Sterling strengthens broadly today as an important hurdle for Brexit is cleared with Conservative’s landslide victory in the UK election. Yen and Swiss Franc are broadly pressured on return of risk appetite, helped also by completion of US-China trade deal phase one. Over the week, the Pound is the strongest, followed by Australian Dollar. Yen is the weakest one, followed by Dollar.

Technically, GBP/JPY’s strong break of medium term trend line now puts 148.87 resistance in focus. Break there will pave the way back to 156.69. GBP/USD also took ut 1.3381 resistance decisively, heading to 1.4376 resistance next. EUR/GBP is on track to 0.8149 fibonacci projection next. EUR/JPY is heading to 123.35 resistance after breaking 121.46 resistance. USD/JPY is a pair to watch today. 109.72 resistance is in focus after strong rebound in the last 12 hours. Break will resume the rebound from 104.45 to 110.50 projection level.

In Asia, Nikkei closed up 2.55%. Hong Kong HSI is up 2.15%. China Shanghai SSE is up 1.65%. Singapore Strait Times is up 0.53%. Japan 10-year JGB yield is down -0.004 at -0.022. Overnight, DOW rose 0.79%. S&P 500 rose 0.86%. NASDAQ rose 0.73%. All three indices hit new record intraday highs. 10-year yield hit as high as 1.924 before closing at 1.897, up 0.107.

Formal announcement of US-China trade deal phase one expected on Friday

It’s reported that US President Donald Trump has already signed off the phase one trade agreement with China. A formal announcement is expected on Friday. The terms are believed to be generally agreed even though it could take some more time to finalize the legal texts.

Under the agreement, China would buy as much as USD 50B in US farm products in 2020, doubling the purchases in 2017, before the start of trade war. Both sides would also cut the currently imposed tariffs by 50%. New tariffs would be put on hold.

The news is welcomed by businesses. US-China Business Council President Craig Allen said “If signed, this is an encouraging first phase that puts a floor under further deterioration of the bilateral relationship. But this is just the beginning. The issues facing the US and China are complex and multi-faceted. They are unlikely to all be resolved quickly.”

However, the reactions from politicians are mixed, even within Trump’s Republican party. Republican Senator Marco Rubio warned, “White House should consider the risk that a near-term deal with China would give away the tariff leverage needed for a broader agreement on the issues that matter the most such as subsidies to domes tic firms, forced tech transfers & blocking U.S. firms access to key sectors”.

Johnson’s Conservative got biggest majority since 80s after landslide election win

Sterling surges as Boris Johnson’s Conservative Party scored the biggest election win since 1987 in UK election. At the time of writing, with results 645 of 650 constituencies declared, Conservatives have already won 361 seats, way above 326 seats needed for a majority. Labour has won 202 seats, suffering the worst defeat since 1935. SNP got 48 seats, Lib Dem 11, DUP 8.

Boris Johnson is expected to push his Brexit deal through the parliament, with a second reading before Christmas. UK would then be on track to finally leave the EU in an orderly manner on January 31. Nevertheless, he would still favor the daunting task of trade agreement with the EU, which needs to be completed before end of 2020.

On the data front

New Zealand BusinessNZ manufacturing index dropped to 51.4 in November, down from 52.6. Japan Tankan large manufacturing index dropped to 0 in Q4, down from 5. Large manufacturing outlook dropped to 0, down from 2. Both missed expectations. However, non-manufacturing index dropped to 20, down from 21. Non-manufacturing outlook rose to 18, up from 15. Both beat expectations. All industry capex rose 6.8%, beat expectation of 6.0%.

Looking ahead, US retail sales will be the major focus. Import price index and business inventories will also be featured.

GBP/USD Daily Outlook

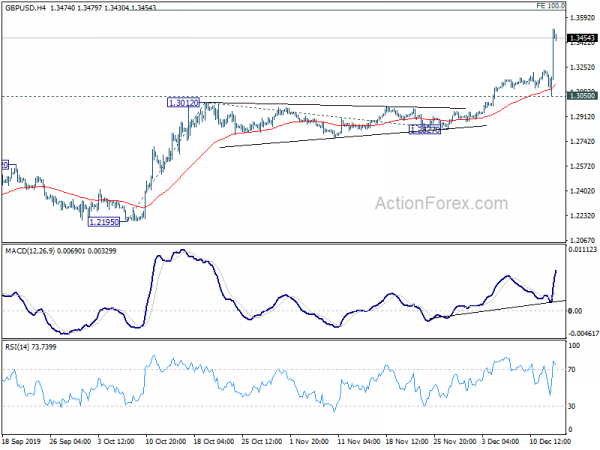

Daily Pivots: (S1) 1.3072; (P) 1.3151; (R1) 1.3250; More….

GBP/USD’s rally accelerates to as high as 1.3514 so far and breaks 1.3381 resistance decisively. Intraday bias remains on the upside at this point. Current rise from 1.1958 should target 100% projection of 1.2195 to 1.3012 from 1.2827 at 1.3644 first. Break will target 161.8% projection at 1.4149 next. In any case, near term outlook will now stay bullish as long as 1.3050, even in case of deep retreat.

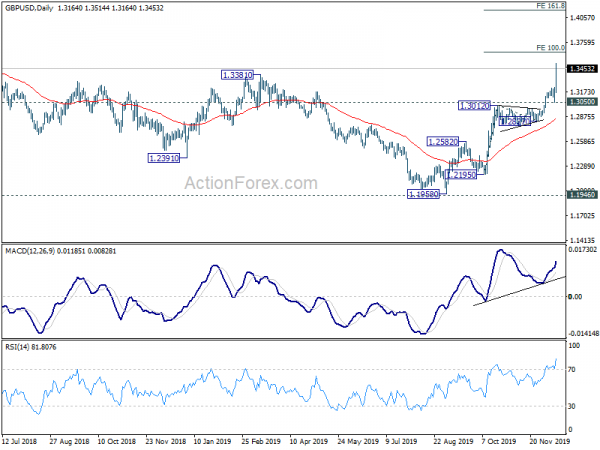

In the bigger picture, rise from 1.1958 medium term bottom is on track to retest 1.4376 key resistance. Reactions from there would decide whether it’s in consolidation from 1.1946 (2016 low). Or, firm break of 1.4376 will indicate long term bullish reversal. In any case, for now, outlook will stay bullish as long as 1.2827 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | BusinessNZ Manufacturing Index Nov | 51.4 | 52.6 | ||

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q4 | 0 | 3 | 2 | |

| 23:50 | JPY | Tankan Large Manufacturing Index Q4 | 0 | 2 | 5 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q4 | 18 | 16 | 15 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q4 | 20 | 16 | 21 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q4 | 6.80% | 6.00% | 6.60% | |

| 4:30 | JPY | Industrial Production M/M Oct F | -4.50% | -4.20% | -4.20% | |

| 13:30 | USD | Retail Sales M/M Nov | 0.40% | 0.30% | ||

| 13:30 | USD | Retail Sales ex Autos M/M Nov | 0.40% | 0.20% | ||

| 13:30 | USD | Import Price Index M/M Nov | 0.20% | -0.50% | ||

| 15:00 | USD | Business Inventories Oct | 0.20% | 0.00% |