European majors, including the Swiss Franc, are under much selling pressure currently. EUR/USD dived through parity, and hit a new low. The development came on worries that Russia will further weaponize its natural gas supplies to Europe, adding further weight to the already troubled economy. Dollar is strong as supported by rising treasury yield, with 10-year yield back above 3% handle. But Aussie and Kiwi are so far also resilient. Yen is mixed with counter forces of risk-aversion and rising yields.

Technically, a focus for the week is US 10-year yield’s reaction to 3.101 resistance, as reaction to Jackson Hole symposium too. Firm break there could prompt some upside acceleration towards 3.483 high before the end of the quarter. Such development, if happens, could also come with deeper selloff in stocks, and give support to the greenback. Anyway, a roller coaster is probably awaiting in September.

In Asia, at the time of writing, Nikkei is down -1.16%. Hong Kong HSI is down -0.49%. China Shanghai SSE is up 0.18%. Singapore Strait Times is down -0.61%. 10-year yield is down -0.0089 at 0.222. Overnight, DOW dropped -1.91%. S&P 500 dropped -2.14%. NASDAQ dropped -2.55%. 10-year yield rose 0.048 to 3.037.

Japan PMI manufacturing dropped to 51 in Aug, services down to 49.2

Japan PMI Manufacturing dropped from 52.1 to 51.0 in August, below expectation of 51.8. PMI Manufacturing Output dropped from 49.7 to 48.3. That’s also the lowest level in 19 months. PMI Services dropped from 50.3 to 49.2, first contraction since March. PMI Composite dropped from 50.2 to 48.9, first contraction since February.

Usamah Bhatti, Economist at S&P Global Market Intelligence, said: “The latest Flash PMI data showed that Japanese private sector activity declined for the first time since February midway through the third quarter. Both manufacturing and services companies recorded a contraction in output in August, with the former falling at the fastest pace for 11 months.

“August data signalled the second-weakest reading in the composite index so far this year, though the rate of deterioration was only mild. Of concern was the amount of new business received by private sector firms, which reduced for the first time in six months and pointed to further weaknesses to come.”

Australia PMI composite output dropped to 49.8, a renewed contraction

Australia PMI Manufacturing dropped from 55.7 to 54.5 in August, a 12-month low. PMI Services dropped from 50.9 to 49.6, a 7-month low. PMI Composite Output dropped from 51.1. to 49.8, a 7-month low.

Laura Denman, Economist at S&P Global Market Intelligence said: “A renewed contraction in Australia’s private sector economy indicates that recent interest rate hikes made by the RBA, as well as sustained inflationary pressures, have begun to take a toll on overall demand levels.

“Should new order growth remain subdued, this may help reduce demand-pull inflation factors, but survey data continue to highlight the supply issues that remain prevalent globally, which will continue to keep price levels elevated for the foreseeable.

“As such, the RBA will likely continue along its rate-hiking path, which bodes ill for the wider economy given the latest survey data highlight clear signs of underlying weakness.”

EUR/CAD downside breakout, 1.2812 projection level next

Following broad-based selloff in Euro, EUR/CAD finally broke out of range this week and it’s now resuming long term down trend. Outlook is clearly bearish with the cross staying well inside falling channel, with recovered capped by falling 55 day EMA.

Next near term target is 61.8% projection of 1.3713 to 1.2970 from 1.3271 at 1.2812. The main question is whether EUR/CAD would accelerate downward further after hitting 1.2812. In that case, the cross could reach 100% projection at 1.2528 and rather quick manner.

There is no clear support level ahead until 2012 low at 1.2127. In any case, for now, outlook will stay bearish as long as 1.3271 resistance holds.

Looking ahead

PMI data from Eurozone, the UK, and the US are the main features for today. US will also release new home sales.

EUR/USD Daily Outlook

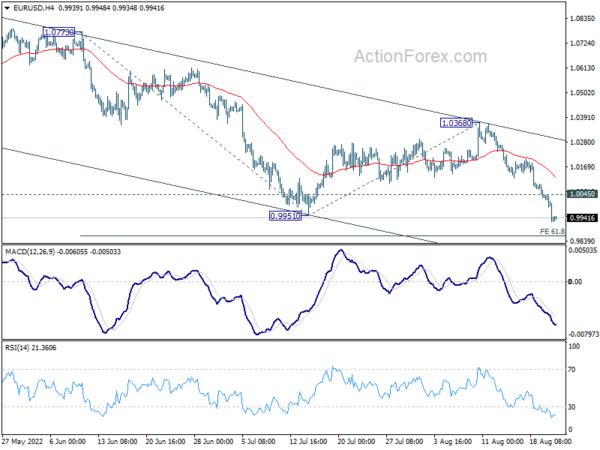

Daily Pivots: (S1) 0.9897; (P) 0.9972; (R1) 1.0018; More…

EUR/USD’s break of 0.9951 support confirms down trend resumption. Intraday bias stays on the downside for 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860. Firm break there should prompt downside acceleration to 100% projection at 0.9546. On the upside, above 1.0045 minor resistance will turn intraday bias neutral and bring consolidations. But recovery should be limited well below 1.0368 resistance to bring fall resumption.

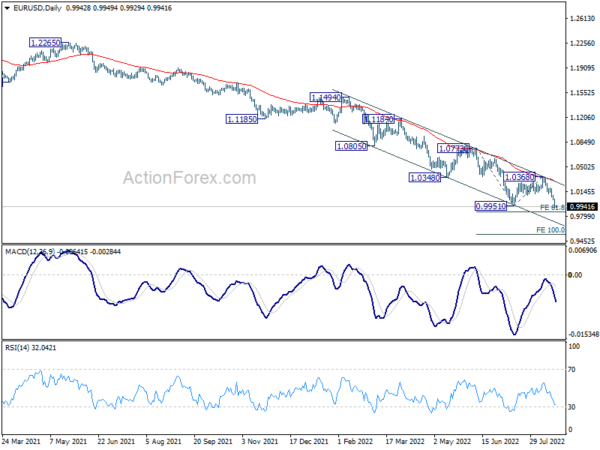

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0368 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Aug P | 54.5 | 57.3 | 55.7 | |

| 23:00 | AUD | Services PMI Aug P | 49.6 | 54 | 50.9 | |

| 00:30 | JPY | Manufacturing PMI Aug P | 51 | 51.8 | 52.1 | |

| 07:15 | EUR | France Manufacturing PMI Aug P | 48.8 | 49.5 | ||

| 07:15 | EUR | France Services PMI Aug P | 53.5 | 53.2 | ||

| 07:30 | EUR | Germany Manufacturing PMI Aug P | 48.1 | 49.3 | ||

| 07:30 | EUR | Germany Services PMI Aug P | 49 | 49.7 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Aug P | 49 | 49.8 | ||

| 08:00 | EUR | Eurozone Services PMI Aug P | 50.5 | 51.2 | ||

| 08:30 | GBP | Manufacturing PMI Aug P | 51.3 | 52.1 | ||

| 08:30 | GBP | Services PMI Aug P | 52 | 52.6 | ||

| 13:45 | USD | Manufacturing PMI Aug P | 51.5 | 52.2 | ||

| 13:45 | USD | Services PMI Aug P | 50.4 | 47.3 | ||

| 14:00 | USD | New Home Sales M/M Jul | 580K | 590K | ||

| 14:00 | EUR | Eurozone Consumer Confidence Aug P | -28 | -27 |