Fed clearly delivered a hawkish hold overnight, signaling that two more rate hikes are underway. However, market participants appear skeptical about the Fed’s aggressive posture. According to Fed funds futures, markets are still projecting interest rate to peak at 5.25-5.00%, anticipating just one more 25-basis point rate hike in July. Moreover, there’s over 60% chance that rates will remain at this level by year-end.

This sentiment was also reflected in performance of major U.S. stock indices, which closed mixed. While NASDAQ and the S&P 500 managed to end the day with gains, 10-year yield declined and settled marginally below the 3.8% mark. Although Dollar has been recovering, its upside momentum appears limited against European majors and commodity currencies.

Meanwhile, Yen is taking the limelight from ECB rate decisions, experience steep selloff in Asia which triggered verbal intervention from the government. Euro also softens as markets await another ECB hike, but more importantly any forward guidance and the new economic projections. Australian Dollar is the strongest one as supported by strong job data, managing to shake off the impact of weaker than expected Chinese economic data.

Technically, Bitcoin’s break of 25242 cluster support (38.2% retracement of 15452 to 31011) is worth a note. The development argues that deeper correction is underway, with trend line support at around (now at 23230) as the first line of defense. Firm break there will pave the way to 61.8% retracement at 21393 or below. Any downside acceleration in Bitcoin could precede selloff in NASDAQ and overall stock markets. Let’s see how it goes.

Fed stood pat, but projects two more hikes this year

Fed keeps interest rate unchanged at 5.00-5.25% as widely expected, by unanimous vote. The new economic projections are rather hawkish, with 2023 median rate projections raised to 5.6% (two more 25bps hikes). GDP growth and core PCE inflation were revised higher while unemployment rate was revised lower.

FOMC leaves the door open for more tightening, as “the Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.:

Fed added that the assessments will take into account information including “readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”.

In the new economic projections, median federal funds rates for 2023 is raised from 5.1% to 5.6%, indicating two more 25bps hike. Median projections for 2024 was raised from 4.3% to 4.6%, for 2025 raised from 3.1% to 3.4%.

Regarding 2023 median economic projections, real GDP growth was raised sharply higher from 0.4% to 1.0%, unemployment rate sharply lower from 4.5% to 4.1%, core PCE inflation from 3.6% to 3.9%.

In the new dot plot, eleven members penciled in rate hikes to 5.50-5.75% this year, with four expecting rate at 5.25-5.50%, and only two at the current 5.00-5.25%.

Some reviews on FOMC:

Japan starts verbal intervention as USD/JPY surges pass 140

The steep decline in Japanese Yen in Asian session trigger verbal intervention by a top government official.

Chief Cabinet Secretary Hirokazu Matsuno said at a press conference,

“It is important for foreign exchange markets to move in a stable manner reflecting fundamentals, and excessive changes are undesirable.”

“There is no change to the government’s stance that we will closely monitor movements in the currency market and take appropriate steps if necessary,” he added.

USD/JPY surges pass 140.90 resistance to resume whole rally from 127.20 (Jan low). 61.8% retracement of 151.93 Further rise should be seen to 127.20 at 142.48. But the pair might start to feel heavy above there, as the government could step up rhetorics on intervention further.

Australia employment grew 75.6k in May, unemployment rate back to 3.6%

Australia employment rose 75.6k in May, well above expectation of 16.5k. Full time jobs grew 61.7k while part-time jobs grew 14.3k.

Unemployment rate dropped from 3.7% to 3.6%, below expectation of 3.7%. Participation rate rose from 66.7% to 66.9%. Monthly hours worked dropped -1.8% mom. Employment-to-population ratio rose 0.2% to 64.5%, a record high.

Bjorn Jarvis, ABS head of labour statistics, said: “Looking over the past two months, the employment increases average out to around 36,000 extra employed people each month. This is still around the average over the past year of 39,000 people a month.”

“Just before the start of the pandemic almost 13 million people were employed in Australia. In May 2023, this had risen to just over 14 million people.”

NZ GDP down -0.1% qoq in Q1, driven by inventory rundown and services exports

New Zealand GDP contracted -0.1% qoq in Q1 as expected. Primary industries fell -0.5%. Service industries fell -0.6%. Goods producing industries fell -0.4%.

StatsNZ noted, “The expenditure measure of GDP fell 0.2 percent this quarter. This decline was driven by run downs in inventories held by businesses, and a fall in exports of services.”

“A 2.4 percent increase in household consumption expenditure and 2.0 percent growth in investment in fixed assets partially offset the falls.”

China production and investment data show struggling private sector

China’s industrial production growth for May came in at 3.5% yoy, aligning with market expectations. However, a discrepancy was observed in growth rates of private and state-owned businesses. Industrial output from private businesses only managed to expand by 0.7% yoy, a stark contrast to the 4.4% yoy growth posted by state-owned enterprises.

Furthermore, China’s fixed asset investment rose 4.0% ytd yoy, a figure falling short of the anticipated 4.4% and a marked deceleration from 4.7% recorded during the first four months of 2023. Notably, private businesses experienced a dip in their fixed asset investment by -0.1% ytd yoy, while state-owned enterprises reported robust growth of 8.4%.

Meanwhile, retail sales failed to meet expectations, recording a rise of 12.7% yoy, lower expectation of 13.9% yoy increase.

In a separate but related development, People’s Bank of China announced a cut in rate on its one-year medium-term lending facility loans to financial institutions. The rate was lowered from 2.75% to 2.65%, following the bank’s decision to cut seven-day reverse repo and standing lending facility rate earlier this week.

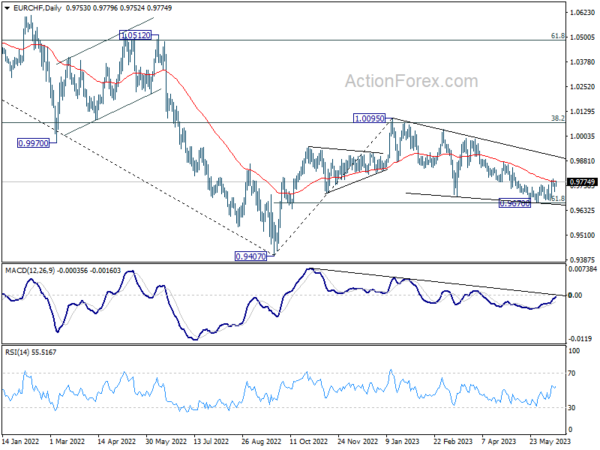

ECB to hike 25bps, can EUR/CHF extend rebound?

ECB is widely expected to raise interest rates today, and lift the main refinancing rate by 25bps to 4.00%, the highest level since 2001. The deposit rate, once negative, will correspondingly be raised to 3.50%. The bigger question is about forward guidance, but it’s unlikely for President Christine Lagarde to shift from the “data-dependent”, “meeting-by-meeting” approach for any future decisions. Nevertheless, the new economic projections could still reveal some hints on ECB’s thought.

Some previews on ECB:

As for market reactions, we’d be closely watching EUR/CHF. A short term bottom should be in place at 0.9670, after hitting 61.8% retracement of 0.9407 to 1.0095 at 0.9670. Sustained trading above 55 D EMA will add to the case that whole correction from 1.0095 has completed today. Such development will also bolster the case that whole rise from 0.9407 (2022 low) is ready to resume later in the year. But, that might require something hawkish from ECB as a trigger.

GBP/JPY Daily Outlook

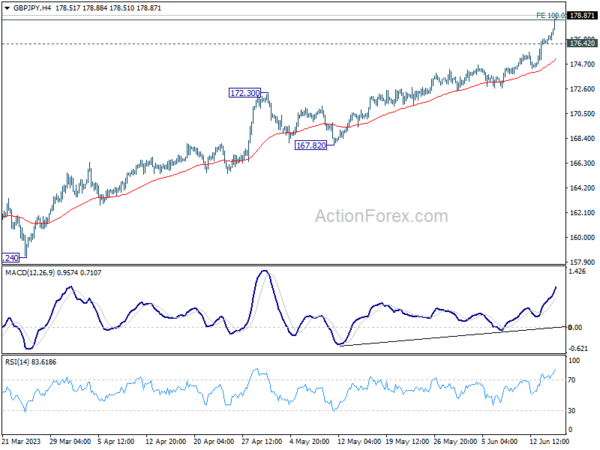

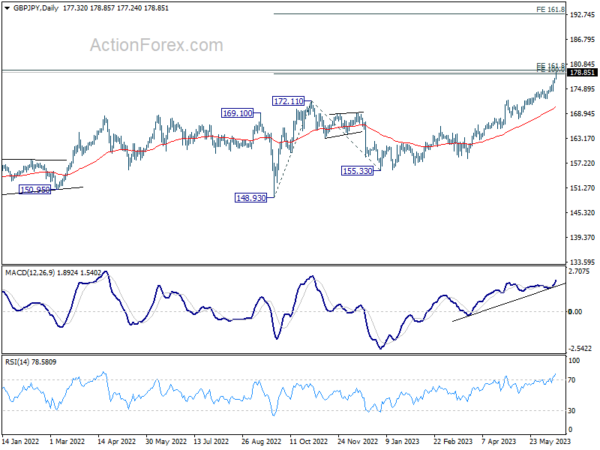

Daily Pivots: (S1) 176.76; (P) 177.09; (R1) 177.74; More…

GBP/JPY’s rally continues today and accelerates to as high as 178.83 so far. 100% projection of 148.93 to 172.11 from 155.33 at 178.51 is already met but there is no sign of topping yet. Intraday bias remains on the upside for the moment. Sustained break of 178.69 (as mentioned below) will carry larger bullish implication, and target 161.8% projection of 148.93 to 172.11 from 155.33 at 192.83 next. On the downside, though, break of 176.42 minor support will turn intraday bias neutral first.

In the bigger picture, up trend from 123.94 (2020 low) is extending. Next target will be 161.8% projection of 122.75 (2016 low) to 156.59 (2018 high) from 123.94 at 178.69. Sustained break there will pave the way to 195.86 long term resistance (2015 high). For now, medium term outlook will remain bullish as long as 172.11 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q1 | -0.10% | -0.10% | -0.60% | |

| 23:50 | JPY | Trade Balance (JPY) May | -0.78T | -0.78T | -1.02T | -1.04T |

| 23:50 | JPY | Machinery Orders M/M Apr | 5.50% | 3.00% | -3.90% | |

| 01:00 | AUD | Consumer Inflation Expectations Jun | 5.20% | 5.00% | ||

| 01:30 | AUD | Employment Change May | 75.9K | 16.5K | -4.3K | -4.0K |

| 01:30 | AUD | Unemployment Rate May | 3.60% | 3.70% | 3.70% | |

| 02:00 | CNY | Retail Sales Y/Y May | 12.70% | 13.90% | 18.40% | |

| 02:00 | CNY | Industrial Production Y/Y May | 3.50% | 3.50% | 5.60% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y May | 4.00% | 4.40% | 4.70% | |

| 04:30 | JPY | Tertiary Industry Index M/M Apr | 1.20% | 0.50% | -1.70% | |

| 06:30 | CHF | Producer and Import Prices M/M May | -0.30% | 0.10% | 0.20% | |

| 06:30 | CHF | Producer and Import Prices Y/Y May | -0.30% | -0.20% | 1.00% | |

| 07:00 | CHF | SECO Economic Forecasts | ||||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Apr | 5.7B | 17.0B | ||

| 12:15 | EUR | ECB Main Refinancing Rate | 4.00% | 3.75% | ||

| 12:30 | CAD | Manufacturing Sales M/M Apr | 0.70% | |||

| 12:30 | USD | Empire State Manufacturing Index Jun | -14.6 | -31.8 | ||

| 12:30 | USD | Retail Sales M/M May | 0.00% | 0.40% | ||

| 12:30 | USD | Retail Sales ex Autos M/M May | 0.10% | 0.40% | ||

| 12:30 | USD | Initial Jobless Claims (Jun 9) | 248K | 261K | ||

| 12:30 | USD | Import Price Index M/M May | -0.10% | 0.40% | ||

| 12:30 | USD | Philadelphia Fed Manufacturing Survey Jun | -12.7 | -10.4 | ||

| 12:45 | EUR | ECB Press Conference | ||||

| 13:15 | USD | Industrial Production M/M May | 0.10% | 0.50% | ||

| 13:15 | USD | Capacity Utilization May | 79.70% | 79.70% | ||

| 14:00 | USD | Business Inventories Apr | 0.20% | -0.10% | ||

| 14:30 | USD | Natural Gas Storage | 97B | 104B |