Dollar rises broadly as the week starts as risk aversion extended into Asia session. But Yen is not benefiting much this time, as recovery lost momentum. Commodity currencies are also weak together with Euro. Swiss Franc and Sterling are just slightly better the others, but still weak against the greenback. The meetings of four major central banks ahead would shape the next moves, at least until the end of H1.

Technically, AUD/USD’s break of 0.7034 support should confirm that rebound from 0.6828 has completed at 0.7282. Larger down trend from 0.8006 might be ready to resume through 0.6828 low. Similarly, NZD/USD’s rebound from 0.6215 should also be finished at 0.6575, after rejection by 55 day EMA. Focus will be on any downside acceleration towards 0.6215, and through, together with AUD/USD.

In Asia, at the time of writing, Nikkei is down -3.13%. Hong Kong HSI is down -2.81%. China Shanghai SSE is down -1.11%. Singapore Strait Times is down -0.62%. Japan 10-year JGB yield is up 0.0066 at 0.261.

NZIER downgrades NZ GDP forecasts, upgrades inflation

In the new Consensus Forecasts of NZIER, growth projections for the forecast horizon were revised down while inflation projections were revised up. NZIER noted “increasing headwinds” for the New Zealand economy, including “continued global supply chain disruptions as countries continue to grapple with COVID-19, the war in Ukraine and rising interest rates.” The highest inflation outlook reflects “expectations that high inflation will remain persistent”.

In June survey (comparing to March survey):

- 2022/23 GDP growth at 2.9% (revised down from 3.6%).

- 2023/24 GDP growth at 1.9% (down from 2.7%).

- 2024/25 GDP growth at 2.1% (down from 2.5%).

- 2022/23 CPI at 4.1% (up from 3.5%).

- 2023/24 CPI at 2.6% (up from 2.5%).

- 2024/25 CPI at 2.4% (up from 2.3%).

Bitcoin and ethereum in free fall again on Celsius Network news

Cryptocurrencies were in free fall again on news that Celsius Network, one of the biggest crypto lenders, paused withdrawals, swaps and transfers on its platform. In the background, bitcoin and ethereum were already under pressure last week, as risk-off sentiments intensified after data showed reacceleration in consumer inflation in the US.

The breach of 25083 support in bitcoin suggests that medium term down trend is ready to resume. 20k handle is the next target but in could indeed fall to as low as61.8% projection of 48226 to 25083 from 32686 at 15258. Overall outlook will stays bearish as long as 32368 resistance holds, even in case of strong recovery.

Ethereum is also extending the down trend from 4863. 1000 handle is the next target but it could fall to as low as 100% projection of 4683 to 2157 from 3577 at 870. Outlook will stay bearish as long as 1674 support turned resistance holds, in case of recovery.

Fed, SNB, BoE and BoJ to meet

Four central banks will meet this week. Fed is widely expected to continue its plan of 50bps hike per meeting, and raise federal funds rate to 1.25-1.50%. Given that CPI reaccelerated to new 40-year high in May, main focus will be on how is that reflected in the new economic projections, and the dot plot. Back in only 7 of 16 FOMC member penciled in interest rate above 2% by the end of 2022. The balance would likely shift further to the hawks’ side.

SNB is expected to keep interest rate unchanged at -0.75% for now. But with inflation at 14-year high, and more importantly, ECB’s pre-commitment to July and September hike, there are talks that SNB could act a small step this week. A 25bps hike to -0.50%, a less negative one, cannot be totally ruled out.

BoE is expected to raise interest rate by 25bps to 1.25%. But opinions are also divided. The government’s plan to cut taxes and provide relief to households on energy bills, there is room for BoE to act larger. Yet, the central bank might still want to wait for the next monetary policy report before altering the pace.

BoJ is expected to stand pat. But both the government and the central bank have expressed deep concerns regarding Yen’s rapid depreciation. The markets would look for something from the BoJ to stabilize it.

On the data front, the UK calendar is busy with GDP, employment and retail sales. US calendar will feature PPI and retail sales. Germany ZEW, Australia business confidence and employment, and a batch of China data will also be watched. Here are some highlights for the week:

- Monday: Japan BSI manufacturing; UK GDP, production, trade balance, NIESR GDP estimate.

- Tuesday: Australia NAB business confidence; Germany ZEW, CPI final; UK employment; Canada manufacturing sales; US PPI.

- Wednesday: Japan machine orders, tertiary industry index; China industrial production, retail sales, fixed asset investment; Swiss SECO economic forecasts, PPI; Eurozone industrial production, trade balance; Canada housing starts; US retail sales, Empire state manufacturing, import prices, business inventories, NAHB housing index, FOMC rate decision.

- Thursday: New Zealand GDP; Australia employment; Japan trade balance; SNB rate decision; BoE rate decision; Canada wholesale sales; US jobless claims, housing starts and building permits, Philly Fed survey.

- Friday: New Zealand BusinessNZ manufacturing index; BoJ rate decision; UK retail sales; Italy trade balance; Eurozone CPI final; Canada IPPI and RMPI; US industrial production.

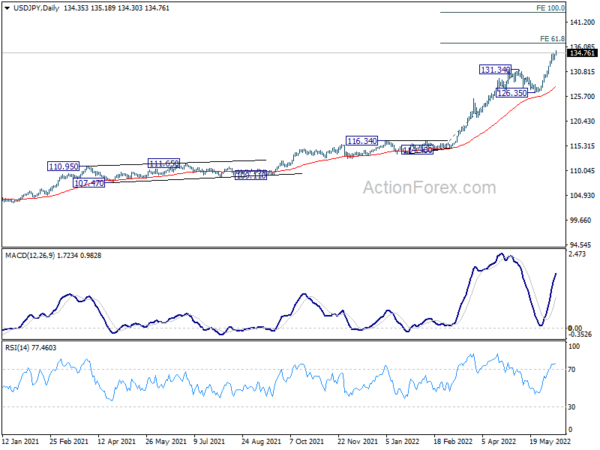

USD/JPY Daily Outlook

Daily Pivots: (S1) 133.71; (P) 134.09; (R1) 134.82; More…

USD/JPY’s rally resumed after brief consolidations and intraday bias is back on the upside. Current up trend should target 61.8% projection of 114.40 to 131.34 from 126.35 at 136.81. Firm break there will target 100% projection at 143.29. On the downside, below 133.17 minor support will turn intraday bias neutral first and bring consolidations, before staging another rise.

In the bigger picture, current rally is seen as part of the long term up trend from 75.56 (2011 low). Next target is 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 149.26, which is close to 147.68 (1998 high). This will remain the favored case as long as 126.35 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BSI Large Manufacturing Index Q/Q Q2 | -9.9 | -4.2 | -7.6 | |

| 06:00 | GBP | GDP M/M Apr | 0.20% | -0.10% | ||

| 06:00 | GBP | Index of Services 3M/3M Apr | 0.40% | 0.40% | ||

| 06:00 | GBP | Manufacturing Production M/M Apr | 0.20% | -0.20% | ||

| 06:00 | GBP | Manufacturing Production Y/Y Apr | 1.80% | 1.90% | ||

| 06:00 | GBP | Industrial Production M/M Apr | 0.20% | -0.20% | ||

| 06:00 | GBP | Industrial Production Y/Y Apr | 0.50% | 0.70% | ||

| 06:00 | GBP | Goods Trade Balance (GBP) Apr | -20.3B | -23.9B | ||

| 13:00 | GBP | NIESR GDP Estimate (3M) May | 0.60% | 0.30% |