Dollar is extending its near term recovery in the early US session. The latest jobless claims data came in better than expected, offering some support to the greenback. However, this was somewhat offset by weaker-than-anticipated durable goods orders. Overall, the current upswing in may not be entirely rooted in these economic releases.

The recovery appears more likely attributed to traders taking profits on short positions ahead of Thanksgiving holiday, a period typically marked by reduced trading activity. This context suggests that the greenback’s recovery could be part of a broader consolidation phase, with a more definitive trend likely to emerge only after the release of crucial economic data next week, including PCE inflation and ISM Manufacturing figures.

In the wider currency market, Australian Dollar is trailing Dollar as the second strongest performer of the day, followed by Swiss Franc. In contrast, Japanese Yen is reversing its recent gains and currently stands as the day’s weakest currency. Similarly, New Zealand Dollar is positioned as the second weakest, and Canadian Dollar follows as the third. Euro and Sterling are exhibiting mixed performance.

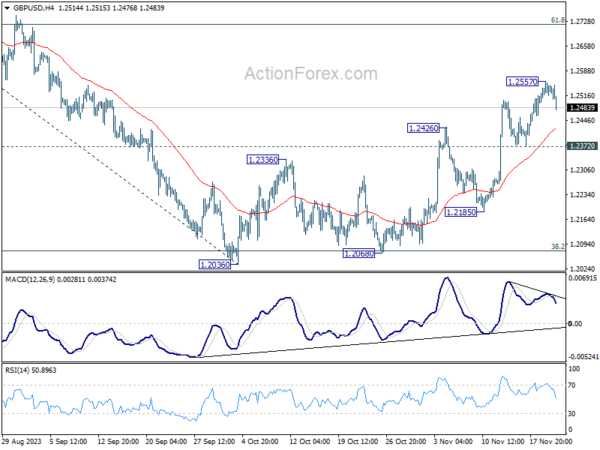

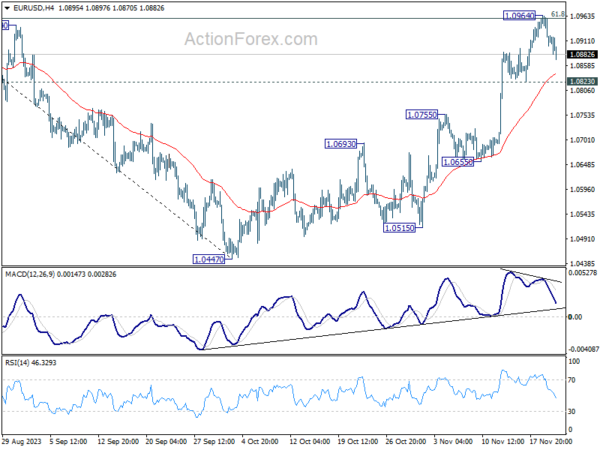

Technically, certain key levels in various Dollar pairs merit close attention for short-term movements. These levels include 1.0823 support in EUR/USD, 1.2372 support in GBP/USD, 0.6451 support in AUD/USD, and 0.8952 resistance in USD/CHF. As long as these levels are maintained, the risk remains tilted towards the downside for Dollar, and resurgence in selling pressure could occur at any time.

In Europe, at the time of writing, FTSE is down -0.12%. DAX is up 0.50%. CAC is up 0.45%. Germany 10-year yield is down -0.038 at 2.533. Earlier in Asia, Nikkei rose 0.29%. Hong Kong HSI closed flat. China Shanghai SSE fell -0.79%. Singapore Strait Times rose 0.60%. Japan 10-year JGB yield rose 0.0320 to 0.731.

US durable goods orders down -5.4% mom, driven by transportation equipment

US durable goods orders fell -5.4% mom to USD 279.4B in October, worse than expectation of -3.2% mom. Headline orders were also down three of the last four months. Ex-transport orders was rose 0.0% mom to 187.4B. Ex-defense orders fell -6.7% mom to 261.6B. Transportation equipment also down three of the last four months, drove the decrease by -14.8% mom to USD 92.1B.

US initial jobless claims falls back to 209k, vs expectation 225k

US initial jobless claims fell -24k to 209k in the week ending November 18, better than expectation of 225k. Four-week moving average of initial claims fell -750 to 220k.

Continuing claims fell -22k to 1840 in the week ending November 11. Four-week moving average of continuing claims rose 14k to 1837k, highest since December 18, 2021.

RBA’s Bullock: Inflation increasingly domestic and lengthy to control

RBA Governor Michele Bullock, in a speech, emphasized the changing nature of the inflation challenge facing Australia, noting its increasing shift towards being “homegrown and demand driven.” This distinction is crucial as it significantly influences the central bank’s policy response.

Bullock differentiated between inflation driven by global supply disruptions, over which monetary policy has limited influence, and inflation stemming from domestic demand exceeding the economy’s potential. In the case of the latter, she argues, “a more substantial monetary policy tightening is the right response.”

The Governor also highlighted three key indicators supporting the demand-driven nature of current inflation: Firstly, the broad-based nature of inflation across various sectors; secondly, the underpinning of inflation by domestic demand, particularly in services; and thirdly, the continued limited spare capacity in the economy, as evident in high rates of labor utilization.

Regarding the timeframe for bringing inflation back to the target range, Bullock suggested that while supply-side issues eased relatively quickly, reducing inflation from 8% to 5.5% within three quarters, the demand-driven component would take longer to address. She projected that it might take another two years for inflation to fall below 3%.

Australia’s Westpac leading index fell to -0.40%, indicates prolonged low growth

Westpac Leading Index in Australia has shown a marginal decline from -0.38% to -0.40% in October, underscoring the ongoing trend of subdued economic growth. This marks the fifteenth consecutive month where the index’s growth rate has been below zero, signaling that the Australian economy is likely to continue experiencing limited growth into 2024.

Despite this, the overall growth rate can still be considered moderately positive, especially when viewed against current annual population growth rate of approximately 2.4%. Both Westpac and RBA project the economy’s actual growth to be within the range of 1-2% for both this and the coming year, a rate that lags behind potential trend growth.

A key concern for RBA is the adequacy of this sluggish growth in achieving inflation target of 2-3% within a reasonable timeframe. As highlighted in RBA’s recent November meeting minutes, Board maintains a strict stance of “low tolerance” against any further unexpected rises in inflation or delays in returning to the target range. This stance indicates that RBA’s policy meetings in the upcoming year will be crucial and “live”.

Japan’s economic outlook downgraded amid domestic demand weakness

The Japanese government has revised its assessment of the nation’s economy, marking the first downgrade in ten months. This change in outlook indicates pausing in part” in Japan’s moderate recovery, primarily attributed to weakening domestic demand. This shift represents a departure from the previously consistent description of the economy as “recovering at a moderate pace” over the past six months.

A critical aspect of this revised assessment is the downgraded view on business investment, which has been adjusted for the first time in nearly two years. The government’s monthly report cites the slowing of global growth, particularly in China, as a significant factor contributing to the “pausing” in pick-up in business investment.

Despite this downgrade, the Cabinet Office maintained its assessment of other economic components. Private consumption is described as “picking up,” driven by a continued recovery in service demand. The report also highlights a positive trend in both industrial production and exports, which are showing signs of “picking up”.

The government’s report, however, underscores several downside risks to the Japanese economy. These include the impacts of aggressive interest rate hikes in other countries and the economic slowdown in China. Additionally, the government emphasizes the need for full attention to price increases, developments in the Middle East, and fluctuations in financial and capital markets.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0885; (P) 1.0926; (R1) 1.0951; More…

Intraday bias in EUR/USD remains neutral for consolidation below 1.0964 temporary top. While deeper retreat could be seen, downside should be contained by 1.0823 support to bring another rally. On the upside, sustained trading above 1.0958 will pave the way to retest 1.1274 high. However, firm break of 1.0823 will indicate short term topping, and turn bias back to the downside for deeper decline.

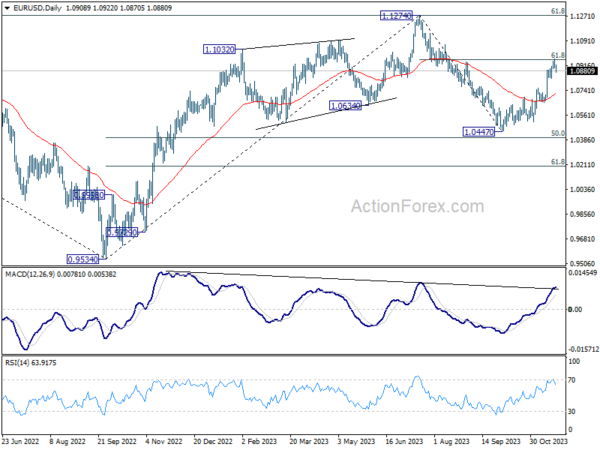

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is tentatively seen as the second leg. Hence while further rally could be seen, upside should be limited by 1.1274 to bring the third leg of the pattern.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | AUD | Westpac Leading Index M/M Oct | 0.00% | 0.10% | ||

| 13:30 | USD | Initial Jobless Claims (Nov 17) | 209K | 225K | 231K | 233K |

| 13:30 | USD | Durable Goods Orders Oct | -5.40% | -3.20% | 4.60% | |

| 13:30 | USD | Durable Goods Orders ex-Transport Oct | 0.00% | 0.20% | 0.40% | |

| 15:00 | USD | Michigan Consumer Sentiment Index Nov F | 61.1 | 60.4 | ||

| 15:00 | EUR | Eurozone Consumer Confidence Nov P | -18 | -18 | ||

| 15:30 | USD | Crude Oil Inventories | 0.9M | 3.6M | ||

| 17:00 | USD | Natural Gas Storage | 1B | 60B |