Commodity currencies are the main drivers in the markets today, as Australian Dollar leads others higher. European majors, on the other hand turn weaker as led by Euro. Dollar and Yen are mixed for the moments, awaiting the next move in risk markets. Global stock markets seem to have stay in a risk-on mode, with mild gains in European indices. US futures also point to higher open. Treasury yields, on the other hand, turn weaker with German 10-year yield back below -0.5% handle. Overall, there is no clear direction.

Technically, Yen crosses could be focus for the rest of the week. USD/JPY remains firm for now. But EUR/JPY and GBP/JPY are both clearly losing upside momentum. Focus could be back on 123.84 minor support in EUR/JPY and 135.05 minor support in GBP/JPY. Break will indicate completion of the near term corrective rebound. If US 10-year yield could stay firm above 0.7 handle while EUR/JPY and GBP/JPY dip, we could see EUR/USD and GBP/USD break through near term support of 1.1.1695 and 1.2675.

In Europe, currently, FTSE is up 0.63%. DAX is up 0.82%. CAC is up 0.59%. Germany 10-year yield is down -0.0241 at -0.515, back below -0.515. Earlier in Asia, Nikkei rose 0.96%. Japan 10-year JGB yield dropped -0.0001 to 0.039. Hong Kong HSI dropped -0.20%. Singapore Strait Times rose 0.19%. China remained on holiday.

US initial jobless claims dropped to 840k, continuing claims dropped to 11m

US initial jobless claims dropped -9k to 840k in the week ending October 3, above expectation of 820k. Four-week moving average of initial claims dropped -13.2k to 857k. Continuing claims dropped -1003k to 10976k in the week ending September 26. Four-week moving average of continuing claims dropped -642k to 12112k.

From Canada, housing starts dropped to 209k in September, below expectation of 220k. UK RICS house price balance rose to 61% in September, up from 44%, much stronger than expectation of 39%. Swiss unemployment rate dropped to 3.3% in September, down from 3.4%, beat expectations. Germany trade surplus narrowed to EUR 15.7B in August, smaller than expectation of EUR 17.1B. New Zealand ANZ Business Confidence rose to -14.5, up from September’s -28.5. Own Activity Outlook turned positive to 3.6, up from -5.4.

ECB minutes: Further appreciation of Euro constitutes a risk to both growth and inflation

In the account of September 9-10 monetary policy meeting, ECB attributed the recent appreciation in Euro exchange to two main drivers. The first and most important one was “substantial improvement in global risk sentiment” and “reversal of previous safe-have flows” into the US. The second was “likely related to monetary policies implemented in the United States and the euro area”. Looking ahead “market positioning remained tilted towards further euro appreciation”.

Members considered that a further appreciation of Euro “constituted a risk to both growth and inflation”. A “significant impact of the exchange rate appreciation on euro area inflation had been included in the September 2020 ECB staff projections.” Nevertheless, an argument was made that the ultimate impact of a “one-off adjustment” of the exchange rate would be seen in the “level of prices” rather than in “rate of inflation”. The economic impacts were also “difficult to reliably disentangle”.

ECB Schnabel: Markets vulnerable to repricing after compression of risk premia

ECB Executive Board member Isabel Schnabel said the central bank is watching out for signs of credit crunch. She noted that markets are “quite resilient so far despite rising in virus infections”. But they’re “vulnerable to repricing after compression of risk premia”. “We are monitoring this very carefully, we’re looking at whether this translates into tighter credit standards and lower lending, which could also impair (ECB) policy transmission.”

Separately, Vice President Luis de Guindos said “Inflation expectations are very subdued as a result of the pandemic and some specific factors and we have to act with the tools available to us.”

BoE Bailey: We are by no means out of firepower

BoE Governor Andrew Bailey said in a EU banking conference that the central bank is “by no means out of firepower”. “In terms of our policy tools, and we will use that firepower as appropriate, properly and strongly in response to second and third waves, where we think it is necessary,” he added.

Bailey also urged the banking sector to tap into the capital buffers. “I understand there is a natural unease to do that. Given the history of this, given the financial crisis, it’s a brave person who says ‘yes, I am going to run my capital ratio down’,” Bailey said. “We have to use the stress test to demonstrate that is a realistic and sensible policy”.

Separately, he also said the impact of the second wave of coronavirus won’t be as damaging as the first. Though, the told Yorkshire Post, “there will be a degree of natural caution… The policy tools will be used to the fullest extent possible to support the businesses and people of this country.”

BoJ upgrades economic assessment on 9 of 10 regions

In the Regional Economic Report, BoJ upgraded assessment on 9 of the 10 regions, except Shikoku which was kept unchanged. The central bank noted, “many regions, while noting that their economy had been in a severe situation due to the impact of the novel coronavirus (COVID-19), reported that it had started to pick up or shown signs of a pick-up, with economic activity resuming gradually.”

“Once the impact of the coronavirus pandemic subsides globally, Japan’s economy is likely to continue improving further as overseas economies resume steady growth,” Governor Haruhiko Kuroda said in the quarterly branch managers’ meeting. “We’ll monitor the impact of COVID-19 and won’t hesitate taking additional easing measures as needed.”

Economy Minister Yasutoshi Nishimura also said the current economic sentiment is becoming really good. The Eco watch current sentiment rose from 43.9 to 49.3 in September.

EUR/USD Mid-Day Outlook

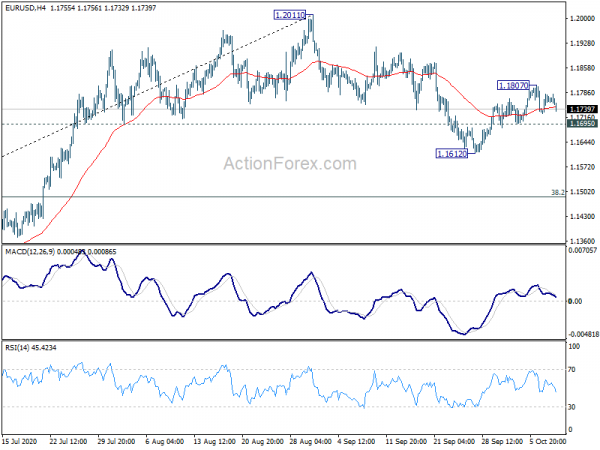

Daily Pivots: (S1) 1.1732; (P) 1.1757; (R1) 1.1789; More…..

EUR/USD dips mildly today but stays above 1.1695 minor support, intraday bias remains neutral for the moment. Another rise is still in favor. Break of 1.1807 will resume the rebound from 1.1612 to retest 1.2011 high. On the downside, break of 1.1695 will likely resume the correction from 1.2011 to 38.2% retracement of 1.0635 to 1.2011 at 1.1485.

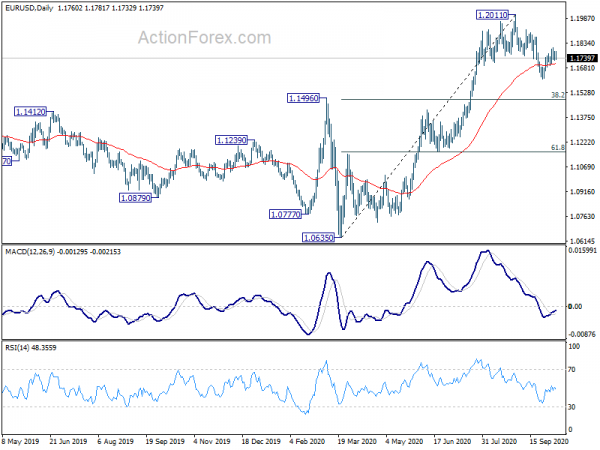

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Sep | 61% | 39% | 44% | |

| 23:50 | JPY | Current Account (JPY) Aug | 1.65T | 1.50T | 0.96T | |

| 00:00 | NZD | ANZ Business Confidence Oct P | -14.5 | -28.5 | ||

| 05:00 | JPY | Eco Watchers Survey: Current Sep | 49.3 | 43.9 | ||

| 05:45 | CHF | Unemployment Rate Sep | 3.30% | 3.40% | 3.40% | |

| 06:00 | EUR | Germany Trade Balance (EUR) Aug | 15.7B | 17.1B | 18.0B | |

| 11:30 | EUR | ECB Meeting Accounts | ||||

| 12:15 | CAD | Housing Starts Sep | 209K | 220.0K | 262.4K | |

| 12:30 | USD | Initial Jobless Claims (Oct 2) | 840K | 820K | 837K | 849K |

| 14:30 | USD | Natural Gas Storage | 73B | 76B |