Asian markets highlights sharp divergence in trends today. Nikkei surged to new 34-year high, buoyed by last week’s record closes in US and bolstered by expectations that BoJ will maintain its negative interest rate policy in the this week’s meeting. Japanese stock market is also riding on the optimism that BoJ is not in a rush to tighten its monetary policy, with the earliest rate hike not expected until April. However, this April decision on rate hikes will still hinge on new economic projections due tomorrow and the results of upcoming spring wage negotiations.

In stark contrast, stocks in Hong Kong and China extended their downtrend, with significant plunges of more than -2% and -1%, respectively. Investors in these markets are showing dissatisfaction with the Chinese government’s lack of substantial stimulus to boost the sluggish economy and counter deflationary pressures. Additionally, there appears to be an emerging sentiment among heavyweight investors favoring investment “anywhere-but-China.”

In the currency markets, most major pairs and crosses are currently trading within Friday’s range. Australian Dollar is leading the decline among commodity currencies, while Swiss Franc is also under pressure. Sterling stands out as the strongest at this point, followed closely by Yen and Euro, with Dollar showing mixed performance. Trading might remain subdued today due to a near-empty economic calendar, but several important events loom on the horizon. These include BoJ, BoC, and ECB meetings, as well as crucial economic data like US GDP and PCE inflation, in addition to global PMI data.

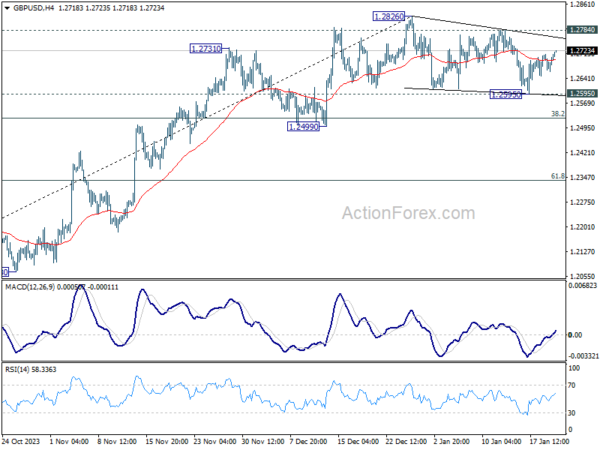

Technically, GBP/USD’s rebound from 1.2595 is picking up some momentum today. It’s plausible that consolidation pattern from 1.2826 has completed with three waves down to 1.2595. Firm break of 1.2784 will argue that larger up trend is ready to resume through 1.2826 high. This is a development to watch in the next two to three days, with UK PMIs on Wednesday a possible trigger.

In Asia, at the time of writing, Nikkei is up 1.59%. Hong Kong HSI is down -2.30%. China Shanghai SSE is down -1.34%. Singapore Strait Times is up 0.20%. Japan 10-year JGB yield is down -0.0107 at 0.658.

PBoC holds 1-yr and 5-yr LPR steady

People’s Bank of China announced today that it would maintain one-year loan prime rate at 3.45%, a level unchanged since August last year. Similarly, five-year rate, critical for mortgage financing, remains steady at 4.2%, consistent since its last reduction in June. This decision follows PBoC’s unexpected move last week to keep its medium-term lending facility rate stable.

PBoC’s decision to hold rates steady comes amid a sluggish economic environment in China, coupled with increasing deflationary pressures. Despite these challenges, the central bank appears reluctant to employ interest rate reductions as a tool to stimulate the economy, primarily due to concerns over the depreciating Yuan. PBoC might continue to avoid further rate cuts until Yuan regains some stability, to prevent exacerbating the currency’s depreciation.

USD/CNH’s break of 55 D EMA last week suggests that the corrective pull back from 7.3679 has completed at 7.0870 already. That came after drawing support from 38.2% retracement of 6.6971 to 7.3679 at 7.1117. Further rise is now mildly in favor as long as 7.1589 minor support holds, back to retest 7.3679 high.

BoJ, BoC and ECB to stand pat; Lots of top tier data too

BoJ, BoC and ECB are all expected to keep monetary policy unchanged this week. It’s unlikely for BoJ Governor Kazuo Ueda to drop any hints on negative interest rate exit for now. Ueda would reserve that card for March meeting, if BoJ is to raise interest rate eventually in April. Yet, some subtle hints could be seen in the new quarterly economic projections. There were reports about BoJ lowering core inflation forecast of fiscal 2024 due to falling oil prices. But instead, the key is on the inflation forecast through fiscal 2026. The chance of a hike could increase notably if BoJ sees core inflation staying around 2% target through this horizon.

As for BoC, attention will be on how much longer will it keep interest rate at current level of 5.00%. The central bank will likely push back against the idea that rate cuts are coming soon, emphasizing that inflation remains sticky. A recent Reuters poll indicated mixed expectations: while 22 of 34 respondents anticipated rate cuts to commence in June or later, 12 predicted an initial cut in April. The survey’s median suggests a cumulative 100 basis points reduction in rates to 4.00% this year..

ECB’s communications are not expected to deviate from the chorus of comments out of Davos last week. President Christine Lagarde would continue to push back on speculation of an early rate cut. The question is whether should would explicitly noted summer is the likely timing for the start of policy loosening. March is the more likely meeting for any substantial shift in tone, given that new economic projections will then be available. A Reuters poll showed a divide in expectations: 55% of respondents predicted no easing until at least the second half of the year, while a significant minority of 45% anticipated a reduction in borrowing costs as early as June.

In terms of economic data, US Q4 GDP and December PCE inflation will be major focal points for the Dollar. Other data with the potential to impact respective currencies include Germany’s Ifo business climate, New Zealand’s CPI, and Japan’s Tokyo CPI. Additionally, PMI data from US, Eurozone, UK, Japan, and Australia will be closely scrutinized for insights into global economic health and potential market movements.

Here are some highlights for the week:

- Monday: US leading index.

- Tuesday; New Zealand BNZ services; Australia NAB business confidence; BoJ rate decision; UK public sector net borrowing; Canada new housing price index; Eurozone consumer confidence.

- Wednesday: New Zealand CPI; Australia PMIs; Japan trade balance, PMI manufacturing; Eurozone PMIs; UK PMIs; BoC rate decision; US PMIs.

- Thursday: Germany Ifo business climate; ECB rate decision; US GDP, jobless claims, durable goods orders, trade balance, new homes sales.

- Friday: Japan Tokyo CPI, SPPI, BoJ minutes; UK Gfk consumer sentiment; Germany Gfk consumer sentiment; Eurozone M3 money supply; US personal income and spending, PCE inflation, pending home sales.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6575; (P) 0.6588; (R1) 0.6611; More…

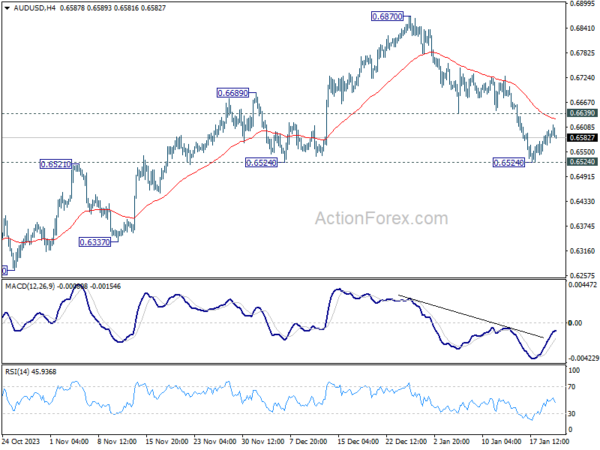

Intraday bias in AUD/USD remains neutral at this point. Some more consolidations could be seen above 0.6524 temporary low. But further decline is expected as long as 0.6639 support turned resistance holds. Firm break of 0.6524 support will argue that whole rebound from 0.6269 has completed, and bring deeper fall to this support.

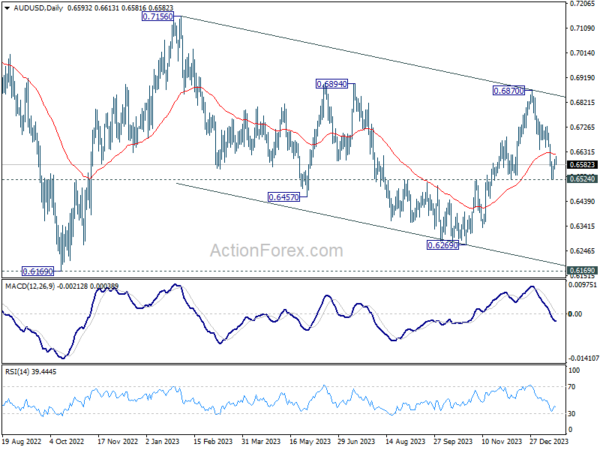

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 15:00 | USD | Leading Index M/M Dec | -0.30% | -0.50% |