Two major themes are vying for attention today. Euro has seen broad gains following hawkish comments from Bundesbank President Joachim Nagel. In contrast, the remarks of BoE Governor Andrew Bailey have left Sterling struggling to keep pace. As these European majors trade blows, the Swiss Franc has been pushed higher too.

Meanwhile, both Australian and New Zealand Dollars have received a boost from China’s recent economic data. However, the Kiwi has outshone the Aussie, as the latter currency has been weighed down by weaker than expected GDP and CPI figures.

Overall, Dollar is the worst performer for the day so far. However, it is worth keeping an eye on risk sentiment in the upcoming US session, which could provide a potential opportunity for the greenback to recover some lost ground, is investors’ mood turn around.

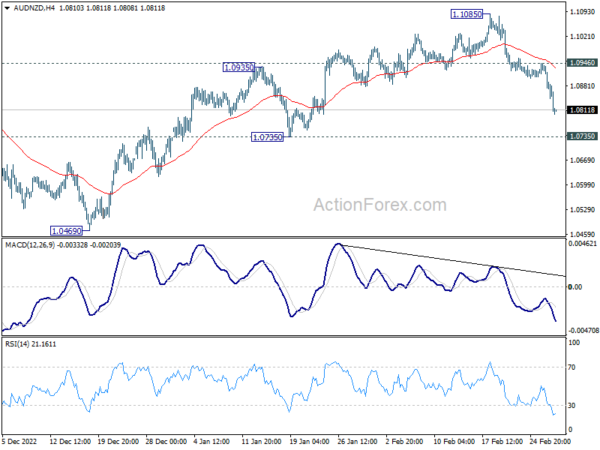

Technically, AUD/NZD’s extended decline from 1.1085 argues that whole rebound from 1.0469 has completed with three waves up to 1.1085. Deeper fall is now in favor as long as 1.0946 resistance holds, towards 1.0735 support first. Firm break there would set the stage to retest 1.0469 low.

In Europe, at the time of writing, FTSE is up 0.49%. DAX is up 0.02%. CAC is up 0.05%. Germany 10-year yield is up 0.071 at 2.720. Earlier in Asia, Nikkei rose 0.26%. Hong Kong HSI rose 4.21%. China Shanghai SSE rose 1.00%. Singapore Strait Times dropped -0.23%. Japan 10-year JGB yield rose 0.005 to 0.508.

Bundesbank Nagel: Further significant rate steps after Mar, steeper balance sheet reduction in Jul

Bundesbank President Joachim Nagel said in a speech today, “the interest rate step announced (by ECB) for March will not be the last.”

“Further significant interest rate steps might even be necessary afterwards, too,” he added.

Regarding the timing of a rate cut, Nagel said, the impact of tightening has to be reflected in underlying inflation. Until that is the case, interest rate cuts are a non-starter.”

Nagel also said with the current pace of balance sheet reduction at EUR 15B a month, it will take too long to make a significant reduction. “I am therefore in favour of taking a steeper path of reduction starting in July in light of experience gained up to that point,” he said.

Regarding the economy, “although there could be a gradual pick-up in the second quarter, there is still no sign of any major improvement for now,” Nagel said. “Our experts are not expecting there to be a visible economic recovery until the second half of the year.”

Eurozone PMI manufacturing finalized at 48.5, output at 50.1

Eurozone PMI Manufacturing was finalized at 48.5 in February, down from January’s 48.8. Manufacturing output was finalized at 50.1, up from 48.9, a 9-month high.

Looking a some member states, readings for Italy (52.0, 10-mont high), Greece (51.7, 9-month high), Ireland (51.3, 4-month high), and Spain (50.7, 8-month high) improved. The Netherlands (48.7, 2-month low), France (47.4, 4-month low), Austria (47.1, 3-month low), and Germany (46.3, 3-month low) deteriorated.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“A marginal expansion of output reported by Eurozone manufacturers in February is welcome news in representing the first increase since last May… Unfortunately, inflows of new orders continued to fall at a marked rate, reflecting persistent weak demand… In the meantime, the combination of improved supply and sustained weak demand – as well as lower energy prices – is helping bring inflationary pressures down sharply”.

BoE Bailey: Some further hike may be appropriate, but nothing is decided

BoE Governor Andrew Bailey said in a speech, “I would caution against suggesting either that we are done with increasing Bank Rate, or that we will inevitably need to do more”.

“Some further increase in Bank Rate may turn out to be appropriate, but nothing is decided. The incoming data will add to the overall picture of the economy and the outlook for inflation, and that will inform our policy decisions.,” he added.

Regarding the economy, he said that data since February meeting, is that the economy is “evolving much as we expected it to”.

“Inflation has been slightly weaker, and activity and wages slightly stronger, though I would emphasise ‘slightly’ in both cases,” he said. “A further set of data will be coming in before our next monetary policy decision later this month.”

UK PMI manufacturing finalized at 49.3 in Feb, showed encouraging signs of resilience

UK PMI Manufacturing was finalized at 49.3 in February, up from January’s 47.0. That’s the highest level in 7 months even though it’s stuck in contraction territory. New orders fell but showed signs of stabilizing. Input cost and output price inflation eased.

Rob Dobson, Director at S&P Global Market Intelligence, said:

“UK manufacturing showed encouraging signs of resilience in February. Output rose for the first time in eight months, boosted by weaker cost inflation and reduced supply chain disruptions. Input prices increased at the slowest pace since July 2020 and supplier performance improved for the first time in three-and-a-half years. This offset some of the ongoing negative impacts from strikes, the cost of living crisis and lower order intakes.

“Manufacturers’ confidence also strengthened, with 60% of companies forecasting production will expand during the coming year. Part of the reason for renewed optimism was a near-stabilisation of new order inflows in February, with total new orders and new export business both falling only slightly and to much lesser extents than in recent months. Manufacturers benefited from growing signs of a global economic recovery and the easing of COVID restrictions by China. This process of economic revival, alongside signs of inflation peaking and reduced recession fears, should hopefully help UK manufacturers eke out further growth in the coming months.”

China PMI manufacturing rose to 52.6, highest since 2012

China official PMI Manufacturing rose from 50.1 to 52.6, above expectation of 50.7. That’s also the highest reading since April 2012. PMI Non-Manufacturing rose from 54.4 to 56.3, highest since March 2021. PMI Composite rose from 52.9 to 56.4.

“In February, the economic stabilisation policy measures further took effect, coupled with the epidemic’s impact receding and other favourable factors, the speed of enterprises to resume production accelerated, meaning China’s economic prosperity level continued to rebound,” said senior NBS statistician Zhao Qinghe.

Also released, Caixin PMI Manufacturing rose from 49.2 to 51.6 in February, slightly above expectation of 51.3. That the first expansion reading in 7 months, and the second-highest since May 2021. Caixin added there were renewed increases in output, new orders and employment. Suppliers’ delivery times improved at the quickest rate for eight years. Business confidence also strengthened to near two-year high.

Japan PMI manufacturing finalized at 47.7 in Feb, continually deteriorating activity

Japan PMI Manufacturing was finalized at 47.7 in February, down from January’s 48.9. That’s also the worst reading since September 2020. S&P Global also noted that backlogs of work decreased at quickest pace for 29 months. Input prices had the slowest rise for a year-and-a-half.

Usamah Bhatti, Economist at S&P Global Market Intelligence, said: “Latest data pointed to continually deteriorating activity in the Japanese manufacturing sector midway through the first quarter of 2023. Both new orders and production levels, which make up 55% of the headline PMI figure, fell at the fastest pace since July 2020 as weak domestic demand and a global economic slowdown hindered sales and output volumes.

“Moreover, the dip is likely to be sustained in the near-term as the absence of new orders amid dampened client confidence lifted capacity pressure on manufacturers further and led to the sharpest reduction in outstanding business in nearly two-and- a-half years.”

Australia CPI slowed to 7.4% yoy in Jan, ex-volatile items down to 7.2% yoy

Australia monthly CPI indicator slowed from 8.4% yoy to 7.4% yoy in January, below expectation of 8.1% yoy. CPI excluding volatile items (i.e. excludes Fruit and vegetables and Automotive fuel) slowed from 8.1% yoy to 7.2% yoy.

The most significant contributors to the annual increase in the January monthly CPI indicator were Housing (9.8%), Food and non-alcoholic beverages (8.2%) and recreation and culture (10.2%).

Australia GDP grew 0.5% qoq in Q4, domestic prices grew fastest since 1990

Australia GDP grew 0.5% qoq in Q4, below expectation of 0.8% qoq. Through the year, GDP grew 2.7% yoy. GDP Implicit price deflator (IPD) rose 1.6% qoq and 9.1% yoy. Domestic prices grew 1.4% qoq and 6.6 yoy, highest annual growth since 1990.

Katherine Keenan, ABS head of National Accounts, said, “the 0.4 per cent rise in total consumption and 1.1 per cent rise in exports were the primary contributors to GDP growth in the December quarter…

“Continued growth in household and government spending drove the rise in consumption, while increased exports of travel services and continued overseas demand for coal and mineral ores drove exports.”

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8763; (P) 0.8788; (R1) 0.8820; More…

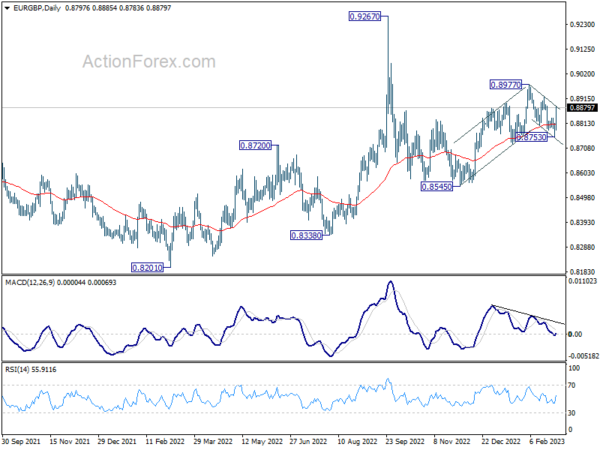

EUR/GBP’s rebound from 0.8753 accelerated higher today. The strong break of 0.8834 resistance argues that fall from 0.8977 has completed with three waves down to 0.8753, ahead of 0.8720 support. The development in turn suggests that rise from 0.8545 is not over. Intraday bias is back on the upside for 0.8927 first. Decisive break there will bring retest of 0.8977 next.

In the bigger picture, outlook is rather mixed for now, except that price actions from 0.9267 (2022 high) are part of the long term range pattern from 0.9499 (2020 high). With 0.8720 support intact, rise from 0.8545 is in favor to continue through 0.8977. However, firm break of 0.8720 will argue that such rebound has completed, and open up deeper fall through this support level.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Jan | -1.50% | -7.20% | ||

| 00:30 | AUD | GDP Q/Q Q4 | 0.50% | 0.80% | 0.60% | 0.70% |

| 00:30 | AUD | Monthly CPI Y/Y Jan | 7.40% | 8.10% | 8.40% | |

| 00:30 | JPY | Manufacturing PMI Feb F | 47.7 | 47.4 | 47.4 | |

| 01:00 | CNY | NBS Manufacturing PMI Jan | 52.6 | 50.7 | 50.1 | |

| 01:00 | CNY | Non-Manufacturing PMI Jan | 56.3 | 55 | 54.4 | |

| 01:45 | CNY | Caixin Manufacturing PMI Feb | 51.6 | 51.3 | 49.2 | |

| 07:30 | CHF | Real Retail Sales Y/Y Jan | -2.20% | -2.20% | -2.80% | -3.00% |

| 08:30 | CHF | Manufacturing PMI Feb | 48.9 | 50.4 | 49.3 | |

| 08:45 | EUR | Italy Manufacturing PMI Feb | 52 | 50.9 | 50.4 | |

| 08:50 | EUR | France Manufacturing PMI Feb F | 47.4 | 47.9 | 47.9 | |

| 08:55 | EUR | Germany Manufacturing PMI Feb F | 46.3 | 46.5 | 46.5 | |

| 08:55 | EUR | Germany Unemployment Change Jan | 2K | 9K | -22K | |

| 08:55 | EUR | Germany Unemployment Rate Jan | 5.50% | 5.50% | 5.50% | |

| 09:00 | EUR | Eurozone Manufacturing PMI Feb F | 48.5 | 48.5 | 48.5 | |

| 09:30 | GBP | Mortgage Approvals Jan | 40K | 36K | 36K | |

| 09:30 | GBP | M4 Money Supply M/M Jan | 1.30% | -0.90% | -0.80% | |

| 09:30 | GBP | Manufacturing PMI Feb F | 49.3 | 49.2 | 49.2 | |

| 13:00 | EUR | Germany CPI M/M Feb P | 0.80% | 0.80% | 1.00% | |

| 13:00 | EUR | Germany CPI Y/Y Feb P | 8.70% | 8.70% | 8.70% | |

| 14:30 | CAD | Manufacturing PMI Feb | 51 | |||

| 14:45 | USD | Manufacturing PMI Feb F | 47.8 | 47.8 | ||

| 15:00 | USD | ISM Manufacturing PMI Feb | 47.9 | 47.4 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Feb | 45.2 | 44.5 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Feb | 50.6 | |||

| 15:00 | USD | Construction Spending M/M Jan | 0.20% | -0.40% | ||

| 15:30 | USD | Crude Oil Inventories | 1.7M | 7.6M |