Trading is relatively subdued in Asian session today with most major pairs and crosses staying inside Friday’s range. Some additional pressure is seen in USD/JPY but loss is so far limited. Markets seemed to have well digested Fed Chair Jerome Powell’s balanced message on tapering already. Attention will turn to this week’s heavy-weight data like ISMs and NFP to gauge the timing of tapering, and thus the next direction in the greenback.

Technically, we’d pay special attention to 1.1804 resistance in EUR/USD, 1.3785 resistance in GBP/USD, 0.9098 support in USD/CHF, 109.10 support in USD/JPY and 1.2577 support in USD/CAD. Synchronized break of these levels would indicate that Dollar sellers are back in full force.

In Asia, Nikkei closed up 0.44%. Hong Kong HSI is up 0.55%. China Shanghai SSE is up 0.19%. Singapore Strait Times is up 0.81%. Japan 10-year JGB yield is down -0.006 at 0.019.

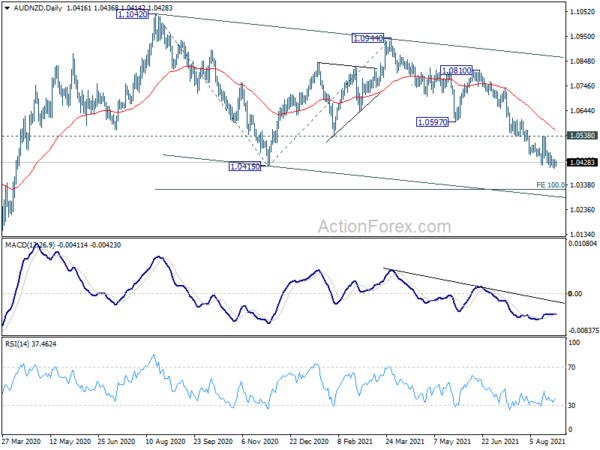

AUD/NZD staying in down trend as AU and NZ lockdowns extend

Australia’s coronavirus deaths surpassed 1000 over the weekend, as New South Wales reported four deaths, with a new daily record of 1290 infections. As lockdown continues, Premier Gladys Berejiklian emphasized in the updated that “when we get to 70 per cent double dose, the freedoms we are expecting will be [for] those of [us who] are fully vaccinated.” Victoria also announced on Sunday that lockdown, the sixth one, would be extended.

Separately, New Zealand announced to extend level 4 restrictions in Auckland today, for at least another two weeks. Nevertheless, alert level for other parts of the country is lowered. Prime Minister Jacinda Ardern said it’s too soon to say whether the outbreak had peaked. But Director-general of health Dr Ashley Bloomfield noted the encouraging sign that the “R number” was already one.

AUD/NZD is still in a near term down trend even though downside momentum is diminishing, as seen in daily MACD. As long as 1.0538 resistance holds, current fall from 1.0944, as the third leg of the pattern from 1.1042, could still extend to 100% projection of 1.1042 to 1.0415 from 1.0944 at 1.0317.

Focus turns to US NFP to gauge the timing of tapering

Fed Chair Jerome Powell has somewhat presented the “center” among FOMC members regarding policy. A start of tapering this year is very likely, but the timing would depend on upcoming economic data. In particular, August non-farm payroll report from US will be a key. Additionally, Fed and markets will also look into consumer confidence and ISMs.

The calendar is also busy elsewhere, in particular with CPI flash and unemployment from Eurozone, Japan industrial production, Canada GDP, Australia GDP and AiG indexes, and China PMIs. Here are some highlights for the week:

- Monday: Japan retail sales; Germany CPI flash; Swiss KOF economic barometer; Canada current account; US pending home sales.

- Tuesday: New Zealand ANZ business confidence; Australia current account, building approvals; Japan unemployment rate, industrial production, consumer confidence, housing starts; China PMIs; France GDP, consumer spending; Germany unemployment; UK M4 money supply, mortgage approvals; Eurozone CPI flash; Canada GDP; US house price index, Chicago PMI, consumer confidence.

- Wednesday: Australia GDP, AiG manufacturing; Japan PMI manufacturing final, capital spending; China Caixin PMI manufacturing; Swiss PMI manufacturing; Eurozone PMI manufacturing final, unemployment rate; UK PMI manufacturing final; Canada PMI manufacturing; US ADP employment, ISM manufacturing, construction spending.

- Thursday: Japan monetary base; New Zealand terms of trade; Australia trade balance; Swiss GDP, retail sales, CPI; Eurozone PPI; Canada trade balance, building permits; US jobless claims, trade balance, factory orders, non-farm productivity.

- Friday: Australia retail sales, AiG construction; China Caixin PMI services; Eurozone PMI services final, retail sales; UK PMI services final; Canada labor productivity; US non-farm payrolls, ISM services.

USD/JPY Daily Outlook

Daily Pivots: (S1) 109.67; (P) 109.97; (R1) 110.16; More…

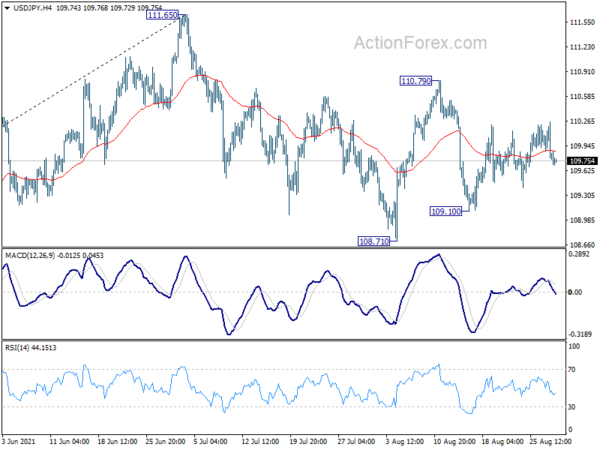

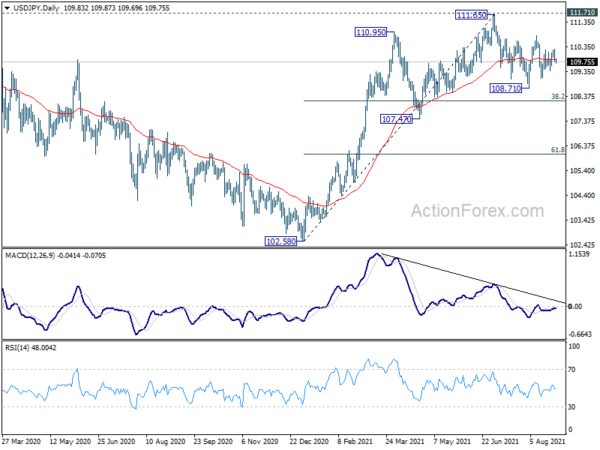

USD/JPY drops slightly today but stays inside range of 109.10/110.79. Intraday bias remains neutral at this point. On the downside, break of 109.10 will target 108.71 support first. Firm break there will resume the decline from 111.65 and target 38.2% retracement of 102.58 to 111.65 at 108.18 next. On the upside, break of 110.79 will resume the rebound from 108.71 to retest 111.65 high.

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. Nevertheless, strong break of 111.71 resistance will confirm completion of the corrective decline from 118.65 (2016 high). Further rise should then be seen to 114.54 and then 118.65 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Jun | 2.40% | 2.10% | 0.10% | |

| 1:30 | AUD | Company Gross Operating Profits Q/Q Q2 | 7.10% | 3.00% | -0.30% | -0.60% |

| 7:00 | CHF | KOF Leading Indicator Aug | 126.3 | 129.8 | ||

| 9:00 | EUR | Eurozone Economic Sentiment Indicator Aug | 118.6 | 119 | ||

| 9:00 | EUR | Eurozone Industrial Confidence Aug | 13.7 | 14.6 | ||

| 9:00 | EUR | Eurozone Services Sentiment Aug | 19.9 | 19.3 | ||

| 9:00 | EUR | Eurozone Consumer Confidence Aug F | -5.3 | -5.3 | ||

| 9:00 | EUR | Eurozone Business Climate Aug | 1.9 | |||

| 12:00 | EUR | Germany CPI M/M Aug P | 0.10% | 0.90% | ||

| 12:00 | EUR | Germany CPI Y/Y Aug P | 3.90% | 3.80% | ||

| 12:30 | CAD | Current Account (CAD) Q2 | 1.5B | 1.2B | ||

| 14:00 | USD | Pending Home Sales M/M Jul | 0.50% | -1.90% |