Sterling is under pronounced pressure in forex markets, trailing as the day’s worst performer. This wave of selloff initiated yesterday following BoE Governor Andrew Bailey’s articulation to the parliament, hinting that UK is “much nearer” to hitting the terminal interest rates. Further aggravating the downfall, a BoE survey rolled out today unveiled a stark decline in businesses’ on-year inflation expectations, thus spotlighting intensified speculation over the path of BoE’s tightening. Euro and Swiss Franc are also caught in this downward spiral, but slightly not as drastically as Sterling.

Contrary to European currencies, commodity currencies are witnessing a tepid recovery. But Australian and New Zealand Dollars remain unmoved from their positions as the weakest players of the week. Dollar retains its ground, drawing support from an encouraging jobless claims data release, while sustained buying momentum seems reserved primarily against European majors. Meanwhile, Yen is on recover, as part of near term consolidations.

Technically, GBP/JPY’s correction from 186.75 looks ready to extend lower with break of near term trend line support. Sustained trading below 183.51 support would target 55 D EMA (now at 182.16). A rebound might occur at this juncture, at least on the first attempt.

But look further ahead, there’s a tangible possibility that GBP/JPY’s decline from 186.75 represents a larger-scale correction to the uptrend from 155.33. The impending two weeks are critical, as employment and inflation data could essentially steer the dynamics, serving as precursors to BoE rate decision on September 21. Sustained break of 55 D EMA could pave the way to 176.29.

In Europe, at the time of writing, FTSE is up 0.03%. DAX is down -0.42%. CAC is down -0.18%. Germany 10-year yield is down -0.0398 at 2.617. Earlier in Asia, Nikkei dropped -0.75%. Hong Kong HSI fell -1.34%. China Shanghai SSE declined -1.13%. Singapore Strait Times rose 0.12%. Japan 10-year JGB yield rose 0.0021 to 0.658.

US jobless claims down to 216k, vs exp. 235k

US initial jobless claims fell -13k to 216k in the week ending September 2, better than expectation of 235k. Four-week moving average of initial claims dropped -8.5k to 229k.

Continuing claims dropped -40k to 1679k in the week ending August 26. Four-week moving average of continuing claims fell -1k to 1701.5k.

BoE Decision Maker Panel indicates easing inflation expectations

In the latest release of BoE Decision Maker Panel survey data for August, there is a tangible shift in business expectations pointing towards a decrease in both output price inflation and CPI inflation over the coming year, albeit with a lingering high degree of uncertainty.

According to the report, firms anticipate a fall in output price inflation over the next year, with the year-ahead output price inflation envisioned to be 4.9% in the three months leading up to August. This projection denotes a dip of -0.5% in comparison to the data gathered in the three months to July.

One-year ahead CPI inflation expectations lowered to 4.8% in August, a significant reduction from the 5.4% foreseen in July. Furthermore, when casting the net wider to encompass a three-year period, August data records a slight decrease to 3.2%, down by a marginal -0.1% from July’s expectations.

In the realm of wage growth, there is a persistence of the previously noted trend with expectations for the year ahead holding steady at 5.0% in August. Despite this, it is essential to note that the figure is overshadowed by the realized wage growth reported at a higher 6.9% for both single month data and the cumulative data for the three months to August.

However, amidst these optimistic projections, businesses seem to be grappling with considerable uncertainty. A substantial 53% of firms expressed that they are facing high to very high levels of uncertainty, a statistic that has remained unchanged from July.

BoJ Nakagawa sees positive developments, but loose monetary policy still needed

BoJ Board member Junko Nakagawa struck a cautiously optimistic tone today about the Japanese economy, citing “positive developments” and “signs of change in corporate price and wage-setting behavior.”

However, she was quick to note that the country has not yet achieved its price target “in a stable, sustainable fashion.”

Nakagawa noted that there are chances inflation could accelerate beyond initial expectations. However, she also warned of the potential for inflation to decelerate once the pass-through effects of higher costs begin to moderate.

The policymaker underscored the need for BoJ to maintain its ultra-loose monetary policy for the time being, citing the prevailing economic uncertainty.

RBA Lowe cautions against complacency in managing inflation risks

In his final public speech as RBA Governor, Philip Lowe stated that for inflation to average around 2.5%, wage increases should typically align with productivity growth plus an additional 2.5%. He sees it as a “reasonable benchmark”, even it’s “not a hard and fast rule”.

Lowe’s recent attention has been particularly focused on the risk associated with the current period of high inflation. Specifically, he warned of the peril that “wages growth and profits running ahead of the rate that is consistent with a sustainable return of inflation to target.”

In such a scenario, he cautioned, inflation would become “sticky,” necessitating “tighter monetary policy and more economic pain later on.”

Lowe acknowledged that recent data offers some level of comfort but emphasized the importance of remaining alert to these inflation risks. Rise in productivity growth, he noted, would be a welcome development as it would facilitate stronger growth in both nominal and real wages and profits.

China’s exports and imports continue to contract

In August, China reported a fourth consecutive monthly contraction in exports, dropping -8.8% yoy to USD 284.9B. However, the contraction was narrower than market’s expectation of a -9.5% yoy decline and an improvement from July’s -14.5% yoy fall.

Imports also shrank by -7.3% yoy to USD 216.5B, beating expectations of -9.4% yoy decline and improving from July’s -12.4% yoy drop. This marks a consistent trend of contracting imports every month in 2023 compared to the year-ago period.

Despite these figures beating expectations, trade surplus shrank from USD -80.6B to USD -68.4B, almost in line with expectation of USD -60.0B.

While the narrowing contraction in exports and imports could be seen as a mildly positive development, it doesn’t significantly alter the broader narrative of economic cooling in China.

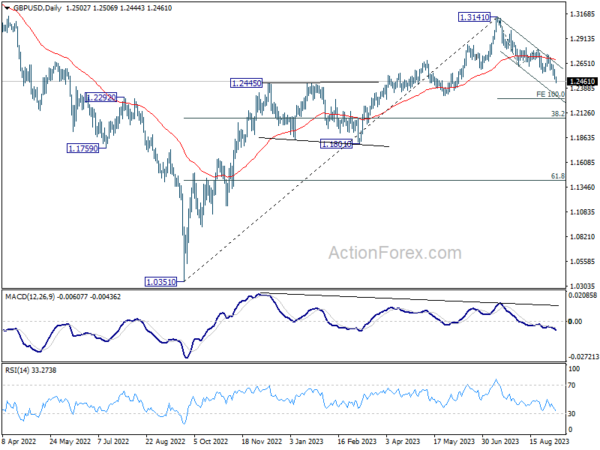

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2463; (P) 1.2526; (R1) 1.2569; More…

GBP/USD’s decline continues today and intraday bias stays on the downside. Current fall from 1.3141 should target 100% projection of 1.3141 to 1.2618 from 1.2799 at 1.2276. On the upside, above 1.2546 minor resistance will turn intraday bias neutral and bring consolidations. But risk will stay on the downside as long as 1.2799 resistance holds, in case of recovery.

In the bigger picture, fall from 1.3141 medium term top is seen as a correction to up trend from 1.0351 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.0351 to 1.3141 at 1.2075. Strong support would be seen there to bring rebound on first attempt. But outlook will be neutral at best as long as 1.3141 resistance holds, and consolidation from there is set to extend, until further development.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Manufacturing Sales Q2 | 0.20% | -2.80% | -2.50% | |

| 01:30 | AUD | Trade Balance (AUD) Jul | 8.04B | 10.05B | 11.32B | 10.27B |

| 03:00 | CNY | Trade Balance (USD) Aug | 68.4B | 68.0B | 80.6B | |

| 03:00 | CNY | Trade Balance (CNY) Aug | 488B | 494B | 576B | |

| 05:00 | JPY | Leading Economic Index Jul P | 107.6 | 107.9 | 109.1 | |

| 05:45 | CHF | Unemployment Rate Aug | 2.10% | 2.10% | 2.10% | |

| 06:00 | EUR | Germany Industrial Production M/M Jul | -0.80% | -0.40% | -1.50% | |

| 06:45 | EUR | France Trade Balance (EUR) Jul | -8.1B | -6.8B | -6.7B | -6.8B |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Aug | 694B | 698B | ||

| 08:00 | EUR | Italy Retail Sales M/M Jul | 0.40% | 0.20% | -0.20% | |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 | 0.10% | 0.30% | 0.30% | |

| 12:30 | CAD | Building Permits M/M Jul | -1.50% | 7.50% | 6.10% | |

| 12:30 | USD | Initial Jobless Claims (Sep 1) | 216K | 235K | 228K | |

| 12:30 | USD | Nonfarm Productivity Q2 | 3.50% | 3.50% | 3.70% | |

| 12:30 | USD | Unit Labor Costs Q2 | 2.20% | 1.80% | 1.60% | |

| 14:00 | CAD | Ivey PMI Aug | 49.2 | 48.6 | ||

| 14:30 | USD | Natural Gas Storage | 38B | 32B | ||

| 15:00 | USD | Crude Oil Inventories | -1.8M | -10.6M |