Japanese Yen registered notable slump today, recording a new low for the year against Dollar, a move driven largely by ascending benchmark yields in the US and European markets. Meanwhile, sentiment in risk markets appears to be on the upswing, partly propelled by encouraging economic data emerging from China, fostering an environment where commodity currencies are experiencing a lift, with Australian Dollar taking the forefront.

Euro, on the other hand, managed to slow its descent, buoyed by remarks from ECB officials who sought to downplay the prospects of rate cuts in the coming year. The comments stimulated a recovery in Euro, particularly against Sterling and Swiss franc. While Dollar is making efforts to strengthen up, traders remain cautious, seemingly unwilling to stake large bets ahead of Fed’s rate decisions slated for next week.

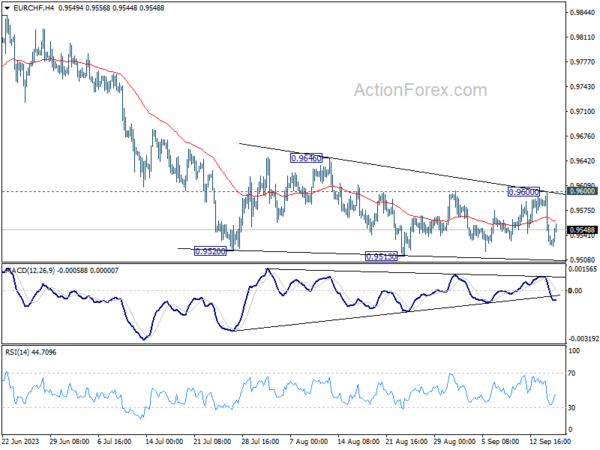

Technically, EUR/CHF recovered well ahead of 0.9513 low, and the developments argues that post-ECB selling might have past its climax. Nevertheless, outlook will stay bearish as long as 0.9600 resistance holds. Break of 0.9513 is in favor sooner or later to resume larger decline from 1.0095.

In Europe, at the time of writing, FTSE is up 0.68%. DAX is up 0.91%. CAC is up 1.43%. Germany 10-year yield is up 0.0649 at 2.661. Earlier in Asia, Nikkei rose 1.10%. Hong Kong HSI rose 0.75%. China Shanghai SSE dropped -0.28%. Singapore Strait Times rose 0.96%. Japan 10-year JGB yield rose 0.0013 to 0.710.

ECB officials dismiss predictions of early rate cuts

In a chorus of comments, ECB officias pushed back on market expectations on a rate cut next year.

During a press conference today, ECB President Christine Lagarde emphasized, “We have not decided, discussed or even pronounced cuts.” She underlined that the institution’s strategy will pivot according to incoming economic data and highlighted that the levels and duration of the existing high rates are designed to foster a return to the inflation target of 2%. The focus is on evolving economic indicators, reviewed in a meeting-by-meeting approach, hinting at the bank’s readiness to adapt in the face of changing economic contexts.

Supporting Lagarde’s stance, ECB Vice President Luis de Guindos conveyed skepticism regarding market pricing that forecast a rate cut in June 2024. Speaking to Spanish radio station Cadena Cope, de Guindos mentioned that the markets often rely on speculative “hypotheses that sometimes do not come true.” He viewed such forecasts as gambles, affirming that they might not materialize. “It is a bet, it may be right and it may not be right,” De Guindos added, underlining the uncertain nature of market forecasts.

Martins Kazaks, a member of ECB’s Governing Council, expressed comfort with the current rate levels, showing optimism regarding achieving the 2% inflation goal by the second half of 2025. He maintained that the bank remains open to the possibility of another rate increase if substantiated by forthcoming data.

Kazaks was assertive in dismissing speculations about a rate cut in April, stating such conjectures are “inconsistent with our macro scenario.” He reiterated the bank’s firm stance to “stay in restrictive territory for as long as necessary to get inflation to 2%.”

UK public anticipates elevated inflation and ascending interest rates, BoE Survey Reveals

Bank of England/Ipsos Inflation Attitudes Survey for August has shed light on how the public perceives inflation trends and the likely moves by the central bank.

Interestingly, public’s perception of current inflation rate seems to have moderated, with a median estimate of 8.6%. This is a full percentage point decline from 9.6% recorded in May. This suggests that the public may feel the worst of inflationary surge has passed.

However, expectations for inflation over the short to medium term are slightly more elevated. The median expectation for inflation over the next year stood at 3.6%, a modest uptick from 3.5% three months ago. Looking a bit further out, the 12-month period after next, expectations rose to 2.8% from 2.6% in the prior survey.

Regarding BoE’s policy path, a significant 63% anticipate interest rate hike over the next year, marking an increase from 57% in May. Meanwhile, those expecting rates to remain stable accounted for 19%, a slight decrease from prior reading of 20%.

Eurozone goods expects down -2.7 yoy, imports fell -18.2% yoy

Eurozone exports of goods to the rest of the world dropped -2.7% yoy to EUR 227.8B in Jul. Imports fell -18.2% yoy to EUR 221.3B. Eurozone recorded EUR 6.5B trade surplus. Intra-Eurozone trade fell -7.9% yoy to EUR 211.8B.

In seasonally adjusted term, exports fell -1.7% mom to EUR 232.6B. Imports rose 0.7% mom to EUR 229.7B. Trade surplus narrowed from EUR 8.6B to EUR 2.9B, smaller than expectation of EUR 13.5B. Intra-Eurozone trade fell slightly from EUR 219.3B to EUR 218.7B.

NZ BNZ PMI falls to 46.1, manufacturing activity slumps to multi-year low

New Zealand’s manufacturing sector experienced a further slowdown in August, with BusinessNZ Performance of Manufacturing Index falling slightly from 46.6 in July to 46.1. This marks the lowest rate of activity for a non-pandemic affected month since June 2009. Furthermore, the latest PMI data sits significantly below its long-term average of 52.9.

A closer look at the August data reveals: Production observed a modest increase, moving from 43.1 to 43.9. Employment metrics improved, rising from 44.8 to 47.7. New orders experienced a minor uptick, growing from 45.5 to 46.6. Finished stock levels retreated slightly from 52.7 to 52.1. Deliveries, however, showed more promise, escalating from 42.9 to 47.7.

Despite the grim headline figure, it is noteworthy that there was a slight decrease in the proportion of negative comments, standing at 66.7%, a marginal relief compared to July’s 72%. However, the level of pessimism mirrored that of May, maintaining the same rate of 66.7%. The pervasive market uncertainty stemming both from domestic and offshore influences, coupled with rising costs and weather-impacted demand, continued to be highlighted as primary drivers for the negative sentiment pervading the industry.

BNZ Senior Economist Craig Ebert expressed concern over the PMI’s latest results, noting that while the headline figure had seen much lower points during previous recessions, the composition of August figures brought little consolation. Ebert pinpointed new orders and production as substantial drags on the performance, trailing behind the standard levels by 8.0 and 9.5 points respectively.

China’s Economic Data Surpasses Forecasts, but Challenges Persist

China’s economic indicators for August showcased a mixed picture but, on the whole, exceeded analyst expectations in key areas. Industrial production exhibited growth of 4.5% yoy, edging out forecast of 4.0% yoy. Retail sales also outperformed predictions, registering 4.6% yoy increase compared to anticipated 3.0% yoy. However, fixed asset investment lagged slightly, presenting a 3.2% rise year-to-date year-on-year, just shy of the 3.3% expected.

The official communique from the NBS acknowledged the data as revealing a “marginal improvement.” Emphasizing the resilience and progress of the national economy, the statement underscored that “high-quality development” was on track and the accumulation of positive factors was evident. However, it also stressed caution. While the recovery is in motion, the bureau pointed out that there are still several “unstable and uncertain factors in the external environment” that China has to contend with.

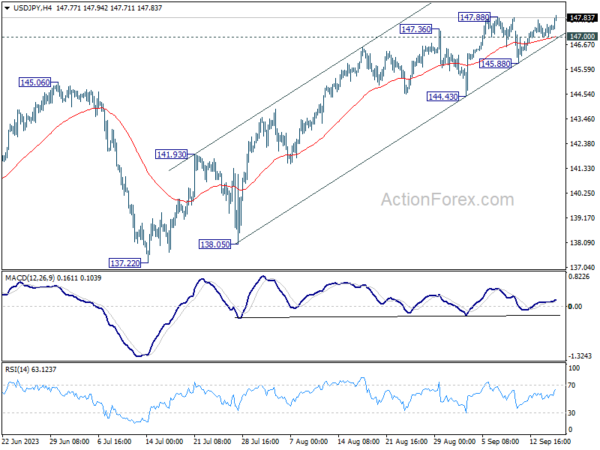

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 147.14; (P) 147.35; (R1) 147.69; More…

USD/JPY’s breach of 147.88 resistance argues that rise from 127.20 is resuming. Intraday bias is back on the upside. Sustained trading above 147.88 will pave the way to retest 151.93 high. On the downside, below 147.00 minor support will turn intraday bias neutral again first. But outlook will remain bullish as long as 145.88 support holds.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by break of 137.22 support will indicate that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Aug | 46.1 | 46.3 | 46.6 | |

| 02:00 | CNY | Industrial Production Y/Y Aug | 4.50% | 4.00% | 3.70% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Aug | 3.20% | 3.30% | 3.40% | |

| 02:00 | CNY | Retail Sales Y/Y Aug | 4.60% | 3.00% | 2.50% | |

| 04:30 | JPY | Tertiary Industry Index M/M Jul | 0.90% | 0.20% | -0.40% | -0.70% |

| 08:30 | GBP | Consumer Inflation Expectations | 3.60% | 3.50% | ||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Jul | 2.9B | 13.5B | 12.5B | 8.6B |

| 12:30 | CAD | Manufacturing Sales M/M Jul | 1.60% | 0.70% | -1.70% | |

| 12:30 | USD | Empire State Manufacturing Sep | 1.9 | -10 | -19 | |

| 12:30 | USD | Import Price Index M/M Aug | 0.50% | 0.30% | 0.40% | |

| 13:15 | USD | Industrial Production M/M Aug | 0.20% | 1.00% | ||

| 13:15 | USD | Capacity Utilization Aug | 79.30% | 79.30% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Sep P | 69.5 | 69.5 |