Euro dips broadly after ECB delivered a 75bps rate hike without additional hawkish surprise. But Aussie and Kiwi are the worst performers for today so far. Swiss Franc is rallying, thanks to buying against Euro, while Dollar is trading slightly firmer. Yen and Sterling are both consolidating this week’s losses.

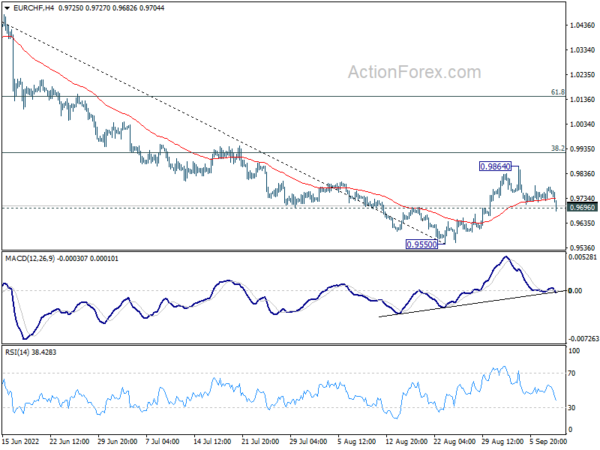

Technically, EUR/CHF’s break of 0.9696 minor support could be a sign that Euro sellers are back. Deeper fall is in favor to retest 0.9550 low and break will resume larger down trend. Let’s see if that will happen.

In Europe, at the time of writing, FTSE is down -0.68%. DAX is down -1.40%. CAC is down -0.80%. Germany 10-year yield is up 0.082 at 1.658. Earlier in Asia, Nikkei rose 2.31%. Hong Kong HSI dropped -1.00%. China Shanghai SSE dropped -0.33%. Singapore Strait Times rose 0.71%. Japan 10-year JGB yield rose 0.0042 to 0.252.

US initial jobless claims dropped to 222k, vs exp. 243k

US initial jobless claims dropped -6k to 222k in the week ending September 3, lower than expectation of 243k. Four-week moving average of initial claims dropped -7.5k to 233k.

Continuing claims rose 36k to 1473k in the week ending August 27. Four-week moving average of continuing claims rose 10.75k to 1439k.

ECB hikes 75bps, more hikes over the next several meetings

ECB raises the three key interest rates by 75bps today. The main refinancing , marginal lending facility and deposit facility rates are 1.25%, 1.50% and 0.75% respectively. The Governing Council also expects to raise interest rates further over the “next several meetings”. Decisions will continue to be “data-dependent” and follow a “meeting-by-meeting approach”.

ECB staff projections now show inflation averaging 8.1% in 2022, 5.5% in 2023, and then 2.3% in 2024. Recent data point to a “substantial slowdown” in growth, with the economy expected to “stagnate later in the year and in Q1 of 2023. Staff now projects the economy to grow by 3.1% in 2022, 0.9% in 2023, and then 1.9% in 2024.

RBA Lowe: Case for slower tightening becomes stronger as rate rises

RBA Governor Philip Lowe reiterated in a speech that “further increases in interest rates will be required over the months ahead”. But policy is “not on a pre-sent path” due to uncertainties. Also, “all else equal, the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises.”

Lowe also highlighted three sources of uncertainty to the economy. The first is the “global economic environment”, including the US, Europe and China. He said, “some slowing in the global economy will help bring inflation down, but a sharp slowing would make the job of delivering a soft landing here in Australia much harder.”

The second source is “how inflation expectations and the inflation psychology in Australia adjust to the period of high inflation”. The third is “how households respond to higher interest rates”.

EUR/USD Mid-Day Outlook

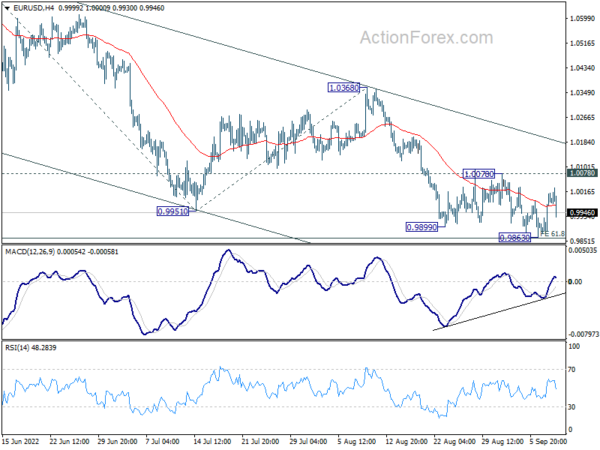

Daily Pivots: (S1) 0.9918; (P) 0.9965; (R1) 1.0053; More…

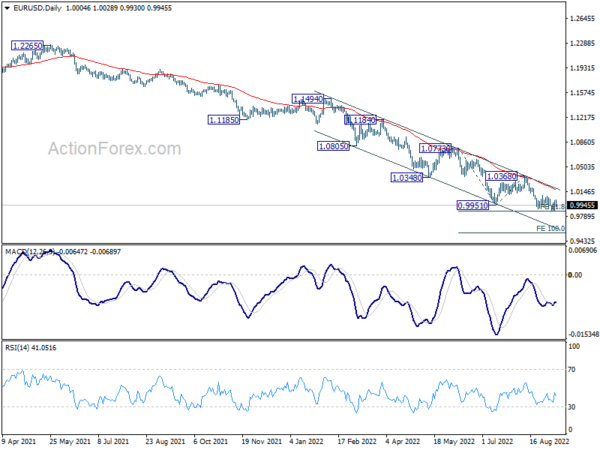

Intraday bias in EUR/USD remains neutral and further decline is expected with 1.0078 resistance intact. Decisive break of 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860 should prompt downside acceleration to 100% projection at 0.9546. On the upside, however, firm break of 1.0078 will indicate short term bottoming, and turn bias back to the upside for 1.0368 resistance instead.

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0368 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Aug | 53% | 61% | 63% | 62% |

| 23:50 | JPY | Bank Lending Y/Y Aug | 1.90% | 1.90% | 1.80% | 1.70% |

| 23:50 | JPY | GDP Q/Q Q2 F | 0.90% | 0.70% | 0.50% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 F | -0.30% | -0.40% | -0.40% | |

| 23:50 | JPY | Current Account (JPY) Jul | -0.63T | 0.02T | 0.84T | |

| 01:30 | AUD | Trade Balance (AUD) Jul | 8.73B | 14.50B | 17.67B | |

| 05:00 | JPY | Eco Watchers Survey: Current Aug | 45.5 | 44 | 43.8 | |

| 05:45 | CHF | Unemployment Rate Aug | 2.10% | 2.20% | 2.20% | |

| 06:45 | EUR | France Trade Balance (EUR) Jul | -14.5B | -12.2B | -13.1B | |

| 12:15 | EUR | ECB Main Refinancing Rate | 1.25% | 1.25% | 0.50% | |

| 12:30 | USD | Initial Jobless Claims (Sep 2) | 222K | 243K | 232K | 228K |

| 12:45 | EUR | ECB Press Conference | ||||

| 14:30 | USD | Natural Gas Storage | 55B | 61B | ||

| 15:00 | USD | Crude Oil Inventories | -2.0M | -3.3M |