30 | CNY | PPI Y/Y Sep | -1.20% | -1.20% | -0.80% | |

| 4:30 | JPY | Tertiary Industry Index M/M Aug | 0.40% | 0.60% | 0.10% | |

| 4:30 | JPY | Industrial Production M/M Aug F | -1.20% | -1.20% | -1.20% | |

| 6:30 | CHF | Producer and Import Prices M/M Sep | -0.10% | -0.20% | ||

| 6:30 | CHF | Producer and Import Prices Y/Y Sep | -2.00% | -1.90% | ||

| 8:30 | GBP | Claimant Count Change Sep | 21.3K | 28.2K | ||

| 8:30 | GBP | Claimant Count Rate Sep | 3.30% | |||

| 8:30 | GBP | ILO Unemployment Rate 3M Aug | 3.80% | 3.80% | ||

| 8:30 | GBP | Average Earnings Including Bonus 3M/Y Aug | 3.90% | 4.00% | ||

| 8:30 | GBP | Average Earnings Excluding Bonus 3M/Y Aug | 3.70% | 3.80% | ||

| 9:00 | EUR | Germany ZEW Economic Sentiment Oct | -27 | -22.5 | ||

| 9:00 | EUR | Germany ZEW Current Situation Oct | -25.5 | -19.9 | ||

| 9:00 | EUR | Eurozone ZEW Economic Sentiment Oct | -26.7 | -22.4 | ||

| 12:30 | USD | Empire State Manufacturing Index Oct | 0.8 | 2 |