Global stock market rebound continues today on optimism the world is finally seeing the coronavirus curve flattening. As US futures point to another day of high open, current rebound is starting to look sustainable. In the currency markets, Australian Dollar continues to lead the way higher, followed by New Zealand Dollar. Sterling shrugs off the health condition of Prime Minister Boris John and is current the third strongest. Dollar is the weakest one on reverse safe haven flow, followed by Yen and then Swiss Franc.

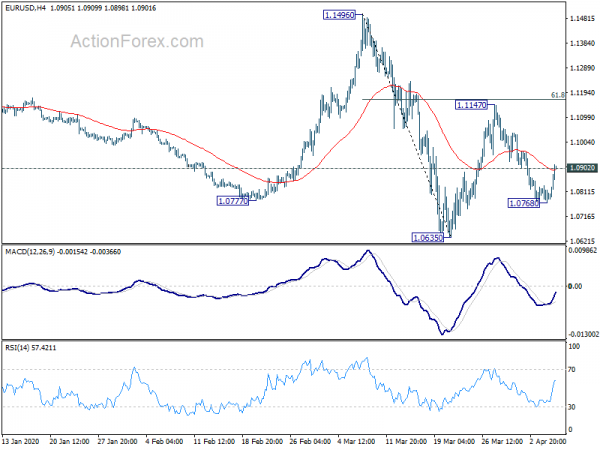

Technically, EUR/USD’s breach of 1.0902 minor resistance suggests that pull back from 1.1147 has completed. Further rise could be seen, as the third leg of the corrective pattern from 1.0635, for 1.1167 fibonacci level. EUR/JPY’s break of 118.87 minor resistance suggests that 116.12 support was defended. Strong rise is likely for 121.14 resistance and above. AUD/USD is pressing 0.6213 resistance now and break will extend the rebound form 0.5506 to 0.6416 projection level.

In Europe, currently, FTSE is up 3.05%. DAX is up 3.73%. CAC is up 2.91%. German 10-year yield is up 0.076 at -0.349. Earlier in Asia, Nikkei rose 2.01%. Hong Kong HSI rose 2.12%. China Shanghai SSE rose 2.05%. Singapore Strait Times rose 4.10%. Japan 10-year JGB yield rose 0.0020 to 0.006.

UK PM Johnson receives oxygen support in ICU, Raab deputize

UK Cabinet Office Minister Michael Gove told LBC radio today that Prime Minister Boris Johnson is “not on a ventilator no” in ICU. Nevertheless, “the prime minister has received some oxygen support and he is kept under, of course, close supervision” for coronavirus treatment.

Meanwhile, Foreign Secretary Dominic Raab to deputise for Johnson. Raab said, “The government’s business will continue. The focus of the government will continue to be on making sure that the prime minister’s direction, all the plans for making sure that we can defeat coronavirus and can pull the country through this challenge, will be taken forward.”

Japan Abe formally declare emergency, approved JPY 108T stimulus

Japan Prime Minister Shinzo Abe finally declared state of emergency for seven prefectures today. The one-month emergency period starts today on April 7, covering Tokyo, Osaka, Kanagawa, Saitama, Chiba, Hyogo and Fukuoka.

Abe said, “According to experts’ calculations, if all of us make efforts to reduce contact between people by at least 70% and if possible 80%, then in two weeks the increase in infections will peak out and we can start to reduce it.”

Additionally, the government approved an emergency economic stimulus package that worth JPY 108.2T. That equals to 20% of Japan’s economy output. Direct fiscal spending would amount to JPY 39T, around 7% of the economy.

RBA kept cash rate at 0.25%, very large economic contraction expected in Q2

RBA left cash rate unchanged at 0.25% as widely expected. It also reaffirmed the 0.25% target for 3-year government bond yield with asset purchases. The central bank also said that it “will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2–3 per cent target band.”

RBA also said noted there is “considerable uncertainty” about the near-term outlook of the economy. Much depends on the successful of coronavirus containment and the length of social distancing. Nevertheless, “a very large economic contraction” is expected in Q2 and unemployment is expected to rise to its “highest level for many years”.

Suggested readings:

- Aussie Gained as RBA Hinted the Possibility of Easing the Pace of QE

- RBA Board Confirms Commitments to Recent Policy Announcements – Excludes Any Economic Forecasts

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0762; (P) 1.0799; (R1) 1.0829; More…

EUR/USD’s break of 1.0902 minor resistance suggests the fall from 1.1147 has completed. Rise form 1.0758 could be the third leg of the corrective pattern from 1.0635. Intraday bias is back on the upside for 61.8% retracement of 1.1496 to 1.0635 at 1.1167 first. On the downside, break of 1.0768 will resume the fall to retest 1.0635 low instead.

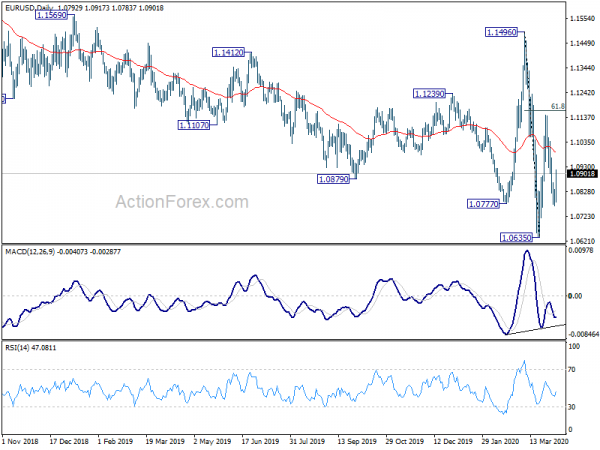

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | NZD | NZIER Business Confidence Q1 | -70% | -21% | ||

| 22:30 | AUD | AiG Performance of Services Index Mar | 38.7 | 47 | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Feb | 1.00% | 0.20% | 1.50% | 1.20% |

| 23:30 | JPY | Overall Household Spending Y/Y Feb | -0.30% | -3.90% | -3.90% | |

| 1:30 | AUD | Trade Balance (AUD) Feb | 4.36B | 3.75B | 5.21B | 4.75B |

| 4:30 | AUD | RBA Interest Rate Decision | 0.25% | 0.25% | 0.25% | |

| 5:00 | JPY | Leading Economic Index Feb P | 92.1 | 90.4 | 90.5 | |

| 6:00 | EUR | Germany Industrial Production M/M Feb | 0.30% | -1.00% | 3.00% | |

| 6:45 | EUR | France Trade Balance (EUR) Feb | -5.2B | -5.1B | -5.9B | -6.0B |

| 7:00 | CHF | Foreign Currency Reserves (CHF) Mar | 766B | 769B | ||

| 8:00 | EUR | Italy Retail Sales M/M Feb | 0.80% | 0.40% | 0.00% | |

| 14:00 | CAD | Ivey PMI Mar | 50.1 | 54.1 |