Despite another rally attempt overnight, Dollar failed to break through near term range against others except versus Yen. The Japanese currency was licking wounds in Asian session but remains the worst performer for the week, following extended rebound in US and European benchmark yields. Canadian is the next weakest followed by Sterling. On the other hand, Euro is the currently strongest one, followed by Swiss Franc and then Aussie. The greenback is mixed for now.

Technically, Bitcoin broke through 24245 resistance to resume the whole rebound from 15452. Notably support was seen above 55 day EMA during prior pull back, which is a bullish signal. Immediate focus is now on 25198 resistance. Firm break there will be another bullish sign and should pave the way to 61.8% projection of 15452 to 24256 from 21357 at 26791. The move could be followed by break of 12269 resistance in NASDAQ to resume the rise from 10069. Such risk-on sentiment could continue to cap Dollar’s rally.

In Asia, at the time of writing, Nikkei is up 0.77%. Hong Kong HSI is up 2.29%. China Shanghai SSE is up 0.84%. Singapore Strait Times is up 1.20%. Japan 10-year JGB yield is down -0.0001 at 0.506. Overnight, Dow rose 0.11%. S&P 500 rose 0.28%. NASDAQ rose 0.92%. 10-year yield rose 0.048 to 3.809.

ECB Lagarde: We intend to hike by 50bps in March

In a speech to the European Parliament, ECB President Christine Lagarde reiterated that “we intend to raise interest rates by another 50 basis points at our next meeting in March”, and the “evaluate the subsequent path”. Future policy decisions will continue to be “data-dependent” and follow a “meeting-by-meeting approach”.

While headline inflation moderated to 8.5% as shown in January flash estimate, “price pressures remain strong and underlying inflation is still high” with core inflation at 5.2%. “Even though most measures of longer-term inflation expectations currently stand at around 2%, these measures warrant continued monitoring.”

Risks to growth outlook are “now more balanced” than they were in December. Russia’s war against Ukraine continues to be a “significant downside risk”. But “faster resolution of the energy shock would support growth”. Risk to inflation outlook “have also become more balanced, especially in the near term.”

Japan posts record monthly trade deficit as exports to China tumbled

Japan goods exports rose 3.5% yoy to JPY 6551B in January, better than expectation of 0.8% yoy, but much worse than prior month’s 11.5% yoy. Exports to China fell -17.1% yoy on cars, car parts and chip-making equipment. Exports to the US were up 10.2% yoy. Exports to Europe ere up 9.5% yoy.

Imports rose 17.8% yoy to JPY 10048B, below expectation of 18.4% yoy and prior month’s 20.7% yoy. Import growth was boosted by coal, liquefied natural gas and crude oil,

Trade deficit came in at JPY -3497B.The monthly deficit was the largest on record going back to 1979.

In seasonally adjusted term, exports dropped -6.3% mom to JPY 7788B. Imports dropped -5.1% mom to JPY 9609B. Trade deficit was largely unchanged at JPY -1821B.

Australian employment down -11.5k in Jan, unemployment rate rose to 3.7%

Australia employment contracted -11.5k or -0.1% mom in January, worse than expectation of 20k growth. Unemployment rate rose from 3.5% to 3.7%, above expectation of 3.5%. Participation rate dropped from 66.6% to 66.5%. Monthly hours worked dropped -2.1% mom.

ABS noted: Along with a larger-than-usual increase in unemployed people in January, there was also a similarly larger-than-usual rise in the number of unemployed people who had a job to go to in the future.

Bjorn Jarvis, ABS head of labour statistics said: “January is the most seasonal time of the year in the Australian labour market, with people leaving jobs but also getting ready to start new jobs or return from leave. This January, we saw more people than usual with a job indicating they were starting or returning to work later in the month.”

AUD/USD Daily Report

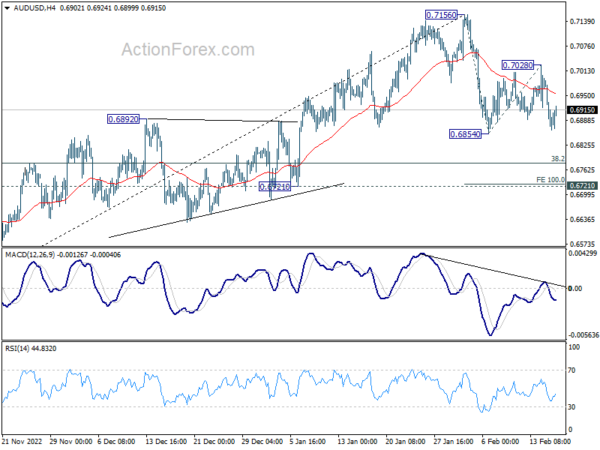

Daily Pivots: (S1) 0.6849; (P) 0.6920; (R1) 0.6974; More…

AUD/USD recovered ahead of 0.6854 support despite yesterday’s dip. Intraday bias remains neutral for the moment. On the downside, break of 0.6854 will resume the corrective fall from 0.7156 to 100% projection of 0.6854 to 0.7028 from 0.6854 at 0.6736, which is close to 0.6721 key structural support. Strong support is expected there to bring rebound. On the upside, break of 0.7028 will turn bias back to the upside for retesting 0.7156 high.

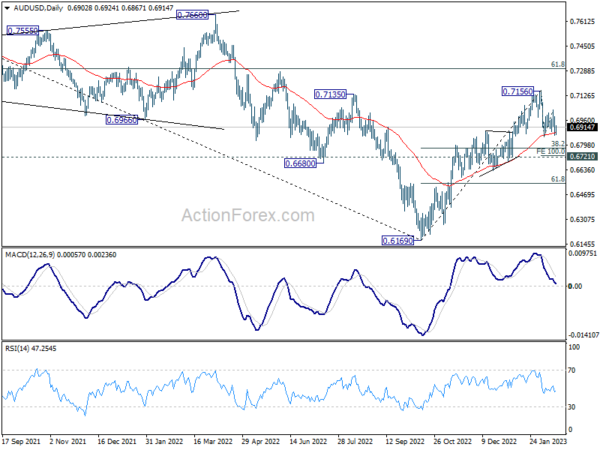

In the bigger picture, corrective decline from 0.8006 (2021 high) should have completed with three waves down to 0.6169 (2022 low). Further rally should be seen to 61.8% retracement of 0.8006 to 0.6169 at 0.7304. Sustained break there will pave the way to retest 0.8006. This will now remain the favored case as long as 0.6721 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Jan | -1.82T | -2.47T | -1.72T | -1.82T |

| 23:50 | JPY | Machinery Orders M/M Dec | 1.60% | 2.70% | -8.30% | |

| 00:00 | AUD | Consumer Inflation Expectations Feb | 5.10% | 5.60% | ||

| 00:30 | AUD | Employment Change Jan | -11.5K | 20.0K | -14.6K | -20.0K |

| 00:30 | AUD | Unemployment Rate Jan | 3.70% | 3.50% | 3.50% | |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 13:30 | USD | Housing Starts Jan | 1.36M | 1.38M | ||

| 13:30 | USD | Building Permits Jan | 1.35M | 1.34M | ||

| 13:30 | USD | PPI M/M Jan | 0.40% | -0.50% | ||

| 13:30 | USD | PPI Y/Y Jan | 5.10% | 6.20% | ||

| 13:30 | USD | PPI Core M/M Jan | 0.30% | 0.10% | ||

| 13:30 | USD | PPI Core Y/Y Jan | 4.90% | 5.50% | ||

| 13:30 | USD | Initial Jobless Claims (Feb 10) | 200K | 196K | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Feb | -7.7 | -8.9 | ||

| 15:30 | USD | Natural Gas Storage | -97B | -217B |