Euro is trading as the worst performer for the today so far, but there is no extended selloff after ECB’s decision to hold interest rates unchanged. President Christine Lagarde’s press conference reiterated that current rates should be bring inflation down to target in a timely manner if maintained for sufficiently long time, which is data dependent. Geopolitical tensions posts downside risks to growth and upside risks to inflation.

Following Euro, Canadian Dollar is the second worst, and then Swiss Franc. Dollar is also softer as it’s paring yesterday’s gains. There is a brief dip in USD/JPY but the scale doesn’t look like Japan’s intervention. Meanwhile, the greenback showed no special reaction to stronger than expected US Q3 GDP data. Aussie and Kiwi are mildly higher with Sterling.

As for the week, Aussie is currently the strongest one, after volatility from yesterday’s CPI data and today’s comments by RBA governor. Dollar is the second strongest, and has the potential to overpower if rise in treasury yields and selloff in stocks extend. Canadian Dollar is the worst performer, followed by Swiss Franc and Sterling. Euro and Yen are mixed.

Technically, WTI crude oil’s recovery from yesterday’s low of 83.05. Rejection by near term channel resistance as well as 55 4H EMA affirms the near term bearish case. That is, corrective recovery from 81.77 has completed at 91.07, fall from 95.50 is probably ready to resume. break of 81.77 will bring deeper fall to 100% projection of 95.50 to 81.77 from 91.07 at 77.34, which is close to 77.95 structural support.

In Europe, at the time of writing, FTSE is down -0.49%. DAX is down -0.85%. CAC is down -0.22%. Germany 10-year yield is down -0.035 at 2.849. Earlier in Asia, Nikkei dropped -2.14%. Hong Kong HSI dropped -0.24%. China Shanghai SSE rose 0.48%. Singapore Strait Times dropped -0.24%. Japan 10-year JGB yield rose 0.0246 to 0.885.

ECB keeps interest rates unchanged as widely expected

ECB keeps interest rates unchanged as widely expected. The main refinancing, marginal lending and deposit rates are held at 4.50%, 4.75%, and 4.00% respectively.

The central bank maintains that key interest are “at levels that, maintained for a sufficiently long duration, will make a substantial contribution to this goal.” Future decisions will ensure the policy rates are set at sufficiently restrictive levels for “as long as necessary”. Nevertheless, ECB still “stands ready” to adjust all of its instruments.

ECB’s Lagarde: Geopolitical tensions posts downside risk to growth, upside to inflation

At the post-meeting press conference, ECB President Christine Lagarde noted that risk to growth are “tilted to the downside”, with geopolitical tensions potentially shaking confidence among businesses and households.

On the other hand, growth could be higher if resilient labour market continue its course and real incomes rise. The world economy could grow “more strongly” than expected.

Lagarde also flagged potential upward risks on inflation from sources like escalating energy and food prices. She underscored the role geopolitical tensions might play in boosting short-term energy prices, while also drawing attention to the repercussions of the climate crisis, which could lead to unexpected hikes in food prices.

However, she also acknowledged scenarios where inflationary pressures could diminish, particularly if there’s a decline in demand. This could be due to factors such as a more pronounced impact of monetary policy or external economic challenges fueled by heightened geopolitical risks.

US GDP exceeds expectations with 4.9% growth in Q3

US economy delivered a strong performance in Q3, with GDP growth registering at an annualized rate of 4.9%, surpassing the anticipated 4.3% and showing a marked improvement from the 2.1% seen in Q2.

This robust growth in real GDP was driven by a series of factors. Notably, there were marked increases in areas such as consumer spending, private inventory investment, exports, both state and local government spending, federal government spending, and residential fixed investment.

However, these gains were somewhat tempered by a decline in nonresidential fixed investment. Additionally, it’s essential to note that imports, which act as a deduction in GDP calculation, saw an increase during this period.

US initial jobless claims rose to 210k, vs expectation 202k

US initial jobless claims rose 10k to 210k in the week ending October 21, above expectation of 202k. Four-week moving average of initial claims rose 1.25k to 207.5k.

Continuing claims rose 63k to 1790k in the week ending October 14. Four-week moving average of continuing claims rose 31k to 1724k.

RBA’s Bullock undecided on rate hike following CPI surprise

In the Senate Economics Committee session today, RBA Governor Michele Bullock indicated that the bank was not entirely caught off guard by the stronger than expected CPI data released yesterday. She refrained from offering a definitive direction for the bank’s next steps

The Q3 and September CPI data, which Bullock admitted “came out a little higher” than the projections in the August Statement on Monetary Policy, still aligned with the bank’s expectations. She clarified, “The numbers were pretty much where we thought it would come out”.

When queried on the prospect of another rate hike in the forthcoming meeting, Bullock responded, “We’re still analyzing the numbers at the moment. I wouldn’t like to say more or less likely, we’re still looking at it.”

Bullock reiterated the bank’s position, stating, “We’ve always said we have a low tolerance” on inflation surprises. She added, “We are wary and we don’t know if the job has been done yet.”

Looking forward, Bullock hinted at imminent changes to their economic projections, announcing, “We will be releasing a new set of forecasts after the board meeting.” Moreover, she alluded to the significance of these revisions by stating, “There is going to be a change to our forecasts. We have to look at whether or not it’s material enough to change our views on monetary policy.”

EUR/USD Mid-Day Outlook

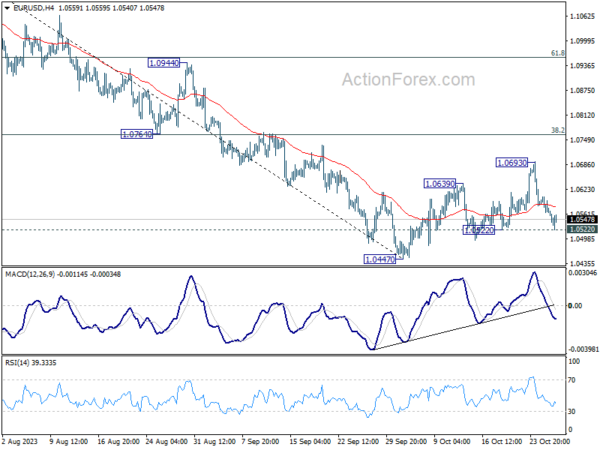

Daily Pivots: (S1) 1.0552; (P) 1.0580; (R1) 1.0593; More…

Intraday bias in EUR/USD remains neutral for the moment. On the downside, break of 1.0522 support will confirm rejection by 55 D EMA, and retain near term bearishness. Intraday bias will be back on the downside for 1.0447. Break there will resume larger fall from 1.1274. On the other, strong bounce from current level, followed by break above 1.0693, rebound from 1.0447 to 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763).

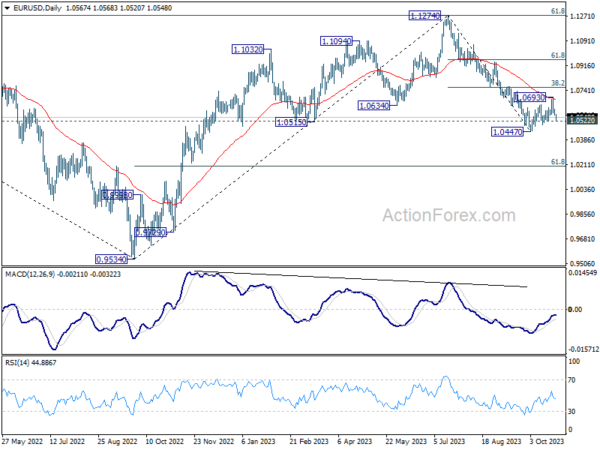

In the bigger picture, fall from 1.1274 medium term top could still be a correction to rise from 0.9534 (2022 low). But chance of a complete trend reversal is rising. In either case, current fall should target 61.8% retracement of 0.9534 to 1.1274 at 1.0199 next. For now, risk will stay on the downside as long as 55 D EMA (now at 1.0684) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Sep | 2.10% | 2.00% | 2.10% | |

| 00:30 | AUD | Import Price Index Q/Q Q3 | 0.80% | 0.20% | -0.80% | |

| 12:15 | EUR | ECB Main Refinancing Rate | 4.50% | 4.50% | 4.50% | |

| 12:30 | USD | Initial Jobless Claims (Oct 20) | 210K | 202K | 198K | 200K |

| 12:30 | USD | GDP Annualized Q3 P | 4.90% | 4.30% | 2.10% | |

| 12:30 | USD | GDP Price Index Q3 P | 3.50% | 2.50% | 1.70% | |

| 12:30 | USD | Goods Trade Balance (USD) Sep P | -85.8B | -85.5B | -84.6B | |

| 12:30 | USD | Wholesale Inventories Sep P | 0.00% | 0.10% | -0.10% | |

| 12:30 | USD | Durable Goods Orders Sep | 4.70% | 1.00% | 0.10% | |

| 12:30 | USD | Durable Goods Orders ex Transport Sep | 0.50% | 0.20% | 0.40% | |

| 14:00 | USD | Pending Home Sales M/M Sep | 1.10% | -7.10% | ||

| 14:30 | USD | Natural Gas Storage | 82B | 97B |