Forex markets have turned noticeably risk-off today, with Aussie and Kiwi showing broad-based declines. Despite Loonie holding strong, it is being outperformed by both Dollar and Yen. Meanwhile, European majors present a mixed picture, with Sterling lagging behind Euro and Swiss Franc.

Today’s PMI data illustrated a ‘two-track’ economy in Europe, marked by robust services and weak manufacturing. Despite the resilience of services sector helping to stave off recession, questions linger about the longevity of this support given the prevailing high inflation. Furthermore, in countries like UK where services sector is a large portion of the economy, it is likely that BoE will be compelled to persist with tightening measures in order to suppress demand.

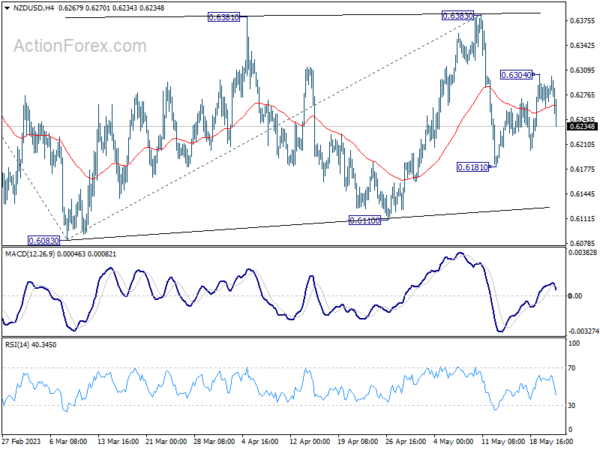

Attention now turns to the upcoming Asian session featuring an anticipated rate hike by RBNZ, placing NZD/USD in the spotlight. Recovery of NZD/USD from 0.6181 appears to be corrective so far, suggesting potential for further downside. Break below 0.6181 could trigger a rapid descent towards 0.6083 low. While a break above the 0.6304 resistance would extend the recovery, near-term outlook will continue to be bearish as long as 0.6383 resistance holds, just that downside breakout is delayed.

In Europe, at the time of writing, FTSE is up 0.31%. DAX is down -0.33%. CAC is down -0.97%, Germany 10-year yield is up 0.0328 at 2.492. Earlier in Asia, Nikkei dropped -0.42%. Hong Kong HSI dropped -1.25%. China Shanghai SSE dropped -1.52%. Singapore Strait Times rose 0.22%. Japan 10-year JGB yield rose 0.0167 to 0.404.

UK PMI composite dropped to 53.9, but BoE has more work to do

UK PMI Manufacturing dropped from 47.8 to 46.9 in May, a 5-month low. PMI Services dropped from 55.9 to 55.1. PMI Composite dropped from 54.9 to 53.9.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“The UK economy enjoyed another month of strong growth in May, with the expansion continuing to be driven by surging post-pandemic demand in the service sector, notably from consumers and for financial services, with hospitality activities buoyed further by the Coronation. The surveys are consistent with GDP rising 0.4% in the second quarter after a 0.1% rise in the first quarter…

“The UK is therefore seeing a tale of two economies, with the divergence between manufacturing and services posing difficulties for policymakers. However, it’s the far larger service sector that will typically dictate policy, meaning these survey results are nothing but hawkish in suggesting the Bank of England has more work to do to quash stubbornly high inflationary pressures in the services economy.”

Eurozone PMI manufacturing fell to 36-mth low, services dipped

Eurozone PMI Manufacturing fell from 45.8 to 44.6 in May, a 36-month low. PMI Services fell from 56.2 to 55.9. PMI Composite decreased from 54.1 to 53.3.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank said: Eurozone GDP is likely to have grown in the second quarter thanks to the healthy state of the services sector. However, the manufacturing sector is a powerful drag on the momentum of the economy as a whole.

He added that ECB will have a “headache” with the PMI price data, as “selling prices in the services sector actually rose more than in the previous month”.

Also released, Germany PMI manufacturing dropped from 44.5 to 42.9 in May, a 36-month low. PMI Services rose from 56.0 to 57.8, a 21-month high. PMI Composite rose from 54.2 to 54.3, a 13-month high.

France PMI Manufacturing rose from 45.6 to 46.1. PMI Services dropped from 54.6 to 52.8. PMI Composite dropped from 52.4 to 51.4.

Australia PMI composite dropped to 51.2, still early to call an end to RBA tightening

Australia’s PMI Manufacturing index stayed put at 48.0 in May, marking the joint-lowest reading since May 2020. On the other hand, PMI Services fell from 53.7 to 51.8, causing Composite PMI to decrease from 53.0 to 51.2.

Warren Hogan, Chief Economic Advisor at Judo Bank, said, “The May Flash result shows a small retracement from the strong April outcome reinforcing the view that overall economic activity in Australia is holding up well as we enter the winter months.”

Despite the manufacturing sector’s continuous slowdown, Hogan emphasized that this does not signal a recession. In contrast to manufacturing, the services sector has shown recent strength, and was “far from the risk of recession:.

However, he warned of the implications of better economic conditions in terms of inflation. “The RBA is trying to engineer a soft landing to rid the economy of inflation. But if they don’t lean hard enough on monetary policy, we could see a more stubborn inflation emerge which will ultimately require a bigger lift in interest rates,” Hogan cautioned.

Highlighting the strong correlation between the pick-up in the services PMI, housing market, rising population growth, and job advertising, he concluded, “Last week’s labour market data on employment and wages have bought the RBA some time, but the Flash PMIs highlight that it is still too early to call an end to the monetary policy tightening cycle.”

Japan PMI manufacturing rose to 50.8, services rose to 56.3

Japan PMI Manufacturing rose from 49.5 to 50.8 in April, signalling the first improvement in operating conditions since October 2022. PMI Manufacturing Output rose from 47.9 to 51.9. PMI Services rose from 55.4 to 56.3. PMI Composite Output rose from 52.9 to 54.9.

Usamah Bhatti, Economist at S&P Global Market Intelligence, said:

“The Japanese private sector economy continued on an upward trajectory, as signalled by a further expansion in May. The rate of growth quickened from April to reach the strongest since October 2013 and the second-strongest in the survey history (since September 2007).

“Service providers continued to report strong growth momentum with a renewed record increase in business activity, while manufacturers indicated an improvement in operating conditions for the first time in seven months, with output and new orders returning to expansion territory for the first time since last June.”

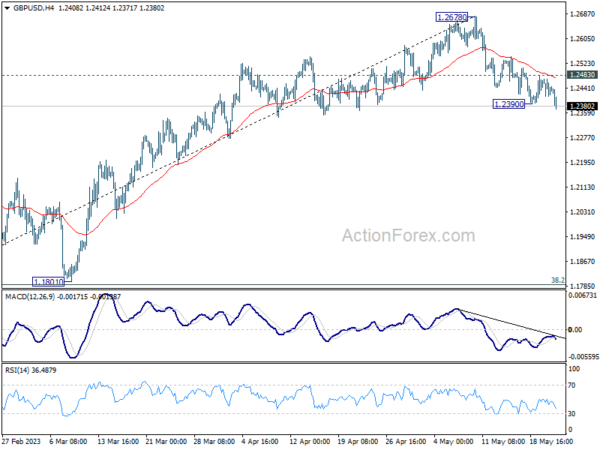

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2410; (P) 1.2441; (R1) 1.2469; More…

GBP/USD’s decline from 1.2678 resumed by taking out 1.2390 temporary low and intraday bias is back on the downside. Current fall is seen as a correction to whole up trend form 1.0351. Deeper fall should then be seen to 1.1801 cluster support (38.2% retracement of 1.0351 to 1.2678 at 1.1789). On the upside, however, break of 1.2483 resistance will bring stronger rebound back to retest 1.2678 high instead.

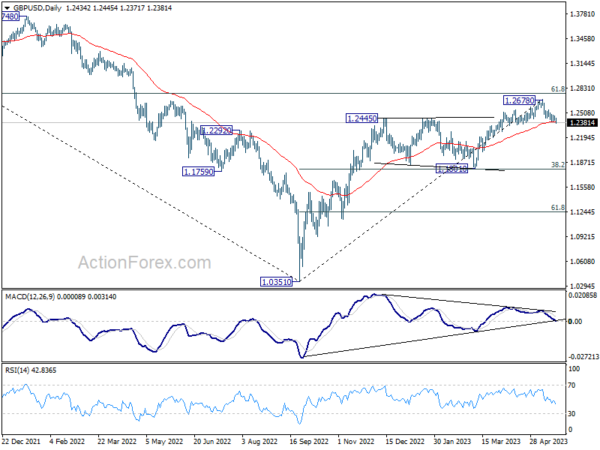

In the bigger picture, as long as 1.1801 support holds, rise from 1.0351 medium term bottom (2022 low) is expected to extend further. Sustained break of 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759 will add to the case of long term bullish trend reversal. However, firm break of 1.1801 will indicate rejection by 1.2759, and bring deeper decline, even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI May P | 48 | 48 | ||

| 23:00 | AUD | Services PMI May P | 51.8 | 53.7 | ||

| 00:30 | JPY | Manufacturing PMI May P | 50.8 | 49.5 | ||

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Apr | 24.7B | 17.5B | 20.7B | 20.0B |

| 07:15 | EUR | France Manufacturing PMI May P | 46.1 | 46.1 | 45.6 | |

| 07:15 | EUR | France Services PMI May P | 52.8 | 54.3 | 54.6 | |

| 07:30 | EUR | Germany Manufacturing PMI May P | 42.9 | 45.2 | 44.5 | |

| 07:30 | EUR | Germany Services PMI May P | 57.8 | 55.5 | 56 | |

| 08:00 | EUR | Eurozone Manufacturing PMI May P | 44.6 | 46.2 | 45.8 | |

| 08:00 | EUR | Eurozone Services PMI May P | 55.9 | 55.6 | 56.2 | |

| 08:00 | EUR | Current Account (EUR) Mar | 31.2B | 20.2B | 24.3B | |

| 08:30 | GBP | Manufacturing PMI May P | 46.9 | 48.2 | 47.8 | |

| 08:30 | GBP | Services PMI May P | 55.1 | 55.5 | 55.9 | |

| 12:30 | CAD | Industrial Product Price M/M Apr | -0.20% | 0.20% | 0.10% | |

| 12:30 | CAD | Raw Material Price Index Apr | 2.90% | 0.70% | -1.70% | |

| 13:45 | USD | Manufacturing PMI May P | 50 | 50.2 | ||

| 13:45 | USD | Services PMI May P | 53.6 | 53.6 | ||

| 14:00 | USD | New Home Sales Apr | 665K | 683K |