Euro weakened broadly today, weighed down by growing recession concerns in Germany. The Eurozone’s largest economy confirmed -0.1% contraction in GDP in Q2. Consumer sentiment showing deeper-than-expected deterioration, particularly in economic expectations. This decline follows weak Ifo business climate released yesterday. The string of negative data points suggests that any economic recovery may be further delayed.

Meanwhile, Dollar and Yen are also weaker, trailing just behind Euro. However, as US session approaches, there is some buying interest emerging, especially with US consumer confidence data set to be a key driver for the day. Overall market sentiment will also be pivotal, particularly as investors watch to see if DOW can extend its recent rally after hitting a new record high yesterday, or if a correction is on the horizon.

In contrast, New Zealand Dollar leads the day, followed by Swiss Franc and Sterling, while Aussie and Loonie are mixed.

In the upcoming Asian session, Australia’s monthly CPI data will be in focus. Expectations are for inflation to slow from 3.8% yoy in June to 3.4% yoy in July. RBA has made it clear that a rate cut is not on the cards for this year. Any upside surprises in the inflation data could push the timeline for policy easing even further into the future.

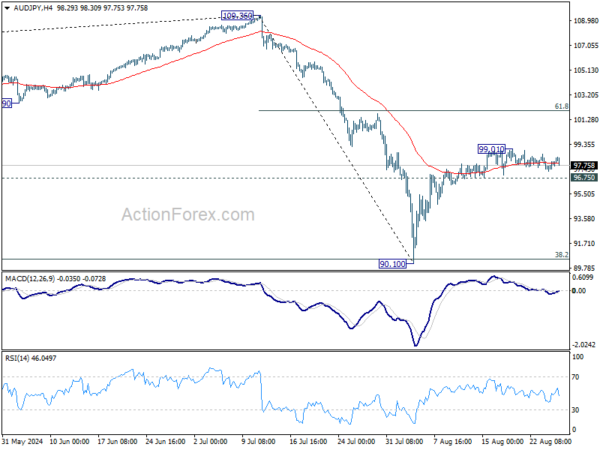

Technically, AUD/JPY turned side after rising to 99.01. For now, further rise is in favor as long as 96.75 support holds. Above 99.01 will resume the rebound from 90.10 to 61.8% retracement of 109.36 to 90.10 at 102.00. However, break of 99.01 will argue that the rebound has already completed and bring deeper fall back towards 90.10 support.

In Europe, at the time of writing, FTSE is up 0.32%. DAX is up 0.47%. CAC is up 0.02%. UK 10-year yield is up 0.0839 at 4.000. Germany 10-year yield is up 0.049 at 2.296. Earlier in Asia, Nikkei rose 0.47%. Hong Kong HSI rose 0.43%. China Shanghai SSE fell -0.24%. Singapore Strait Times rose 0.07%, Japan 10-year JGB yield fell -0.005 to 0.880.

ECB’s Knot calls for tighter fiscal policy to support inflation fight

In a panel discussion today, ECB Governing Council member Klaas Knot emphasized the need for a more restrictive fiscal policy to support the central bank’s efforts in curbing inflation.

Knot stated that the ECB has “assumed most of the burden of bringing inflation down,” but he added, “A more restrictive fiscal policy would have been desirable.”

He also highlighted the impact of interest-rate hikes on debt-servicing costs, suggesting that these should be offset by higher primary fiscal balances.

Knot pointed out that increased spending by the European Union should be balanced by reduced fiscal space at the national level, noting, “After all, the national and European taxpayer is ultimately one and the same person.”

German GfK consumer sentiment drops to -22, pushing back prospects of recovery

Germany’s GfK Consumer Sentiment for September took a sharper downturn than expected, falling from -18.6 to -22.0, below the anticipated -18.3.

August saw significant drops in key indicators: economic expectations plummeted from 9.8 to 2.0, income expectations nosedived from 19.7 to 3.5, and the willingness to buy dipped further from -8.4 to -10.9. Conversely, the willingness to save increased from 8.0 to 10.7, indicating a cautious approach to spending.

According to Rolf Buerkl, consumer expert at NIM, “Apparently, the euphoria of German consumers triggered by the European Football Championship was only a brief flare-up and faded after the end of the tournament.”

He added that “negative news about job security is making consumers more pessimistic and a fast recovery in consumer sentiment seems unlikely.”

The decline in sentiment is exacerbated by slightly rising unemployment rates, an increase in corporate insolvencies, and staff reduction plans at various companies in Germany. Buerkl concluded, “Hopes for a stable and sustainable economic recovery must therefore be further postponed.”

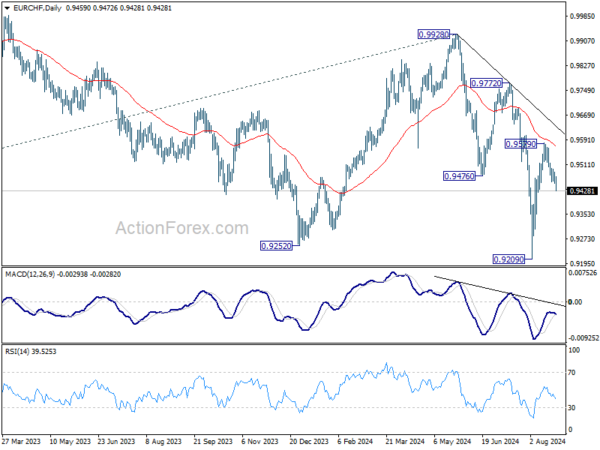

EUR/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9442; (P) 0.9467; (R1) 0.9482; More….

EUR/CHF’s break of 0.9448 support suggests that rebound from 0.9209 has completed at 0.9579, after rejection by 55 D EMA (now at 0.9569). That also keeps the whole decline from 0.9928 high intact. Intraday bias is back on the downside for retesting 0.9029 low next. For now, risk will stay on the downside as long as 0.9579 resistance holds, in case of recovery.

In the bigger picture, medium term corrective pattern from 0.9407 (2022 low) might have completed with three waves to 0.9928. Decisive break of 0.9252 (2023 low) will confirm long term down trend resumption. Next target will be 61.8% projection of 1.1149 to 0.9407 from 0.9928 at 0.8851. For now, outlook will stay bearish as long as 0.9928 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Jul | 2.80% | 2.90% | 3.00% | 3.10% |

| 06:00 | EUR | German GfK Consumer Sentiment Sep | -22 | -18.3 | -18.6 | |

| 06:00 | EUR | Germany GDP Q/Q Q2 F | -0.10% | -0.10% | -0.10% | |

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Jun | 6.50% | 7.10% | 6.80% | 6.90% |

| 13:00 | USD | Housing Price Index M/M Jun | -0.10% | 0.20% | 0.00% | |

| 14:00 | USD | Consumer Confidence Aug | 100.2 | 100.3 |