The forex markets continue to stay in consolidative mode in Asian session. Dollar’s recovery attempt overnight was rather short-lived. Sterling also regains some ground after initial reaction to the UK government’s new budget. Yen is also soft despite strong CPI data from Japan. Overall, New Zealand Dollar is the strongest for the week so far, followed by Sterling and then Euro. Swiss Franc is the worst followed by Yen, and then Canadian.

Technically, WTI oil’s breach of 82.38 support raises the chance that corrective recovery from 76.61 has completed with three waves up to 94.25. That came after rejection by 38.2% retracement of 124.12 to 76.61. Sustained trading below 82.38 will affirm the case of down trend resumption through 76.61 low. If happens, that could put extra pressure on Canadian Dollar, in particular against other commodity currencies.

In Asia, at the time of writing, Nikkei is down -0.13%. Hong Kong HSI is up 0.31%. China Shanghai SSE is down -0.05%. Singapore Strait Times is down -0.48%. Japan 10-year JGB yield is down -0.0029 at 0.246. Overnight, DOW dropped -0.02%. S&P 500 dropped -0.31%. NASDAQ dropped -0.35%. 10-year yield rose 0.083 to 3.775.

Fed Kashkari: We cannot be overly persuaded by one month’s data

Minneapolis Fed President Neel Kashkari said yesterday, “I need to be convinced that inflation has at least stopped climbing, that we’re not falling further behind the curve, before I would advocate stopping the progression of future rate hikes,” adding, “we’re not there yet.”

Kashkari acknowledged that October CPI data provided “some evidence that inflation is at least plateauing.” Yet, “we cannot be overly persuaded by one month’s data.”

“It’s an open question of how far we are going to have to go with interest rates to bring that demand down in the balance,” he said.

SNB Maechler sees risk of more persistent inflation

SNB board member Andrea Maechler said yesterday, “our mandate is to bring down inflation and we will use the tools we have to do so… If we see our inflation forecast above 2 percent, we will continue to raise rates.”

“Inflation started with shocks but it’s no longer just shock-driven,” Maechler said. “We see inflation as having the risk of being more persistent.”

“It’s very important that we maintain the focus on implementing the policies to reach price stability in a consistent and sustainable way.”

Regarding Swiss Franc exchange rate, she said the appreciation “has been actually helping us keep our inflation much lower than in some of our neighboring countries.”

Yet, she added, “We’re willing – if the exchange rate were to rise too rapidly, too high – to use intervention to buy foreign exchange… We’re also willing, if the exchange rate were to become too weak, to sell exchange rate but we’re not yet ready to reduce our balance sheet as a policy in itself. This is not the right time.”

Japan CPI core hits 40-yr high, BoJ Kuroda rules out rate hike

Japan headline CPI rose from 3.0% to 3.7% yoy in October, above expectation of 2.7% yoy. CPI core (all item ex-fresh food) rose from 3.0% to 3.6% yoy, above expectation of 3.5% yoy. That’s the highest level in 40 years since 1982. CPI core-core (all item ex-fresh food and energy) rose from 1.8% yoy to 2.5% yoy, above expectation of 1.9% yoy.

BoJ Governor Haruhiko Kuroda said that core inflation was rising “quite a bit” but he expects it to slow back to below 2% in the next fiscal year.

“Raising interest rates now could delay Japan’s economic recovery,” Kuroda told the parliament. “I’m not saying the BOJ cannot raise rates indefinitely. I’m saying that it’s inappropriate to raise rates now, in light of current economic and price developments.”

“It’s difficult to sustainably achieve our 2% inflation target unless nominal wages rise steadily,” Kuroda said. “We’ll continue with our monetary easing to support the economy and achieve our 2% inflation target in a sustained, stable fashion backed by wage growth.

Looking ahead

UK retail sales is the only feature in European session. Canada will release IPPI and RMPI later in the day, while US will release existing home sales.

USD/CAD Daily Outlook

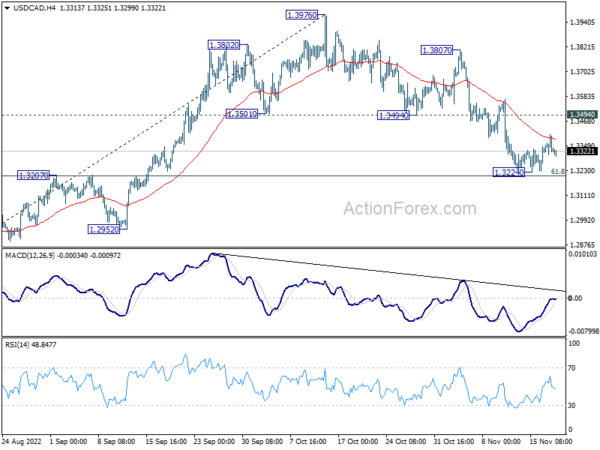

Daily Pivots: (S1) 1.3288; (P) 1.3344; (R1) 1.3384; More….

Intraday bias in USD/CAD remains neutral for the moment. On the upside, break of 1.3494 support turned resistance will argue that fall from 1.3976 has completed with three waves down to 1.3224. Further rally would then be seen back to 1.3807 resistance first. However, sustained trading below 1.3207 cluster support (61.8% retracement of 1.2726 to 1.3976 at 1.3204) will carry larger bearish implication and target 1.2952 support next.

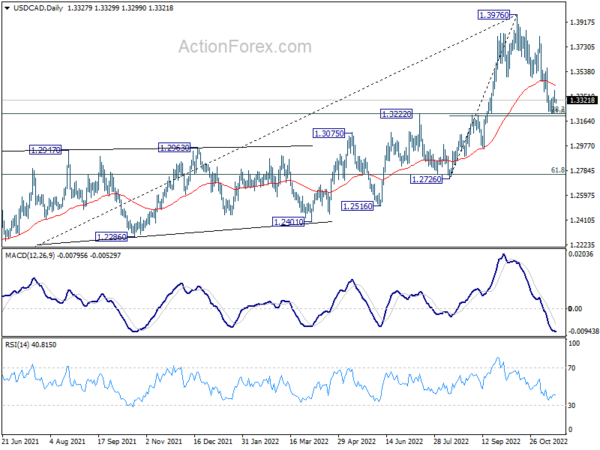

In the bigger picture, as long as 1.3222 cluster support (38.2% retracement of 1.2005 to 1.3976 at 1.3223) holds, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 high at a later stage. . However, firm break of 1.3222/3 will indicate that the trend might have reversed. Deeper fall would be seen to next cluster support at 1.2726 (61.8% retracement at 1.2758).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Oct | 3.60% | 3.50% | 3.00% | |

| 00:01 | GBP | GfK Consumer Confidence | -44 | -46 | -47 | |

| 07:00 | GBP | Retail Sales M/M Oct | 0.30% | -1.40% | ||

| 07:00 | GBP | Retail Sales Y/Y Oct | -6.50% | -6.90% | ||

| 07:00 | GBP | Retail Sales ex-Fuel M/M Oct | 0.60% | -1.50% | ||

| 07:00 | GBP | Retail Sales ex-Fuel Y/Y Oct | -6.70% | -6.20% | ||

| 13:30 | CAD | Industrial Product Price M/M Oct | 0.20% | 0.10% | ||

| 13:30 | CAD | Raw Material Price Index Oct | -1.00% | -3.20% | ||

| 15:00 | USD | Existing Home Sales Oct | 4.36M | 4.71M |