Yen reverses some of yesterday’s gains after cautious comments from BoJ Governor Kazuo Ueda, which highlighted that Japan is “not there yet” to reach the long-sought-after sustainable inflation rate of 2%. Ueda’s perspective starkly contrasted with the more hawkish tones of Board Member Hajime Takata, who has advocated for beginning discussions on exiting the ultra-loose monetary policy.

While Governor Ueda’s role naturally predisposes him to a more guarded stance, his optimistic comments on the ongoing wage negotiations inject a positive note into inflation outlook, potentially signaling confidence in domestic economic strengthening.

At the same time, the rally in Japanese stock continue to look unstoppable. Nikkei makes more records highs today, and it’s now tantalizingly close to 40k psychological milestone. sentiment.

In the wider currency market, Yen maintains its position as the week’s strongest contender, closely followed by the robust Dollar. On the other end of the spectrum, commodity currencies are facing headwinds, getting scant support from the less-than-stellar PMI data from China. New Zealand Dollar, in particular, lags as the weakest, with the Australian and Canadian Dollars also underperforming.

Euro stands out as the third strongest currency, showing resilience and outpacing both Sterling and Swiss Franc, as market participants await CPI flash data from Eurozone for further direction.

Technically, GBP/CHF would be an interesting one to watch today. Near term consolidation from 1.1182 has possibly completed with three waves to 1.1114, just ahead of short term rising channel support. Firm break of 1.1182 would confirm this bullish case, and resume whole rise from 1.0634. Next target will be 61.8% projection of 1.0893 to 1.1182 from 1.1114 at 1.1293. The move could be accompanied by break of 0.8884 resistance in USD/CHF on broad-based Swiss Franc selloff.

In Asia, at the time of writing, Nikkei is up 1.92%. Hong Kong HSI is up 024%. China Shanghai SSE is up 0.04%. Singapore Strait Times is down -0.09%. Japan 10-year JGB yield is up 0.0030 at 0.717. Overnight, DOW rose 0.12%. S&P 500 rose 0.52%. NASDAQ rose 0.90%. 10-year yield fell -0.022 to 4.252.

BoJ’s Ueda stays cautious on achieving sustainable inflation

Bank of Japan Governor Kazuo Ueda reiterated that Japan has not yet achieved sustainable 2% inflation. “I don’t think we are there yet,” he said after G20 finance ministers’ meeting.

A significant focus for BoJ in the near term will be the outcome of upcoming annual wage negotiations between companies and unions. Ueda pointed out the importance of these negotiations in determining the potential for a positive wage-inflation cycle in Japan.

“We need to confirm whether a positive wage-inflation cycle would kick off and strengthen,” he noted, acknowledging the rising demands from unions for pay increases exceeding last year’s and the apparent willingness among many firms to comply.

However, Ueda also stressed the need for a comprehensive review of the collective results of these wage negotiations, alongside other economic data, to gauge whether wages and inflation will sustainably rise in tandem.

Japan’s PMI manufacturing finalized at 47.2, worst since Aug 2020

Japan’s PMI Manufacturing was finalized at 47.2 in February, down from January’s 48.0. This marks the ninth consecutive month of contraction, presenting the most significant downturn since August 2020.

According to S&P Global, the decline was characterized by sharper falls in both output and new orders. Additionally, the sector experienced the most substantial decline in employment seen in over three years, indicating that the downturn is having a tangible impact on workforce. Furthermore, rate of increase in output prices slowed to the lowest level since June 2011, suggesting that price pressures are easing amid weakened demand.

China’s NBS PMI manufacturing falls slightly to 49.1, Caixin manufacturing rises to 50.9

China’s manufacturing sector continued its contraction for the fifth consecutive month in February, with official NBS PMI decreasing slightly from 49.2 to 49.1, matched expectations.

New orders subindex remained steady at 49, indicating stagnant demand. New export orders fell further from 47.2 to 46.3, reflecting ongoing pressures on the export front.

NBS PMI Non-Manufacturing rose from 50.7 to 51.4 , surpassing the anticipated 50.8. PMI Composite remained unchanged at 50.9.

In parallel, Caixin PMI Manufacturing, which focuses more on small and medium-sized enterprises, edged up from 50.8 to 50.9 , slightly above expectations of 50.7.

Caixin noted sustained increase in output and new orders, with firms expressing improved business optimism for the second consecutive month. Additionally, input cost inflation declined to a seven-month low, while selling prices fell.

RBNZ’s Orr: Restrictive policy to stay, expects normalization next year

RBNZ Governor Adrian Orr affirmed today that the economy is “evolving as anticipated”, with inflation expectations declined. However, he reiterated inflation “is still too high”.

The governor emphasized the necessity of maintaining a restrictive monetary policy stance “for some time.” He added that he expects to “begin normalizing policy in 2025.”

Fed’s Williams sees rate cut this year, stresses lack of urgency

New York Fed President John William reiterated that he expected rate cuts to start this year, but emphasized there is “no sense of urgency to do that”.

“I think that makes sense with inflation coming down, the economy being in better balance, that we’re going to move interest rates back to more normal levels,” he said at an event overnight.

Williams noted that monetary policy is “in good place”, and the focus now is to gain confidence that inflation is on track to 2% target.

Fed’s Mester: Inflation fight continues, yet three rate cuts still expected in 2024

Cleveland Fed President Loretta Mester remains steadfast in her view that inflation is on track to Fed’s target, despite a month-over-month jump in the preferred inflation gauge.

Nevertheless, “it does show you there is a little more work for the Fed to do,” Mester said in a Yahoo Finance interview overnight.

Mester reiterated her December forecast of three rate cuts in 2024, suggesting that this remains a plausible scenario if the economy progresses as she expects. “Right now that feels about right to me if the economy evolves as I anticipate it will,” she stated.

Fed’s Goolsbee optimistic about US economy’s golden path in 2024

Chicago Fed President Austan Goolsbee, at an even overnight, highlighted the scope for the US economy to maintain what he terms the “golden path,” a scenario where inflation falls in conjunction with sustained labor market strength and economic growth. This balance, he notes, is historically rare but remains a viable outcome for the current year.

Goolsbee’s confidence stems from anticipated improvements in supply chain efficiency and labor supply impacts, which he believes will bolster this optimistic economic scenario.

“I still feel like there is supply benefit coming through the system on both the supply chain, and the impact of labor supply,” Goolsbee remarked.

Fed’s Daly sees greenshoots yet rate cuts await clearer signals

San Francisco Fed President Mary Daly highlighted the shift towards a more data-dependent approach, a move away from extensive forward guidance. She underscored the importance of being “methodical” in decision-making, emphasizing Fed’s intention to “hold on just right” without being locked into predefined commitments.

In a Bloomberg TV interview overnight, Daly articulated the need for “a collage of evidence” to confirm a sustainable downward trend in inflation, relying not just on published economic statistics but also on insights from business contacts. Although she acknowledged the emergence of positive signs, or “green shoots,” in the economy, she cautioned, “we’re not there yet,” indicating that more evidence is needed to confirm that inflation is on a consistent decline.

Furthermore, Daly discussed the implications of adjusting the nominal interest rate as inflation begins to ease. She argued for the necessity of reducing interest rates in a timely manner to prevent overly tightening monetary policy that could inadvertently trigger an economic downturn.

Looking ahead

Eurozone CPI flash is the main focus in European session. Eurozone unemployment rate, PMI manufacturing final; Swiss retail sales and PMI manufacturing; UK PMI manufacturing final will also be released.

Later in the day, US ISM manufacturing is the main focus while Canada will also release PMI manufacturing.

USD/JPY Daily Outlook

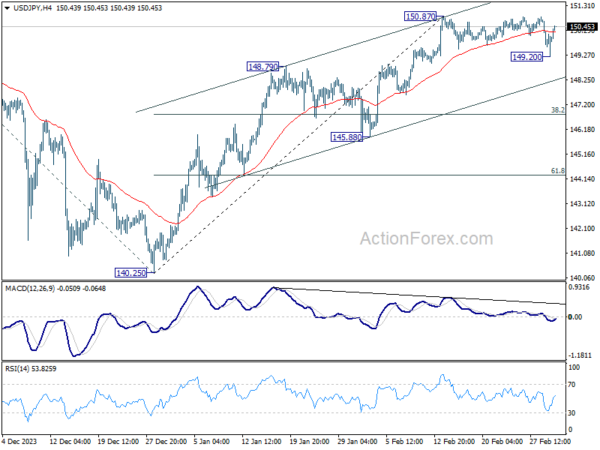

Daily Pivots: (S1) 149.24; (P) 149.97; (R1) 150.74; More…

USD/JPY rebounded strongly after brief dip to 149.20 and intraday remains neutral for now. On the upside, decisive break of 150.87 will resume whole rally from 140.25 to retest 151.89/93 key resistance zone. On the other hand, considering bearish divergence condition in 4H MACD, firm break of 149.20 will confirm short term topping at 150.87. Deeper fall would be seen to channel support (now at 148.29), even as a corrective move.

In the bigger picture, rise from 140.25 is seen as resuming the trend from 127.20 (2023 low). Decisive break of 151.89/.93 resistance zone will confirm this bullish case and target 61.8% projection of 127.20 to 151.89 from 140.25 at 155.50. However, break of 148.79 resistance turned support will delay this bullish case, and extend the corrective pattern from 151.89 with another falling leg.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Jan | -8.80% | 3.70% | 3.60% | |

| 23:30 | JPY | Unemployment Rate Jan | 2.40% | 2.40% | 2.40% | |

| 00:30 | JPY | Manufacturing PMI Feb F | 47.2 | 47.2 | 47.2 | |

| 01:00 | CNY | NBS Manufacturing PMI Feb | 49.1 | 49.1 | 49.2 | |

| 01:00 | CNY | NBS Non-Manufacturing PMI Feb | 51.4 | 50.8 | 50.7 | |

| 01:45 | CNY | Caixin Manufacturing PMI Feb | 50.9 | 50.7 | 50.8 | |

| 05:00 | JPY | Consumer Confidence Index Feb | 39.1 | 38.4 | 38 | |

| 07:30 | CHF | Real Retail Sales Y/Y Jan | 0.40% | -0.80% | ||

| 08:30 | CHF | Manufacturing PMI Feb | 44.6 | 43.1 | ||

| 08:45 | EUR | Italy Manufacturing PMI Feb | 49.5 | 48.5 | ||

| 08:50 | EUR | France Manufacturing PMI Feb F | 46.8 | 46.8 | ||

| 08:55 | EUR | Germany Manufacturing PMI Feb F | 42.3 | 42.3 | ||

| 09:00 | EUR | Italy Unemployment Jan | 7.20% | 7.20% | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Feb F | 46.1 | 46.1 | ||

| 09:30 | GBP | Manufacturing PMI Feb F | 47.1 | 47.1 | ||

| 10:00 | EUR | Eurozone Unemployment Rate Jan | 6.40% | 6.40% | ||

| 10:00 | EUR | CPI Y/Y Feb P | 2.50% | 2.80% | ||

| 10:00 | EUR | CPI Core Y/Y Feb P | 2.90% | 3.30% | ||

| 14:30 | CAD | Manufacturing PMI Feb | 48.3 | |||

| 14:45 | USD | Manufacturing PMI Feb F | 51.5 | 51.5 | ||

| 15:00 | USD | ISM Manufacturing PMI Feb | 49.5 | 49.1 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Feb | 52 | 52.9 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Feb | 47.1 | |||

| 15:00 | USD | Construction Spending M/M Jan | 0.10% | 0.90% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Feb F | 79.6 | 79.6 |