European majors are trading generally higher today, as led by Euro this time. In particular, Euro looks set to reclaim parity against Dollar with current rebound. On the other hand, commodity currencies are trading lower together with Yen. Aussie is under renewed selling pressure, as traders continue to assess RBA’s smaller than expected rate hike. Meanwhile, Kiwi is also weak ahead of tomorrow’s RBNZ rate decision. A 50bps is expected for RBNZ, but could they miss? Dollar is mixed for now, with traders continue to lighten up long position. The greenback will need some support from ISM services tomorrow and NFP on Friday, if it is to resume recent up trend.

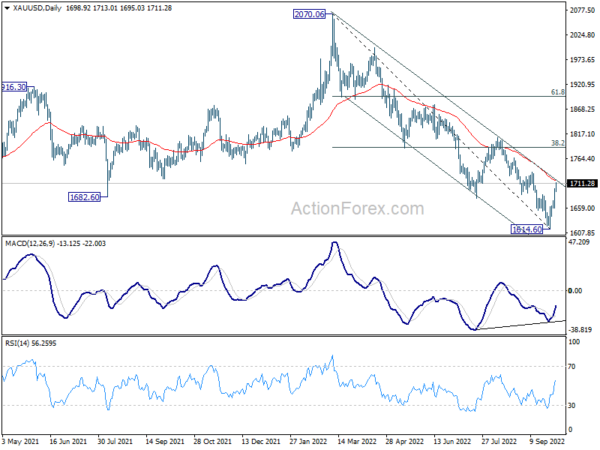

Technically, Gold is also worth a watch today, as it’s heading back to 55 day EMA (now at 1718.59), which is close to medium term channel resistance. Sustained break there will confirm medium term bottoming at 1614.60, on bullish convergence condition in daily MACD. Strong rise would be seen to 38.2% retracement of 2070.06 to 1614.60 at 1788.58, even as a corrective rise.

In Europe, at the time of writing, FTSE is up 2.04%. DAX is up 2.84%. CAC is up 3.35%. Germany 10-year yield is down -0.0487 at 1.864. Earlier in Asia, Nikkei rose 2.96%. Japan 10-year JGB yield dropped -0.0125 to 0.232. Singapore Strait Times rose 1.02%. China and Hong Kong were on holiday.

ECB Villeroy: Should continue rate hike to neutral by year end

ECB Governing Council member Francois Villeroy de Galhau said in a Dutch newspaper NRC interview, “we will raise interest rates as much as necessary to bring core inflation down.”

Villeroy added that ECB should continue raising interest rates, “without hesitation”, to neutral “by the end of the year”. He estimates that neutral a somewhere “below or close to 2%”.

“I don’t say that rate hikes will stop there, but we will have to comprehensively assess the inflation and economic outlook,” he added.

Eurozone PPI up 5.0% mom, 43.3% yoy in Aug

Eurozone PPI rose 5.0% mom 43.3% yoy in August. For the month,industrial producer prices increased by 11.8% in the energy sector, by 0.8% for non-durable consumer goods, by 0.4% for capital goods, by 0.3% for durable consumer goods and by 0.1% for intermediate goods. Prices in total industry excluding energy increased by 0.3%.

EU PPI rose 4.9% mom, 43.0% yoy. The highest monthly increases in industrial producer prices were recorded in Ireland (+28.4%), Bulgaria (+12.5%) and Hungary (+10.6%), while the only decreases were observed in Luxembourg (-1.8%), Portugal (-0.6%) and Czechia (-0.1%).

RBA hikes by only 25bps, maintain tightening bias

RBA raises the cash rate target by only 25bps to 2.60%, smaller than expectation of a 50bps hike. Tightening bias is maintained as the board “expects to increase interest rates further over the period ahead”. The size and timing of future hikes will continued to be determined by incoming data and the board’s assessment of inflation and labor market outlook.

In the accompanying statement, RBA said inflation is expected to “further increase” over the coming months. CPI would be around 7.75% over 2022, a little above 4% over 2023, and around 3% over 2024. The economy is “continuing to grow solidly” with national income boosted by a “record level of the terms of trade”. Labor markets is “very tight”. Wages growth is “continuing to pick up” but “remains lower than in other advanced economies” with high inflation.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 0.9770; (P) 0.9808; (R1) 0.9862; More…

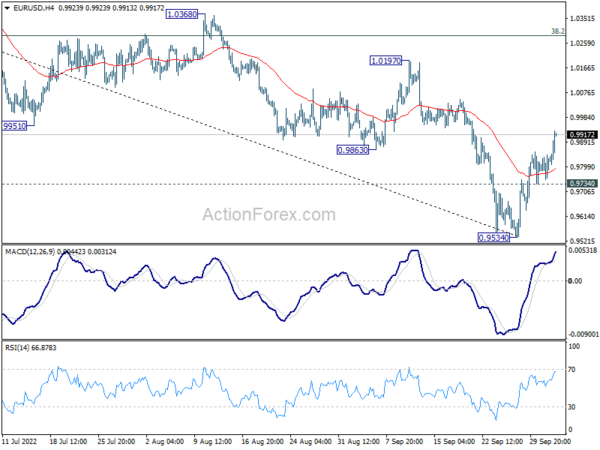

With break of 0.9863 support turned resistance, intraday bias in EUR/USD is back on the upside for 55 day EMA (now at 1.0033). Considering bullish convergence condition in Daily MACD, sustained break there will raise the chance of medium term bottoming at 0.9534. Further rally should then be seen to 38.2% retracement of 1.1494 to 0.9534 at 1.0283. On the downside, though, break of 0.9734 minor support will bring retest of 0.9534 low instead.

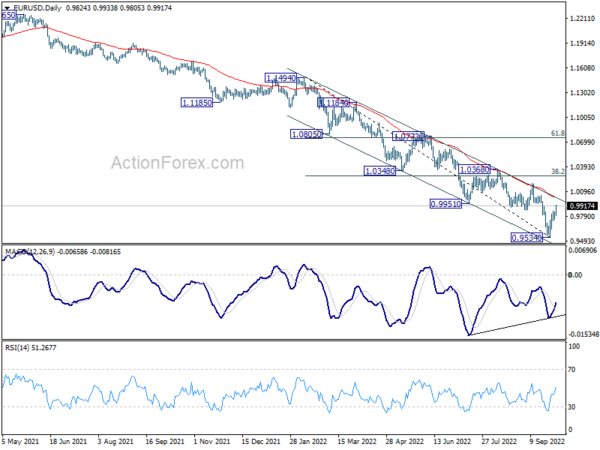

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, break of 1.0197 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish even with strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | NZIER Business Confidence Q3 | -42 | -65 | ||

| 21:30 | AUD | AiG Performance of Mfg Index Sep | 50.2 | 49.3 | ||

| 23:30 | JPY | Tokyo CPI Core Y/Y Sep | 2.80% | 2.80% | 2.60% | |

| 23:50 | JPY | Monetary Base Y/Y Sep | -3.30% | 0.60% | 0.40% | |

| 00:30 | AUD | Building Permits M/M Aug | 28.10% | 9.00% | -17.20% | -18.20% |

| 03:30 | AUD | RBA Interest Rate Decision | 2.60% | 2.85% | 2.35% | |

| 09:00 | EUR | Eurozone PPI M/M Aug | 5.00% | 4.90% | 4.00% | |

| 09:00 | EUR | Eurozone PPI Y/Y Aug | 43.30% | 43.20% | 37.90% | 38.00% |

| 14:00 | USD | Factory Orders M/M Aug | 0.30% | -1.00% |