Dollar weakens slightly in early US session, as dragged down by disappointing ADP private sector job data. Despite this, the downturn is contained, as market participants remain cautious ahead of FOMC rate decision later in the day. While no changes in interest rates are anticipated, considerable attention is centered on Fed Chair Jerome Powell’s commentary. A prevalent risk is that if Powell’s tone is not sufficiently assertive on inflation, it might be construed as a dovish inclination, and with markets responding correspondingly.

Other major currencies are displaying a lack of significant movement too, with most pairs and crosses hovering within yesterday’s range. Euro is showing resilience against Germany’s lower-than-expected CPI data and dovish remarks from ECB Vice-President. On the other hand, Canadian Dollar is gaining mild traction, bolstered by Canada’s GDP data that surpassed expectations. Australian Dollar remains the weakest link, pressured by Australia’s inflation figures falling short of forecasts, though it’s attempting to regain some ground. Sterling is trading within a narrow range as the market also awaits BoE’s rate decision tomorrow. Japanese Yen continues its near-term consolidation.

Technically, US 10-year yield is worth some attention today. This week’s decline is raising the chance that rebound from 3.785 has already completed at 4.198, ahead of 38.2% retracement of 4.997 to 3.785 at 4.247, and after rejection by 55 D EMA. Sustained break of 4.000 handle will affirm this case, and bring deeper fall back towards 3.785 low. If materialized, such a development in yields could exert downward pressure on Dollar or at least limit its upward momentum.

In Europe, at the time of writing, FTSE is up 0.15%. DAX is down -0.12%. CAC is up 0.15%. UK 10-year yield is down -0.029 at 3.876. Germany 10-year yield is down -0.037 at 2.237. Earlier in Asia, Nikkei rose 0.61%. Hong Kong HSI fell -1.39%. China Shanghai SSE fell -1.48%. Singapore Strait Times rose 0.09%. Japan 10-year JGB yield rose 0.245 to 0.736.

Canada’s GDP grows 0.2% mom in Nov, primarily driven by goods-production sectors

Canada’s GDP grew 0.2% mom in November, above expectation of 0.1% mom. Growth was primarily driven by goods-producing industries, which marked the highest expansion rate since January 2023 at 0.6% mom.

Services-producing industries experienced a modest increase of 0.1% mom during the same period. This slight rise came despite the adverse impacts of strikes within Quebec’s public sector, which began in November.

Overall, 13 of 20 industrial sectors increased in November.

Additionally, preliminary data suggests continued upward trend, with an anticipated increase of 0.3% mom in real GDP for December.

US ADP jobs grows 107k, below expectation 143k

US ADP private employment grew 107k in January, below expectation of 143k. By sector, goods-producing jobs rose 30k while service-providing jobs rose 77k. By establishment size, small companies added 25k jobs, medium added 61k, large added 31k.

Pay gains for job-stayers slowed from 5.4% yoy to 5.2% yoy. Pay gains for job-changers slowed to 7.2% yoy, smallest gain since May 2021.

“Progress on inflation has brightened the economic picture despite a slowdown in hiring and pay,” said Nela Richardson, chief economist, ADP. “Wages adjusted for inflation have improved over the past six months, and the economy looks like it’s headed toward a soft landing in the U.S. and globally.

ECB’s de Guindos see lower growth and inflation than Dec forecasts

ECB Vice President Luis de Guindos, in an interview with Die Zeit, offered indicated that the growth forecast for the region, previously set at 0.8% for this year, might fall short of expectations.

De Guindos highlighted several factors contributing to this revised outlook, saying, “The prospects have even deteriorated.” He pointed out the key issues impacting the forecast: a slowdown in world trade, heightened geopolitical uncertainties, and the more rapid than anticipated impact of ECB’s interest rate hikes on the economy.

De Guindos also touched upon inflation trends, noting a shift from previous projections. The December projections had inflation returning to the 2% target by the second half of 2025. However, recent data suggest a more optimistic scenario.

De Guindos observed, “But inflation figures have mostly brought positive surprises recently.” He further speculated that inflation might settle “slightly lower” than their predictions.

BoJ summary of opinions suggests rate hike within reach

The Summary of Opinions from BoJ’s meeting on January 22-23 signaled the central bank’s intensified focus on initiating its first rate hike since 2007 and moving away from its long-standing negative interest rate policy. The deliberations, however, stopped short of providing a clear timeline for these policy shifts.

A notable hawkish sentiment within BoJ pointed to the “growing possibility” of significant wage revisions in the upcoming spring, at “relatively higher levels” than in the past. This perspective is underpinned by the recognition of “improving trend” in both economic activities and price. Such developments suggest that the necessary conditions for revising monetary policy, including ending the negative interest rate regime, are increasingly “being met”.

Concurrently, the impact of Noto Peninsula Earthquake on is a key factor under close observation. One opinion suggested that, after a thorough assessment of the earthquake’s effects over “the next one or two months”, BoJ is “highly likely to reach a point where it can normalize monetary policy”.

On the other side of the spectrum, a more cautious stance was also expressed. While acknowledging that the probability of achieving the BoJ’s 2 percent price stability target is becoming “more realistic”, it was noted that certainty in reaching this goal is not yet fully established. However, this view also supports the initiation of discussions regarding the exit from the current monetary policy stance.

Japan’s industrial production rises 1.8% mom in Dec, a bounce in seesawing pattern

Japan’s industrial production rose 1.8% mom in December, rebounding from prior month’s -0.9% mom contraction, but missed expectation of 2.4% mom.

Manufacturers have tempered expectations for the coming months, predicting a -6.2% mom drop in production in January, followed by a modest 2.2% mom increase in February. The Ministry of Economy, Trade and Industry maintains its assessment of “seesawing” on production.

As an METI official indicated, the recent Noto Peninsula earthquake’s impact on manufacturing appears minimal for January. However, production forecasts are clouded by the suspension of operations at Daihatsu due to issues with collision-safety test irregularities.

“Although we believe that the production sentiment of companies is gradually getting out of the bearish phase, for the time being, we need to pay attention to the impact of the suspension of auto manufacturers’ operation,” the official said.

In separate release, retail sales grew 2.1% yoy in December, well below expectation of 5.0% yoy.

Australia’s CPI down to 4.1% yoy in Q4, monthly CPI down to 3.4% yoy in Dec

Australia’s inflation data for Q4 show notable easing in price pressures. CPI rose by 0.6% qoq, a considerable slowdown from the previous quarter’s 1.2% qoq and below expectation 0.8% qoq. This marks the smallest quarterly increase since Q1 2021. On an annual basis, CPI decelerated from 5.4% yoy to 4.1% yoy, coming in lower than the forecasted 4.3% yoy.

RBA’s trimmed mean CPI, which is a measure of core inflation, also reflected this trend. It increased by 0.8% qoq and 4.2% yoy, down from 1.2% qoq and 5.2% yoy respectively in the previous quarter. These figures were below the expected 0.9% qoq and 4.3% yoy. Notably, this represents the fourth consecutive quarter of declining annual trimmed mean inflation, falling from a peak of 6.8% in Q4 2022.

Additionally, monthly CPI showed a sharp slowdown from 4.3% yoy to 3.4% yoy, undershooting expectation of 3.7% yoy.

NZ ANZ business confidence rises to 36.6, inflation expectations lowest since Nov 2021

New Zealand ANZ Business Confidence rose from 33.2 to 36.6 in January. However, Own Activity Outlook fell from 29.3 to 25.6.

In a significant development, inflation expectations decreased from 4.61% to 4.28%, reaching their lowest point since November 2021. Despite this decline in inflation expectations, a high number of firms still plan to increase their prices, with the pricing intentions index only marginally decreasing from 50.2 to 49.7. Cost expectations also saw a slight reduction, moving from 76.2 to 75.6, but they remain at elevated levels.

ANZ’s commentary on the situation pointed out that the New Zealand economy is at a critical point, expressing a cautiously optimistic outlook. They anticipate that RBNZ has implemented sufficient tightening measures and expect a gradual realization of their impact, leading to a possible initiation of “a steady stream of OCR cuts” by August.

China’s NBS PMI manufacturing ticks up to 49.3, contraction continues

China’s manufacturing sector remained in contraction for the fourth consecutive month, with NBS PMI Manufacturing index marginally rising from 49.0 to 49.3 in January, slightly below the expected 49.3.

The continued manufacturing contraction is evident in the subindexes: new orders was 49.0, marking the fourth month of contraction, while new export orders index stood at 47.2, contracting for the tenth consecutive month. A concerning detail is the employment subindex, which fell to a 13-month low of 47.6, indicating contraction for 11 straight months.

On a positive note, the manufacturing sector’s production index attained a 4-month high, advancing to 51.3, and has sustained expansion for eight consecutive months.

In contrast, PMI Non-Manufacturing saw a slight improvement, rising from 50.4 to 50.7, marginally above the forecast of 50.6. Consequently, PMI Composite, which encompasses both manufacturing and services sectors, reached a four-month peak of 50.9, up from 50.3 in the previous month.

GBP/USD Mid-Day Outlook

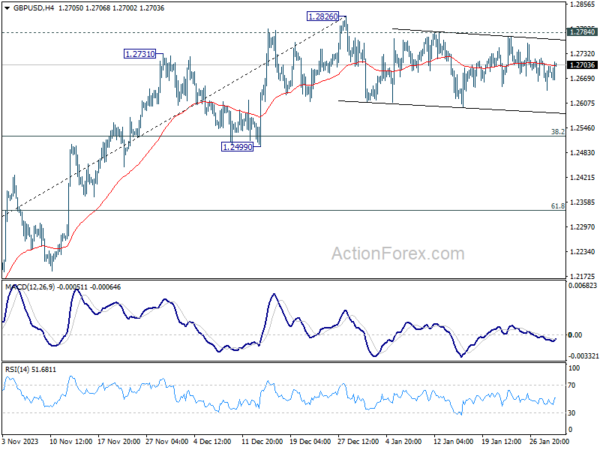

Daily Pivots: (S1) 1.2653; (P) 1.2687; (R1) 1.2734; More…

Range trading continues in GBP/USD and intraday bias remains neutral. Another fall cannot be ruled out, but downside should be contained above 1.2499 support to bring rebound. On the upside, firm break of 1.2784 resistance will suggest that consolidation pattern has completed. Further rise should be seen through 1.2826 to resume the rally from 1.2036. Next target will be 1.3141 high.

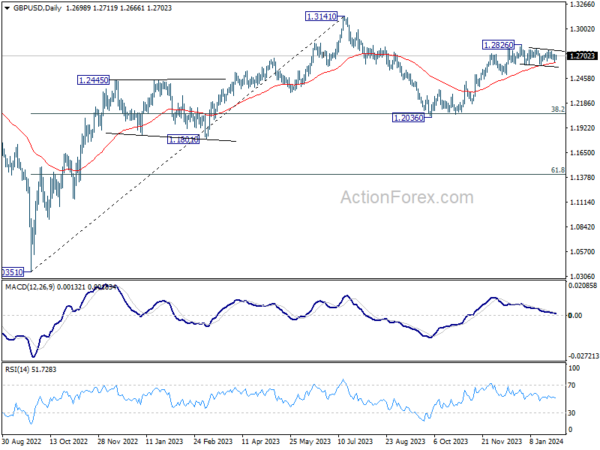

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg that’s in progress. Upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 23:50 | JPY | Industrial Production M/M Dec P | 1.80% | 2.40% | -0.90% | |

| 23:50 | JPY | Retail Trade Y/Y Dec | 2.10% | 5.00% | 5.30% | 5.40% |

| 00:00 | NZD | ANZ Business Confidence Jan | 36.6 | 33.2 | ||

| 00:30 | AUD | CPI Q/Q Q4 | 0.60% | 0.80% | 1.20% | |

| 00:30 | AUD | CPI Y/Y Q4 | 4.10% | 4.30% | 5.40% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Q/Q Q4 | 0.80% | 0.90% | 1.20% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Y/Y Q4 | 4.20% | 4.30% | 5.20% | |

| 00:30 | AUD | Monthly CPI Y/Y Dec | 3.40% | 3.70% | 4.30% | |

| 00:30 | AUD | Private Sector Credit M/M Dec | 0.40% | 0.40% | 0.40% | |

| 01:00 | CNY | NBS Manufacturing PMI Jan | 49.2 | 49.3 | 49 | |

| 01:00 | CNY | NBS Non-Manufacturing PMI Jan | 50.7 | 50.6 | 50.4 | |

| 05:00 | JPY | Housing Starts Y/Y Dec | -4.00% | -6.20% | -8.50% | |

| 05:00 | JPY | Consumer Confidence Jan | 38 | 37.6 | 37.2 | |

| 07:00 | EUR | Germany Import Price Index M/M Dec | -1.10% | -0.50% | -0.10% | |

| 07:00 | EUR | Germany Retail Sales M/M Dec | -1.60% | 0.60% | -2.50% | |

| 07:30 | CHF | Real Retail Sales Y/Y Dec | -0.80% | 0.90% | 0.70% | -1.50% |

| 08:55 | EUR | Germany Unemployment Change Jan | -2K | 10K | 5K | |

| 08:55 | EUR | Germany Unemployment Rate Jan | 5.80% | 5.90% | 5.90% | |

| 09:00 | CHF | Credit Suisse Economic Expectations Jan | -19.5 | -23.7 | ||

| 09:00 | EUR | Italy Unemployment Dec | 7.20% | 7.50% | 7.50% | 7.40% |

| 13:00 | EUR | Germany CPI M/M Jan P | 0.20% | 0.20% | 0.10% | |

| 13:00 | EUR | Germany CPI Y/Y Jan P | 2.90% | 3.40% | 3.70% | |

| 13:15 | USD | ADP Employment Change Jan | 107K | 143K | 164K | |

| 13:30 | CAD | GDP M/M Nov | 0.20% | 0.10% | 0.00% | |

| 13:30 | USD | Employment Cost Index Q4 | 0.90% | 1.00% | 1.10% | |

| 14:45 | USD | Chicago PMI Jan | 48.2 | 46.9 | ||

| 15:30 | USD | Crude Oil Inventories | -0.8M | -9.2M | ||

| 19:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | ||

| 19:30 | USD | FOMC Press Conference |