The European session has been marked by a resurgence of market turbulence as Deutsche Bank shares nosedive, fueled by a surge in its credit default swaps. This development has had a domino effect on major European indexes and US futures, both experiencing significant drops. Investors are seeking refuge in bonds, driving the US 10-year yield towards 3.3% and Germany’s 10-year yield notably below 2.1%.

In the realm of currency, Yen is enjoying a broad rally, keeping company with Dollar and Swiss Franc. On the other hand, the Euro is taking a plunge, erasing most of its week’s gains. Australian and New Zealand Dollars find themselves in an even more precarious situation, with Sterling and Canadian Dollar showing mixed performance. Market responses to today’s economic data have been rather tepid.

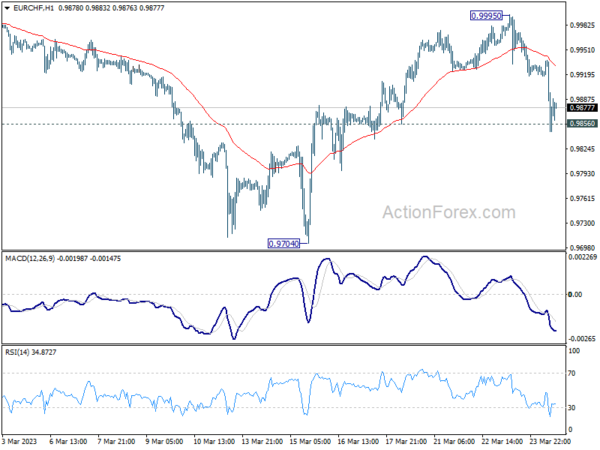

From a technical perspective, the sharp descent of EUR/CHF implies that the rebound from 0.9704 might have already reached its zenith at 0.9995. As Credit Suisse encountered challenges last week, funds seemed to flow from Swiss Franc to Euro. However, with Deutsche Bank now in hot water, funds are making their way back to the Franc. The critical question is whether the 0.9856 minor support can hold its ground before the weekly close.

In Europe, at the time of writing, FTSE is down -1.67%. DAX is down -2.28%. CAC is down -2.23%. Germany 10-year yield is down -0.1312 at 2.062. Earlier in Asia, Nikkei dropped -0.13%. Hong Kong HSI dropped -0.67%. China Shanghai SSE dropped -0.64%. Singapore Strait Times dropped -0.20%. Japan 10-year JGB yield dropped -0.035 to 0.276.

US durable goods orders down -1.0% mom in Feb, led by transport equipment

US durable goods orders dropped -1.0% mom to USD 268.5B in February, much worse than expectation of 0.4% mom rise. Ex-transport orders was flat 0.0% mom at USD 179.0B, below expectation of 0.2% mom. Ex-defense orders dropped -0.5% mom to USD 251.5B. Transportation equipment dropped -2.8% mom to USD 89.4B.

Canada retail sales up 1.4% mom in Jan, beat expectations

Canada retail sales value rose 1.4% mom to CAD 66.4B in January, above expectation of 0.7% mom. Sales increased in seven of nine subsectors, led by sales at motor vehicle and parts dealers (+3.0%) and gasoline stations and fuel vendors (+2.9%).

Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—increased 0.5% in January.

Advance estimates indicates that sales deceased -0.6% mom in February.

BoE Bailey: Interest rates will go up further if inflation got embedded

In a interview with BBC, BoE Governor Andrew Bailey emphasized that the central bank expects inflation to decline sharply this year as the impact of last year’s steep energy price increases drops from year-on-year price comparisons. He expressed relief that inflation had stabilized and noted some “encouraging signs” of progress. However, he urged continued vigilance, stating, “we have to be extremely vigilant on that front.”

Bailey also issued a warning to businesses setting prices, cautioning that “if we get inflation embedded, interest rates will have to go up further.” While acknowledging that companies must set prices according to the costs they face, he urged them to remember the anticipated decrease in inflation this year when setting prices: “we do expect inflation to come down sharply this year and I would just say please bear that in mind.”

UK PMIs: Economic returns to modest growth in Q1

UK PMI Manufacturing dropped from 49.3 to 48.0 in March. PMI Services dropped from 53.5 to 52.8. PMI Composite dropped from 53.1 to 52.2. All three were two-month lows.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, indicated that the UK economy has shown signs of growth in the first quarter, with the flash PMI surveys indicating a second consecutive month of rising output in March. The data suggests a modest quarterly GDP growth rate of 0.2%, which is a welcome change from the stagnation seen in the second half of the previous year.

Despite concerns over the banking sector, businesses remain optimistic about growth possibilities, and the improvement in order book growth suggests that a near-term recession has been averted. The upturn in companies’ expectations for the year ahead indicates that firms are more focused on growth opportunities rather than banking sector challenges.

UK retail sales volume up 1.2% mom in Feb, sales value rose 1.6% mom

UK retail sales volume rose 1.2% mom in February, well above expectation of 0.2% mom. Ex-fuel sales volume rose 1.5% mom, above expectation of 0.1% mom. Nevertheless, in the three months to February, comparing to the prior three month, sales volume declined -0.3%, while ex-fuel sales volume dropped -0.4.

In value term, total sales rose 1.6% mom while ex-fuel sale rose 2.2% mom. In the three months to February, comparing to the prior three months, total sales value rose 0.7% while ex-fuel sales value rose 1.0%.

Eurozone PMI composite rose to 10-month high on strong services

Eurozone PMI Manufacturing dropped from 48.5 to 47.1 in March, hitting a 4-month low. However, PMI Services rose sharply from 52.7 to 55.6. PMI Composite rose from 52.0 to 54.1. Both PMI Services and Composite were the highest levels in 10 months.

According to Chris Williamson, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, the eurozone economy is experiencing a resurgence, with business activity in March growing at the fastest rate in ten months. The data indicates a 0.3% GDP growth in Q1, accelerating to a 0.5% rate in March. This growth is attributed to fading recession fears, easing inflation pressures, and significant improvements in supplier delivery times.

Despite these positive signs, inflationary pressures continue to be a concern, particularly in the service sector and rising wage costs. The growth remains unbalanced, with the service sector driving growth while manufacturing struggles to maintain production amid falling demand.

Also released, Germany PMI Manufacturing dropped further from 46.3 to 44.3 March, a 34-month low. But PMI Services rose from 50.9 to 53.9, a 10-month high. PMI Composite rose from 50.7 to 52.6, also a 10-month high.

France PMI Manufacturing ticked up from 47.4 to 47.7 in March. PMI Services rose from 53.1 to 55.5, a 10-month high. PMI Composite rose from 51.7 to 54.0, also a 10-month high.

Japan CPI core down sharply to 3.1%, but core-core rose to 40-yr high

Japan’s headline CPI in February experienced a sharp slowdown from 4.3% yoy to 3.3% yoy, falling below the expected 4.1% yoy. CPI core (all items excluding food) dropped from 4.2% yoy to 3.1% yoy, meeting expectations. Meanwhile, CPI core-core (all items excluding food and energy) rose from 3.2% yoy to 3.5% yoy, surpassing the anticipated 3.4% yoy.

Despite the steep decline in CPI core from a 41-year high of 4.2% to 3.1%, the figure remains well above the Bank of Japan’s (BoJ) 2% target. The core-core reading, closely monitored by the BoJ as an indicator of domestic demand, reached its highest rate since January 1982.

The data suggests that incoming BoJ Governor Kazuo Ueda may need to address a shift from cost-push inflation to demand-driven inflation, which could prove more sustainable.

Japan PMIs: Growth continues with strong services but struggling manufacturing

Japan PMI Manufacturing rose from 47.7 to 48.6 in March, slightly above expectation of 48.2. PMI Manufacturing Output rose from 45.3 to 47.4. PMI Services ticked up from 54.0 to 54.2, the best reading since October 2013. MI Composite improved from 51.1 to 51.9.

Japanese private sector firms experienced growth for the third consecutive month, with the services sector witnessing a notable improvement. Demand conditions strengthened, as government support and the lifting of COVID-19 restrictions in mainland China led to increased activity and new orders.

However, the manufacturing sector continued to face challenges, with output and new orders still contracting, albeit at a slower rate than February. Manufacturers reported ongoing supply chain normalization, as supplier delivery times lengthened at the slowest pace since October 2020.

Australia PMI composite dropped to 48.1, renewed contraction

Australia PMI Manufacturing dropped from 50.5 to 48.7 in March, a 34-month low. PMI Services dropped from 50.7 to 48.2, a 3-month low. PMI Composite dropped from 50.6 to 48.1, a 3-month low. All readings indicated renewed contraction in the private sector following improvements in February.

Looking at some details, the results indicate a continued economic slowdown, with composite output and new orders indexes at their lowest since the 2021 Delta lockdowns. Despite easing labor demand, employment indexes suggest businesses are still looking to expand their workforce in 2023. Price indicators have eased but remain elevated, with Australian inflation peaking in late 2022. Service industry input prices are still high, suggesting potential inflationary pressures in 2023 due to labor costs and energy prices.

As RBA prepares for its April meeting, it faces a tough decision on whether to pause its tightening cycle amid global financial uncertainty, strong employment numbers, and concerns about inflation levels. Some argue that the RBA should raise the cash rate closer to 4% before pausing to observe the economy’s performance over the next few months.

Warren Hogan, Chief Economic Advisor at Judo Bank noted: “There is no point pausing for a month before hiking again. The RBA Board need to get the cash rate to a level that they think will buy them the time to observe how the economy unfolds for at least three months, if not longer.”

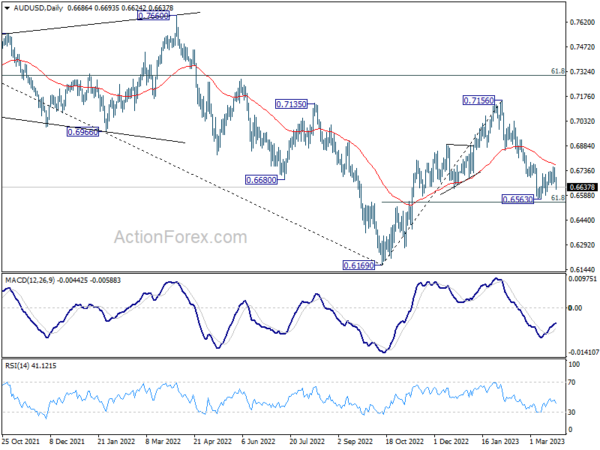

AUD/USD Mid-Day Report

Daily Pivots: (S1) 0.6652; (P) 0.6704; (R1) 0.6737; More…

Break of 0.6648 minor support argues that AUD/USD’s recovery from 0.6563 has completed at 0.6758, ahead of 55 day EMA. Intraday bias is back on the downside for 0.6563 low and 0.6546 fibonacci level. Decisive break there will resume whole fall from 0.7156 and carries larger bearish implications.

In the bigger picture, as long as 61.8% retracement of 0.6169 to 0.7156 at 0.6546 holds, the decline from 0.7156 is seen as a correction to rally from 0.6169 (2022 low) only. Another rise should still be seen through 0.7156 at a later stage. However, sustained break of 0.6546 will raise the chance of long term down trend resumption through 0.6169 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | Manufacturing PMI Mar P | 48.7 | 50.5 | ||

| 22:00 | AUD | Services PMI Mar P | 48.2 | 50.7 | ||

| 23:30 | JPY | CPI Y/Y Feb | 3.30% | 4.10% | 4.30% | |

| 23:30 | JPY | CPI ex-Fresh Food Y/Y Feb | 3.10% | 3.10% | 4.20% | |

| 23:30 | JPY | CPI ex Food & Energy Y/Y Feb | 3.50% | 3.40% | 3.20% | |

| 00:01 | GBP | GfK Consumer Confidence Mar | -36 | -35 | -38 | |

| 00:30 | JPY | Manufacturing PMI Mar P | 48.6 | 48.2 | 47.7 | |

| 07:00 | GBP | Retail Sales M/M Feb | 1.20% | 0.20% | 0.50% | 0.90% |

| 07:00 | GBP | Retail Sales Y/Y Feb | -3.50% | -4.70% | -5.10% | -5.20% |

| 07:00 | GBP | Retail Sales ex-Fuel M/M Feb | 1.50% | 0.10% | 0.40% | 0.90% |

| 07:00 | GBP | Retail Sales ex-Fuel Y/Y Feb | -3.30% | -4.70% | -5.30% | -5.40% |

| 08:15 | EUR | France Manufacturing PMI Mar P | 47.7 | 48.2 | 47.4 | |

| 08:15 | EUR | France Services PMI Mar P | 55.5 | 53 | 53.1 | |

| 08:30 | EUR | Germany Manufacturing PMI Mar P | 44.4 | 47.1 | 46.3 | |

| 08:30 | EUR | Germany Services PMI Mar P | 53.9 | 51.1 | 50.9 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Mar P | 47.1 | 48.9 | 48.5 | |

| 09:00 | EUR | Eurozone Services PMI Mar P | 55.6 | 52.9 | 52.7 | |

| 09:30 | GBP | Manufacturing PMI Mar P | 48 | 50 | 49.3 | |

| 09:30 | GBP | Services PMI Mar P | 52.8 | 53.1 | 53.5 | |

| 12:30 | CAD | Retail Sales M/M Jan | 1.40% | 0.70% | 0.50% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Jan | 0.90% | 0.60% | -0.60% | |

| 12:30 | USD | Durable Goods Orders Feb | -1.00% | 0.40% | -4.50% | |

| 12:30 | USD | Durable Goods Orders ex Transportation Feb | 0.00% | 0.20% | 0.70% | |

| 13:45 | USD | Manufacturing PMI Mar P | 47.3 | |||

| 13:45 | USD | Services PMI Mar P | 50.6 |